New York State, whose 25% cap on interest rates for short-term loans is one of the country's strictest usury laws, is considering carving out an exception for check cashers.

In May the State Senate Banking Committee passed a bill that would allow check cashers to make loans for periods from 90 to 180 days with a maximum rate to be determined by the New York State superintendent of banks.

Consumer advocates call the legislation a backdoor attempt to allow payday lending in the nation's third-most populous state. The bill's progress, after several years of languishing, comes after Wells Fargo & Co. shelved a plan to offer its "direct deposit advance" loan in New York and other East Coast states following a public outcry. The annual percentage rates on that loan, which Wells offers in 26 states, range from 120% to 1,200%; the company reportedly planned to use its status as a federally regulated bank to get around the state usury cap.

Consumer advocates say that the bill has the potential to undermine the state usury law by inviting banks to try to offer loans under the "most favored lender" doctrine, which says a national bank can charge the highest rate a state allows for any other type of lender. The advocates are worried banks may test the limits amid a broader debate over whether the Dodd-Frank Act strengthened state banking laws from preemption challenges by national banks.

"The biggest argument that we had in saying that Wells Fargo cannot come into New York State is that high-interest loans have always been illegal in New York State," said Uriah King, vice president of state policy at the Center for Responsible Lending. "Our argument was, 'Do you really want to test the new laws trying to roll out high-interest loans in a state that has never allowed it?' "

(Richele Messick, a spokeswoman for Wells, said potential legal challenges in New York were not a reason for the bank putting the East Coast rollout of the direct deposit advance on hold. "There were a lot of considerations and we took input from various stakeholders," she said. "Before we introduce it to new markets, specifically the East Coast, we decided to take a step back and consider all the features before introducing it.")

The check-cashing industry argues that strictly regulated short-term loans are a preferable alternative to the Internet payday loans that many low-income New Yorkers are taking out.

"The check cashers, which have become neighborhood financial service centers for probably a million people in New York State, are the natural locations for providing a credit product for people who are unable to or cannot get a credit card or a bank product," said Edward D'Alessio, deputy general counsel for the Financial Service Centers of New York, a trade group for local check cashers that lobbied for the bill.

"Right now these folks are bouncing checks, paying their bills late or getting Internet payday loans, and what we are doing in providing an alternative," D'Alessio said.

Opponents of the bill say the loans would saddle low-income people with debt.

"If the Legislature passes this bill, it sends a message that New York State is open for business to usurious lenders," said Josh Zinner, co-director of the Neighborhood Economic Development Advocacy Project.

"This is just payday lending by another term," he said. "They are short-term, they will have triple-digit interest rates and they will target low-income New Yorkers and trap people in a cycle of debt."

State Sen. Hugh Farley, a Republican member of the banking committee and sponsor of the bill, said the consumer advocates misunderstand it. "This has nothing to do with payday loans," he said. "They keep getting confused." According to Farley, true payday loans are characterized by shorter time periods of two weeks and can be rolled over, which his bill would prohibit.

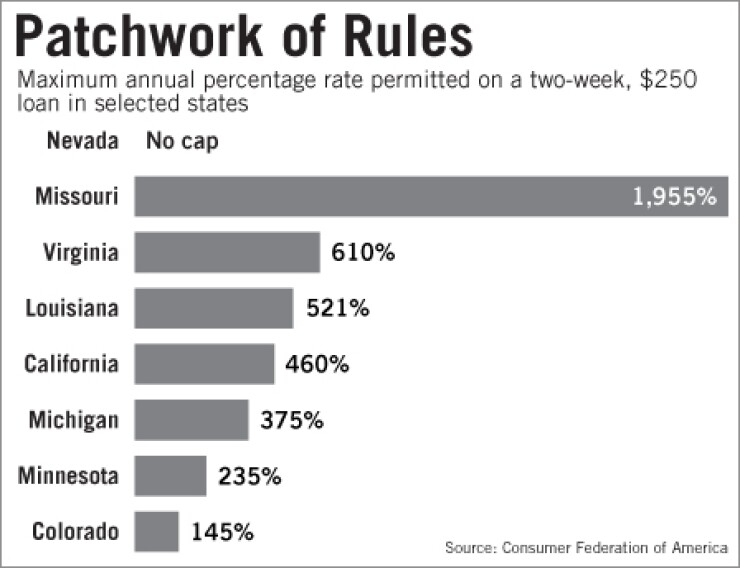

Further, he said, unlike many states that do not put limits on interest rates on payday loans, consumers in New York will be protected by the State Banking Superintendent who under the bill will be charged with setting the interest rates charged by the check cashers.

To clear up the confusion, Farley is making some changes to the language of the bill, such as taking out language that instructs the superintendent to consider interest rates charged in other states.

But those changes are not enough to sway opponents.

"It wants an exemption from state usury laws; it requires a short-term loan to be secured from a borrower's bank account; it would require payments every two weeks; and it is trying to establish a guaranteed rate of return," said State Sen. Liz Krueger, a Democrat. "So it seems to me that it smells a lot like a payday loan."

The proliferation of unregulated forms of credit, she said, is not a reason to allow the bill to pass.

"Internet payday loans are also illegal in New York State," Krueger said, "and I argue we should do better enforcement to stop payday loans, not basically wave a white flag and say legalize them."

State Assemblyman Darryl Townes introduced a version of the bill a few years ago and reintroduced it at the beginning of this year. Then he left the assembly and another member, Carl Heastie, reintroduced it in April. The assembly version of the bill is at that chamber's banking committee, and the Senate version, having passed the banking committee, is at the finance committee.