The swelling of the ranks of failed banks across Florida is creating opportunities for those fortunate enough to survive.

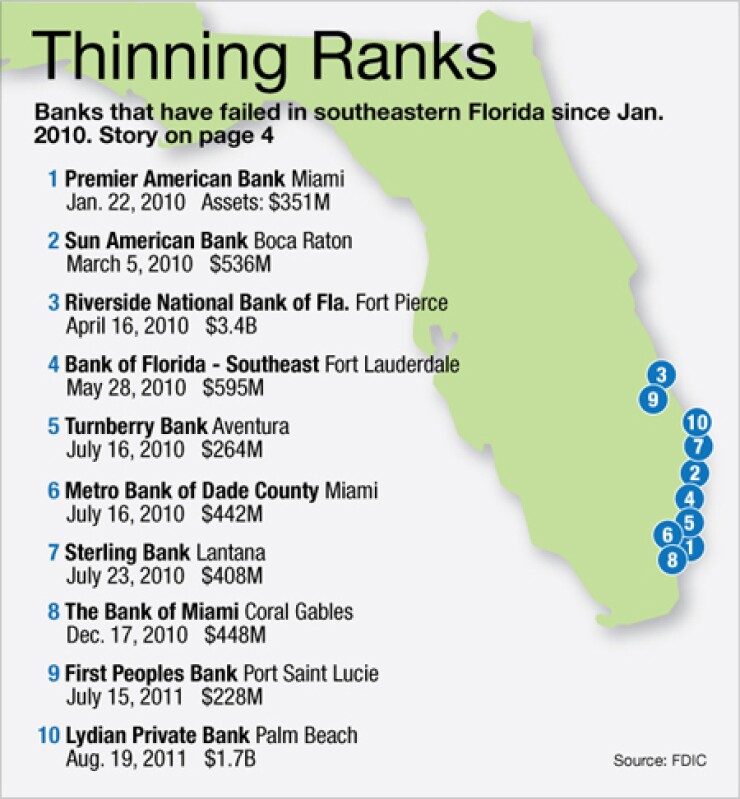

Ten banks have failed since January 2010 in an area stretching from Miami north to Vero Beach. They ranged from the $228 million-asset First Peoples Bank of Port St. Lucie, which was sold to Premier American Bank, to the $3.4 billion-asset Riverside National Bank in Fort Pierce, which was sold to Toronto-Dominion Bank.

The market contraction and the void it has created are reasons Dennis Hudson cited for his company's recent spike in new household accounts. "The competitive landscape for community banks has been completely transformed," says Hudson, the chairman and chief executive of Seacoast Banking Corp. of Florida, one of a handful of locally owned banks still operating in the southeast part of the state.

A big segment of the banking market in southeast Florida is ripe for someone to seize, says Mac Hodgson, an analyst at SunTrust Robinson Humphrey.

Seacoast and other survivors are "in a good position to pick up new business, although it's hard to know what business they're getting," he says. "There has been a lot of disruption in the markets where Seacoast operates."

For potential acquirers, the main opportunities lie with small to midsize institutions that the state's big outside banks tend to overlook, industry observers say.

Bank of America Corp. "appears to be focused on mass-market retail and large corporate," Hodgson says. Another target is retail clients "who want more of a high-touch feel."

Banks have changed names or disappeared frequently in southern Florida. That, combined with a perception of poor customer service from big banks, has left many consumers frustrated, says Chris Russell, a senior lender at Colonial Banc Corp.'s $131 million-asset Oculina Bank in Fort Pierce.

"A large percentage of people want to pick up the phone and talk to a human being," and by providing customers with that Colonial has had an increase in new household accounts, he says.

The $198 million-asset Apollo Bancshares Inc. has also enjoyed an increase in new customers, likely thanks to disruption in the marketplace, says Eddy Arriola, Apollo's chairman. "The time is right and consumers and small businesses are more interested in switching," he said.

Second-quarter figures for the $2 billion-asset Seacoast appear to back Hudson's claims. In the quarter, new deposit households rose 11% from a year earlier. New personal checking accounts grew 17% and new commercial business checking accounts 9%.

Those results helped lift Seacoast's noninterest income by 7% from a year earlier, to $4.6 million. Income from fees and service charges rose even though Seacoast didn't raise pricing for either category, Hudson says. Service charges on deposits rose 6.5% from a year earlier, to $1.6 million.

Such positive figures came after a long stretch of hard times. Seacoast skipped nine dividends related to the Troubled Asset Relief Program. Earlier this month, Seacoast paid $6.6 million to the Treasury Department to cover those dividends. Seacoast has yet to repay the government's $50 million Tarp investment.

Survivors in Florida face plenty of challenges, which could slow efforts to fully capitalize on market disruptions.

At Seacoast, executives have spent months trying to clean up a portfolio of bad loans. Nonperforming assets fell to 3.5% of total assets as of June 30 from 5.3% a year earlier. Its loan-loss provision fell 95% from a year earlier, to $902,000. Such improvements helped Seacoast swing to a second-quarter profit of $1.1 million from a loss of $14 million a year earlier.

Some parts of South Florida are healthier than others. Metropolitan Port St. Lucie, where Seacoast has a large branch network, has recovered much more slowly than the Miami, Fort Lauderdale and West Palm Beach areas, says William Stronge, an economics professor at Florida Atlantic University in Boca Raton. "Port St. Lucie has the highest unemployment rate in the South Florida area by far," Stronge said. In June unemployment was 12.4% in Port St. Lucie and 11.4% in the Miami area, U.S. Bureau of Labor Statistics data indicates.

Hudson remains optimistic, both because of fewer competitors and due to an opportunity created when Bank of America made its overdraft-fee policy less favorable for consumers.

That opportunity is visible at Publix Super Markets, a Lakeland, Fla., grocery chain. Before the Dodd-Frank Act was implemented, many shoppers used debit cards on Thursday nights to buy groceries, even if they lacked the funds to cover the purchase. On Friday morning they deposited paychecks, funds were available to cover their supermarket bills.

Bank of America used to authorize those late night purchases and then assess an overdraft fee on the transaction, which many shoppers willingly accepted, Hudson says. Now that the Dodd-Frank law has tightened regulation of overdraft fees, Bank of America has, in an abundance of caution, begun declining all such overdraft-related purchases, Hudson says. That, in turn, has led hundreds of people to switch to Seacoast National Bank.

"You're seeing a massive change in service-charge structures begin to occur at large banks," Hudson says. Seacoast authorizes debit card purchases if an account holder has insufficient funds and assesses an overdraft fee, presuming the account holder has not opted out of that program.

Bank of America spokeswoman Christina Beyer Toth said the company has seen growth in its customer relationships in southeast Florida, existing relationships have deepened and customer retention numbers are on plan.