Finding good employees has never been easy, but it’s only going to get more difficult from here.

That’s a key takeaway for banks from the latest jobs report, which showed signs that employers across the country are revving up hiring. Manufacturing and professional services

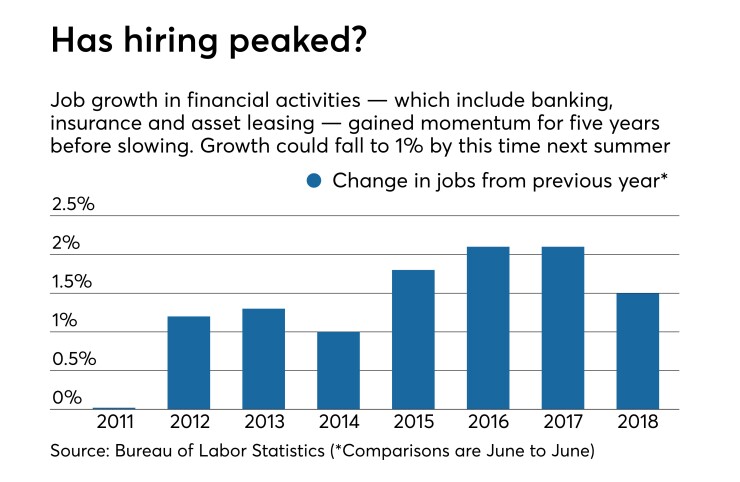

Still, the pace of hiring among financials slowed down to 1.5%, after hovering around 2% for the past three years, and it is expected to further decelerate to about 1% in the year ahead.

“We have seen growth in the industry slow over the past couple of years," said Gus Faucher, chief economist at PNC Financial Services Group in Pittsburgh, discussing the monthly jobs report

Faucher described the total job gains in financial services as "pretty solid" overall, but he said hiring for skilled positions in particular has become more challenging.

“It’s becoming more and more difficult to hire in the industry,” Faucher said.

There are a number of reasons behind the gradual slowdown. As the labor market tightens, experts said, it is simply harder (and more expensive) to recruit new bankers — especially the experienced lenders and executives who are normally in high demand.

But there are other contributing factors as well, including the fact that banks may be putting less of a focus on hiring in their compliance and risk divisions amid the deregulatory wave in Washington. Compliance jobs had been among the more plentiful openings at banks in recent years.

“That is a perhaps a slight negative for job growth,” Faucher said. He added, however, that the addition of fewer risk employees could be overshadowed by an increase in hiring in other areas, as

Nationally, the unemployment rate edged up to 4% as of June 30, from 3.8% a month earlier, reflecting

Within financial services, in particular, depository institutions increased their workforces by about 1%, according to the BLS. Hiring in securities and investments, meanwhile, rose by nearly 3%.

Still, there are signs that

The total number of people employed in commercial banking held steady from a year earlier, at just over 1.3 million people.

Michele Gil, managing partner at Chrisman & Co., an executive search firm in Los Angeles, said that her company has observed a notable increase over the past year in the recruiting that it does on behalf of banks.

“We’re seeing a lot of everything,” Gil said, noting that her queries run the gamut from compliance to technology.

What many of the job descriptions in financial services have in common, however, is the high level of experience and skills they require.

As an example, Gil described a recent search she completed for a senior credit executive at a community bank.

The bank, which she did not name, was particular about what it wanted — someone who both understood the culture of a community bank and also understood how credit controls work at larger institutions.

Gil also described her recent searches for high-tech employees. She said it is a challenging process, given that banks are looking for candidates who know how to create new mobile products, and also improve back-end systems in a way that saves costs down the road.

“You’re looking for very specific skill sets,” she said.