As the co-owner of Kademi, a gift shop in Mississippi that sells T-shirts, jewelry and home decor, Dawn Lea Chambers relies heavily on an American Express card. She uses the card, which is tied to her own personal credit report, to finance merchandise purchases.

“Your credit is basically your word,” said Chalmers, who opened the store in the small town of Philadelphia with her best friend more than 20 years ago. “It’s how you get things done. And it’s how we’ve been able to be in business this long.”

But Chalmers worries that the recent data breach at Equifax could hurt her ability to continue financing her business. She is one of roughly 143 million Americans whose personally identifiable information, including Social Security numbers, addresses and dates of birth, were potentially compromised.

The massive breach leaves Chalmers vulnerable to identity theft, which could hurt not only her own carefully maintained credit file, but also that of her business. It seems virtually certain that millions of other U.S. small-business owners are in the same predicament.

Concerns about the potential impact on small-business credit add to a growing list of economic worries that have emerged in the wake of the breach.

“The majority of businesses in America are sole proprietor businesses, and the line between business and personal credit is very blurry,” said Adrian Nazari, the CEO of Credit Sesame, a website that offers free credit scores to consumers.

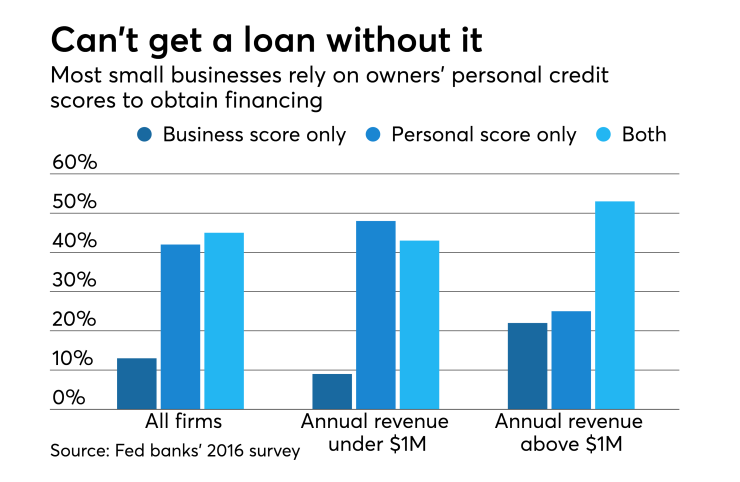

A 2016 survey of more than 7,500 small businesses by the Federal Reserve found that 87% of them rely on the owners’ personal credit scores, either alone or in tandem with a business credit score, to obtain financing.

Among firms with $1 million or less in annual revenue, 91% said that they were at least partially dependent on their owners’ personal credit scores.

On Tuesday, the top two Democrats on congressional small-business committees demanded answers from Equifax regarding the breach’s impact on the nation’s 29 million business owners.

Sen. Jeanne Shaheen, D-N.H., and Rep. Nydia Velazquez, D-N.Y., sent a letter to top officials at Equifax asking what steps the Atlanta company is taking to educate small-business owners about the breach.

They also asked whether Equifax plans to have dedicated agents for small-business owners who suffer identity theft. And they inquired about how the credit bureau is working with lenders to establish a safe way to check credit scores for small-business borrowers.

“Most small businesses do not have the staff or financial resources to become experts in cybersecurity and identity theft protections, and banking laws mostly protect consumers, not small business owners,” the letter stated.

An Equifax spokeswoman did not immediately respond to a request for comment.

Equifax is also facing pressure to waive the $99 fee that it currently charges for business credit reports. Under federal law, the three major credit bureaus are required to provide one free credit report per year to consumers, but that mandate does not apply to businesses.

“Equifax certainly should not be able to profit from the breach,” argued Jason Doss, a Georgia lawyer who has filed a lawsuit against Equifax on behalf of small-business owners.

“This is the central nervous system of our credit industry,” Doss added. “If business owners can’t feel comfortable with the fact that their business credit is safe, then the backbone of our business credit is harmed.”

The lawsuit, which is seeking class-action status, asks for reimbursement of out-of-pocket losses, including the $99 fee that some businesses have paid, as well as credit monitoring services, identity theft insurance, and other alleged damages.

Of the roughly 29 million U.S. small businesses, many firms are run as a hobby or a side business. Still, some 8 million-9 million companies are full-time businesses that rely on some form of credit, according to Rohit Arora, the CEO of Biz2Credit, an online marketplace for small-business credit. “So that’s a pretty large number,” he said.

At this stage, it is not clear what steps business owners should take to best protect themselves. They can freeze their credit, but that option may be less feasible for business owners who rely on credit to finance the daily operations of their companies than it is for consumers who use credit far less frequently. Credit monitoring services are another option.

Chalmers, the gift shop owner, said that she has signed up for a credit monitoring and identity theft protection service that Equifax is offering free for one year, as she contends with the potential ramifications of the breach.

“The whole thing has just made us very skeptical,” she said.