A multiyear effort to modernize payments in the United States, led by the Federal Reserve, is drawing unexpectedly strong interest from private-sector firms, which are vying to build the backbone of a faster and more secure system.

Fed officials said that a preliminary request for proposals drew more than 20 responses prior to the April 30 submission deadline.

The proposals will now be evaluated based on how well they satisfy three dozen criteria for an up-to-date payment system. Those criteria were established last year by a Fed-convened task force whose more than 300 members include banks, tech companies, retailers, government agencies and consumer groups.

-

The central bank originally established a 10-year time horizon for completing upgrades to the nation's aging electronic payment system. But a task force convened by the Fed thinks that's not ambitious enough.

October 6 -

A task force convened by the Federal Reserve has made substantial progress in its first few months, but the path to real-time payment in the U.S. is still littered with challenges.

September 23 -

The central bank is floating the concept of using the Internet to facilitate the direct clearing of transactions between financial institutions, which would likely diminish its own role in the U.S. payment system.

February 11

Fed officials declined to say which private-sector firms submitted proposals. But in response to questions from American Banker, three companies confirmed that they are participating.

Two of those firms were built from the ground up during the Internet era: Dwolla, which currently offers real-time payments with BBVA Compass, and Ripple Labs, which uses distributed-ledger technology to transfer value.

The third firm is The Clearing House, which was founded in 1853 and is owned by the nation's largest banks. It

The Fed-convened task force does not plan to crown a single winner at the end of the evaluation process. Still, proposals that win praise are expected to gain a leg up in the marketplace.

"It's almost like the Good Housekeeping seal of approval," said Russ Waterhouse, an executive vice president at The Clearing House.

The 20-plus proposals will initially be evaluated by McKinsey & Co., the global consulting firm, which has been hired by the task force to conduct an independent review.

McKinsey was retained partly due to worries that members of the task force would have a hard time overcoming their conflicts of interest when evaluating the various proposals. The Clearing House, Dwolla and Ripple Labs each have a representative on the task force's 17-member steering committee.

During the initial phase of the review process, all of the companies that submitted proposals will receive feedback from McKinsey and get a chance to withdraw their proposals before the plans get shown to members of the task force.

The opt-out process could whittle down the number of submissions, since firms whose proposals do not score well may not see any reason to reveal confidential information about their technology to competitors that have seats on the task force.

In the next phase of the process, McKinsey will write assessments of the remaining proposals. The consulting firm's unedited assessments are expected to be included in a final report by the task force. The report will also include a broader discussion about how to modernize the U.S. payment system.

"It is going to be a grueling process, I think," said Gene Neyer, a payments executive at DH Corp., which has helped build real-time payment systems in other countries but decided not to submit a proposal to the Fed's task force.

Due to the surprisingly large number of submissions, the review process could take longer than was initially anticipated. The task force expects to release its final report sometime next year.

"Information about specific proposals and final assessments will be released as part of the Faster Payments Task Force final report in 2017," Doug Tillett, a vice president at the Federal Reserve Bank of Chicago, said in an email.

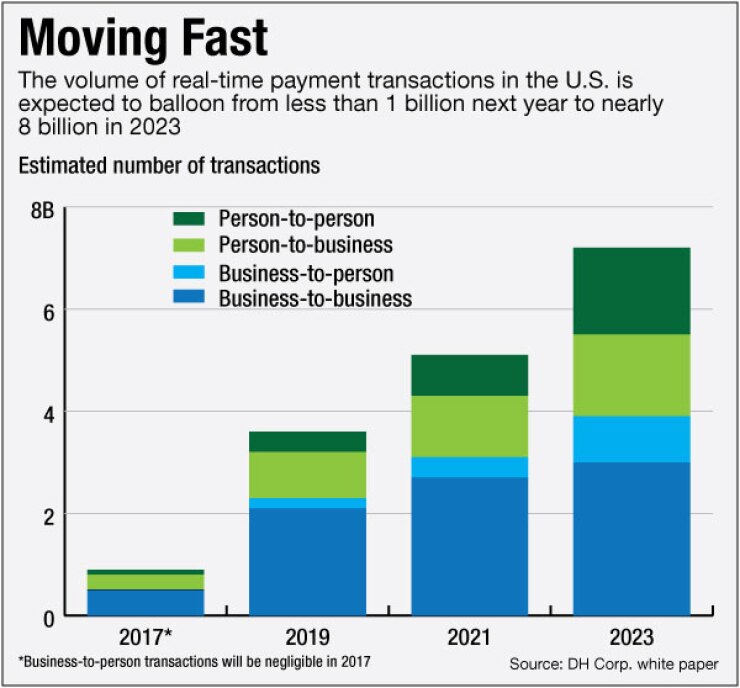

The task force's criteria state that private-sector proposals will be deemed effective if they can achieve initial implementation by 2019 and reach all U.S. banks and credit unions by 2021. Likewise, proposals will be judged effective if they allow payment recipients to access their funds within 30 minutes.

In addition, the criteria state that a modernized payment system should be available to users 24 hours a day and 365 days a year. The system should allow the sender to initiate payments based on minimal information, such as the recipient's name, email address or phone number. And it should be available through mobile devices.

The task force has also established detailed security standards. For instance, the two parties to the transaction should not be required to know each other's bank account numbers or other sensitive information, according to the group's criteria.

Many other countries, including the United Kingdom, Mexico and Sweden, already have nationwide real-time payment systems. By convening a task force, the Fed has kick-started interest in the topic in the U.S. But some private-sector firms are not waiting for the Fed's imprimatur to move forward.

For example, The Clearing House and FIS recently announced plans to start operating their real-time system on a limited basis in the first quarter of 2017. The pilot project is expected to involve banks in one specific geographic area, and to focus on bill payments.

Another leading real-time payments firm, Early Warning, elected not to participate in the Fed's process.

The company's technology is currently used by U.S. Bancorp and Bank of America to enable their customers to make person-to-person payments. Early Warning is co-owned by the two aforementioned banks, as well as Capital One Financial, Wells Fargo, PNC Financial Services Group and BB&T.

Melissa Lowry, Early Warning's vice president of payments, declined to say why the company decided not to submit a proposal to the Fed's task force. However, the seven banks that own Early Warning are also co-owners of The Clearing House.

"We think what the Clearing House is doing can be largely complementary to our solution," Lowry said.

It remains to be seen what impact the Fed-convened process will have on the fast-changing payments market.

During remarks last week at a conference in Beverly Hills, Calif., Chicago Fed Vice President Dan Gonzalez noted that the proposal that is best for business-to-business payments may not be the best choice for person-to-person payments.

"So there could be multiple providers, multiple rails. We don't know yet," he said.

Gonzalez recalled that during the early days of the ATM, many different networks were competing, and consumers had to check the back of their cards to make sure they were using the right cash machine.

"Now you can pretty much go to any ATM. So that didn't happen overnight," he said, suggesting that real-time payments could be similarly fragmented in the early days. "It's going to evolve over time."