With each passing day, the partial government shutdown is eroding confidence in the Small Business Administration.

Several industry experts say the SBA's inability to process and approve loan applications is creating a backlog while leaving small businesses scrambling for costlier alternative financing.

“It’s a bad situation and it’s only getting worse,” said Rohit Arora, CEO of Biz2Credit, who predicted a bigger backlash against the SBA the longer the impasse drags on.

“Depending on how long the shutdown is in effect, we could see some negative impact to the program and economy,” said Miguel Maldonado, senior vice president at the $9 billion-asset Randolph-Brooks Federal Credit Union in Live Oak, Texas. “The delay ... can affect small businesses and their ability to operate, or even get off the ground.”

Even in a best-case scenario, the agency would have to play catch-up when the shutdown, now nearly three weeks old, ends, said Arne Monson, president of Holtmeyer & Monson, which services more than $1 billion in SBA loans. Still, Monson said, his team continues to process and package deals so they can be submitted as soon as the impasse ends.

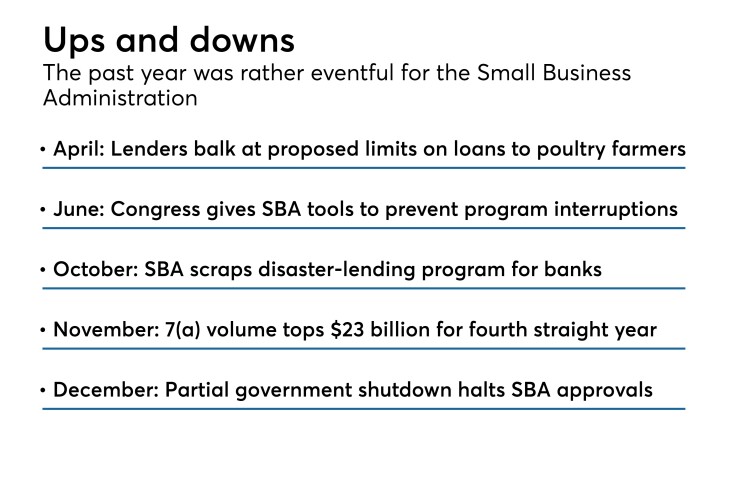

The timing couldn't be worse for the agency, which had made strides in providing responses more promptly. Volume in the agency's flagship 7(a) program has topped $20 billion during the last four fiscal years, which end Sept. 30.

Efforts to reach an SBA representative were unsuccessful. The agency last updated its weekly 7(a) volume data on Dec. 14.

“Before the shutdown, we were seeing really good turnaround times" of a week or less for standard applications, Monson said. Due to a backlog, wait times could extend to two or three weeks once the government fully reopens.

“Many small-business owners have the perception that government guarantees take a long time and require a lot of paperwork,” said Jody Niko, executive vice president for SBA operations at the $801 million-asset Celtic Bank in Salt Lake City. “We have worked hard to simplify the process and improve this perception. ... I was starting to see quicker responses than we had experienced in the past.”

Now, with an eye on the growing backlog awaiting the agency when government does resume operations, “I expect the delays are going to be greater than what we experienced a few years ago,” Niko added.

The options for small-business owners who can’t wait are likely limited to high-cost alternative lenders, Arora said. "The funding comes at higher rates and shorter terms” and could result in “cash-flow shock” for many businesses.

“I’m positive that will happen — and it’s not good,” said Lynn Ozer, president of the SBA lending division at the $20.4 billion-asset Fulton Financial in Lancaster, Pa. Alternative lenders “are absolutely faster in delivery, but the terms businesses get themselves into are oftentimes very detrimental."

Ozer said she has received a handful of emailed solicitations from marketplace lenders seeking to capitalize on the shutdown.

Fulton and Celtic were able to mitigate the impact of the government impasse on some borrowers by front-loading applications as the likelihood of a shutdown became apparent. At this point, there’s very little either company can do for borrowers whose applications didn’t get in under the wire.

“We have 20 to 30 loans … that could see a severe impact if the shutdown continues much longer,” Niko said.

Beyond lending, the shutdown also halted the SBA’s consideration of several proposed regulatory changes that had many bankers,

The agency received 4,100 comment letters on the planned changes, which may well be the most ever, said Ozer, who chaired the National Association of Government Guaranteed Lenders from 2012 to 2014.

The shutdown means it will take the SBA even longer to review the comment letters, leaving lenders in an extended limbo.

“Those rules and changes are very consequential and, of course, they’re not getting looked at,” Ozer said.

“It takes quite some time to finalize those regulatory changes as is, but certainly the clock is ticking away and it will tick even longer because of this," Ozer added. "It’s very difficult.”