In the land of eat or be eaten, another of Georgia's small banks is on the prowl.

Last week, the $245 million-asset Hamilton State Bancshares Inc. in Hoschton, Ga., raised $231.6 million through two New York investment firms. Hamilton plans to exit the Troubled Asset Relief Program and pursue failed bank deals.

Robert Oliver, Hamilton's president and chief executive, said the company had been working on raising capital since the fall of 2009, "but the regulatory process can be long and trying to get it finalized." The company filed the application for change in control with regulators in mid-2010.

Still, despite the lag, Oliver said, there are "a lot of opportunities in the Southeast."

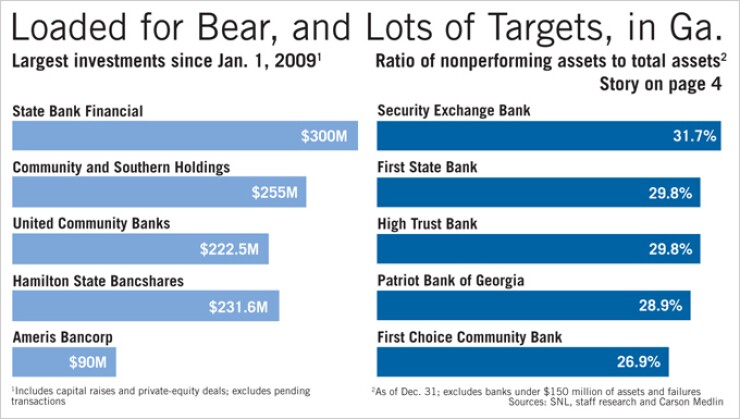

Based on the weakened asset-quality figures in Georgia, analysts and bankers could not agree more. Nonperforming assets to total assets in the fourth quarter reached a median of 6.2%, up from 5.5% a year earlier, and 6% in the previous quarter, according to Carson Medlin's latest asset-quality report.

"These institutions in Georgia are literally frozen in a vise in a slowly collapsing world," said Jeff Davis, an analyst at Guggenheim Securities LLC in Nashville. Banks are faced with a costly, heightened regulatory environment while grappling with static balance sheets.

Georgia's troubled banking situation does leave a lot of open targets for the few banks in position to buy, however.

"We saw that maybe there were better consolidation opportunities than we first imagined," since Hamilton opened in 2004, Oliver said. "So we started looking at FDIC-assisted deals. We realized in order to do that, we needed to raise a good bit of money or we didn't need to be in the market at all."

Hamilton was formed to be a consolidator, given Oliver's background as president and chief operating officer at Premier Banchares Inc., where he helped complete eight acquisitions in less than three years and made Premier into the third-largest bank in Georgia. BB&T Corp. in Winston-Salem, N.C., bought the Atlanta bank in 1999.

Oliver still works with some of the same senior management team. Hamilton last week revamped its board with seven new directors, including former JPMorgan Chase & Co. executives Denis O'Leary and Joseph Sclafani.

The additions include Ray Christman, a former president and chief executive of the Federal Home Loan Bank of Atlanta; Art Peponis, the co-head of private equity at Angelo Gordon & Co.; and Larry Sorrel, a managing partner at Tailwind Capital.

Oliver said Hamilton will mostly focus on FDIC-assisted deals in and around Atlanta, where most of the state's failures have taken place. The first step is to get the Treasury Department's approval to repurchase its $7 million in Tarp funds. If successful, Hamilton would join Georgia Commerce Bancshares Inc., which redeemed its $9.1 million in Tarp last month after raising $21 million late last year.

Capital-raisings are not impossible for the state's small banks. A few months ago, Brand Group Holdings Inc. in Lawrenceville, Ga., reached an agreement for up to $200 million through three investment firms.

But they are hard to come by, and welcome when they do.

"The more capital coming into the market, the greater the ability to resolve the institutions that are failing," said Chris Frieden, a partner at Alston & Bird in Atlanta, which assisted one of the investor groups in the Hamilton deal.

Hamilton isn't the first bank successful at raising new funds to use, or plan to use, the money to get bigger.

For example, the $2.8 billion-asset State Bank and Trust in Macon, Ga., has bought 10 failed banks since raising $300 million in July 2009. Community & Southern Bank has acquired five failed banks since its initial $255 million capital injection in January 2010. The bank's parent, Community Southern and Holdings Inc., raised another $115 million later that year to support acquisitions.

Still, observers cautioned that while the new funds provide some cushion in a state severely constricted by slumping real estate, it is not enough to shake overall credit deterioration or encourage regulators to push bank deals through faster.

Georgia, they agree, largely remains stuck in neutral.

"There are certain positives to be taken from seeing the larger raises being executed," said Jeff Adams, a managing director at Carson Medlin's Atlanta office. "But it's not a situation where I would say Atlanta is out of the woods by any means."