WASHINGTON — Whatever happens in the midterm elections coming up in less than two weeks, the Senate Banking Committee may see a big shake-up in leadership and membership.

The result could play a big role in whether banks see more regulatory relief next year or policymakers can coalesce around a housing finance reform plan.

Whichever party has control of the Senate, the leadership of the banking panel may change. If the GOP keeps the chamber — as is most likely given the latest polls — Chairman Mike Crapo could take the gavel of the Senate Finance Committee, depending on whether Sen. Chuck Grassley, R-Iowa, wants that seat. If Crapo chairs the finance panel, that is likely to elevate Sen. Pat Toomey, R-Pa., to take his place as chair of the Banking Committee. If Democrats win the chamber, Sen. Sherrod Brown, D-Ohio, is expected to chair the panel.

Membership of the panel is also likely to change significantly. Seven of the banking panel’s members are up for re-election, and four of them are viewed as particularly vulnerable. Sen. Dean Heller, R-Nev., is the only Republican up for re-election in a state Hillary Clinton took in 2016. On the Democratic side, Sens. Heidi Heitkamp, D-N.D., Jon Tester, D-Mont., and Joe Donnelly, D-Ind., are all defending seats in states won by President Trump.

With Sen. Bob Corker, R-Tenn., retiring, next year's panel could have several new members.

“The first question is what the ratio is in the full Senate,” a source familiar with the Senate process said.

The banking committee currently has 13 Republicans and 12 Democrats. Before Sen. Doug Jones, D-Ala., joined the Senate earlier in 2018, shrinking Republicans’ majority to 51-49, the panel had 12 Republicans and 11 Democrats.

Brian Gardner, a policy analyst at KBW, said he thinks Democrats’ best pickup opportunity is in Nevada, which would leave Heller’s seat on the committee open.

“The Democrats two best pickup opportunities really are Arizona and Nevada and I think Nevada is the easier state for them,” said Brian Gardner, a policy analyst at KBW.

But even with potential pickup opportunities for Democrats in Arizona and Nevada, polls are pointing toward Democrats losing their seat in North Dakota. Cook Political Report recently changed that race’s rating from “toss-up” to “lean Republican.” And Republicans remain largely favored to maintain their Senate majority.

Heitkamp is considered one of the most moderate members of the Senate and was notably the only Democrat who attended the White House signing ceremony in May for a bill to ease some of the Dodd-Frank Act’s regulations, known as S 2155.

If Heitkamp loses her seat, she could be succeeded on the panel by Rep. Kyrsten Sinema, D-Ariz., another moderate who supported S 2155 and is hoping to take the open Senate seat currently held by retiring Sen. Jeff Flake, R-Ariz.

Sinema has a history of working across the aisle as a member of the House Financial Services Committee. And bankers have been backing her in campaign contributions, with commercial banks giving her $170,507 as of Oct. 16, according to the Center for Responsive Politics.

But if Republicans build a stronger majority in the Senate, Democrats may not be able to fill a seat on the committee vacated by a member who loses a re-election bid.

“If the Republicans end up picking up three or even four seats … seats could go away and the Dems might not even replace them,” the source familiar with the Senate process said.

Industry and advocacy groups will likely attempt to sway party leadership over committee membership, but in some cases the assignments are more of a political calculation.

The banking panel is a particularly good perch to place freshmen senators to help with fundraising, said Gardner.

“I suspect that when both leaders look to fill vacancies on that committee, they will look for incoming freshmen who will get elected next cycle," he said.

Justin Schardin, a fellow at the Bipartisan Policy Center and former Democratic Banking Committee staffer, said that Senate leadership will sometimes look to diversify committee membership or assign members from states that are particularly impacted by the panel’s jurisdiction.

“Generally, leadership wants committee membership to represent the key stakeholders in their party, so you want a mix of positions,” Schardin said. “For small state senators, there are a lot of them that want to be on [Senate Banking] because the small banks are well represented in those states.”

While several of the Senate Banking Committee members face tough re-election battles, the banking industry is coming in with financial support.

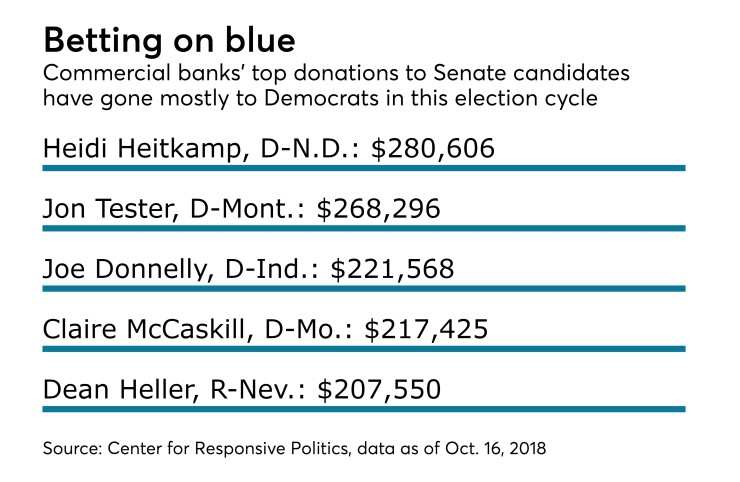

As of Oct. 16, Heitkamp, Tester, Donnelly and Heller, who all supported S 2155, were among the top five Senate candidates in terms of total campaign contributions from commercial banks. They each raked in more than $200,000 from commercial banks, according to the Center for Responsive Politics. Sen. Claire McCaskill, D-Mo., who also supported S 2155, is also in that group, but is not on the Senate Banking Committee.

And when looking at three of the biggest banks — JP Morgan, Bank of America, and Citigroup — one other Senate candidate seems to be gaining traction.

Bob Hugin, R-N.J., is hoping to unseat Senate Banking Committee Member Sen. Bob Menendez, D-N.J. As of Oct. 16, he has received $53,400 from the JPMorgan Chase’s political action committees, individual members, employees, or owners, and immediate families of those individuals — more than any other Senate candidate for the bank. He is in the top five candidates for the Senate in terms of campaign contributions from Bank of America and Citigroup as well, according to the Center for Responsive Politics.

New Jersey is typically viewed as a safe “blue” state, but Menendez, who opposed S 2155, has been under a microscope recently over allegations of corruption, though criminal charges have been dropped.

Gardner said that if Hugin pulled an upset and won the race in New Jersey, he could potentially end up on the Senate Banking Committee.

“Financial services industry have a huge presence in New Jersey, not just physical presence, but the employees who commute into New York City,” Gardner said. “It’s also a very expensive state in which to run. He would definitely be somebody that I think would be considered for the committee.”

Two of the Senate Banking Committee’s harshest Wall Street critics — Brown, D-Ohio, and Sen. Elizabeth Warren, D-Mass., are also up for reelection — but polls point toward them keeping their seats. Both members were outspoken in their opposition to S 2155 and they could put pressure on the Democratic leadership to add more progressives to the panel.

“Elizabeth Warren doesn’t love another industry Dem on the committee,” the source familiar with the Senate process said. “Sherrod Brown wants to have a group that he can more easily lead. If the group looks a little more like him, that’s helpful for him as well.”

As far as Republicans who could get added to the panel, the source said he has heard speculation that former Republican presidential nominee Mitt Romney, who is expected to win the open Senate seat in Utah, could get the nod.

And Sen. Shelley Moore Capito, R-W.V., could also be another add to the committee. Prior to joining the Senate in 2014, she chaired the financial institutions subcommittee on the House Financial Services Committee.

“She definitely has a background in financial services from her House days,” Gardner said. “Going into a re-election campaign [in 2020], her first, it certainly is a possibility.”