Illinois regulators are swinging their hammers again, but this time, their targets are better equipped to take the blow.

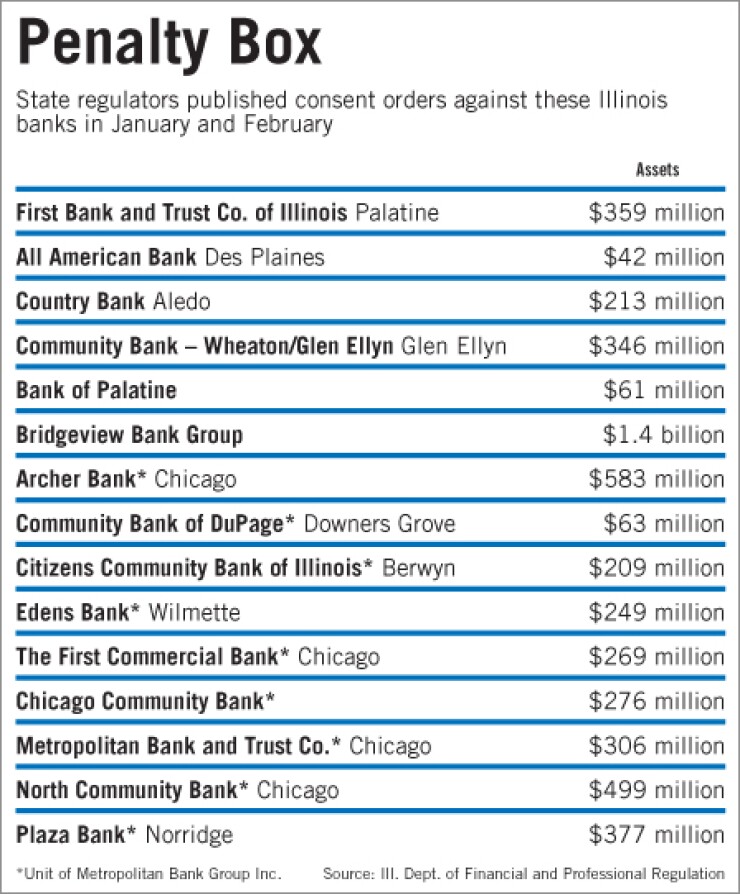

After a late-2010 lull, the Illinois Department of Financial and Professional Regulation in January and February made public 15 consent orders with community banks, primarily in the Chicago market.

That's roughly the same number of enforcement actions the state, alongside the Federal Deposit Insurance Corp., released in the second half of 2010.

But while the directives in the orders haven't changed — they still often call for more capital, an assessment of management and a plan to deal with problem assets — the connotation has changed.

"It no longer means that the bank is headed to extinction," said Frank Bonaventure, a lawyer at Ober, Kaler, Grimes & Shiver. "Today they mean that the regulators have identified what they believe are serious problems, and they want to get the attention of board and management to make sure that the issues are resolved."

To be sure, that has always been the intention of enforcement actions, said an FDIC spokesman. However, in the past few years, as banks suffered under credit woes, the orders had perilous ramifications, de facto signaling would-be capital to stay away.

And investors have. Illinois has been one of the failure hubs, with 40 banks failing in the Land of Lincoln since 2008.

Among those are two multibank groups, FBOP Corp., which had two banks in Illinois and seven elsewhere, and the Founders Group, which had ties to eight banks that failed in 2009 and 2010. There were 13 undercapitalized banks in Illinois at Dec. 31., data from Loan Workout Advisers LLC shows.

Enforcement actions are based on examination findings and are often issued several months after the exams are completed. Analysts said the ebb and flow of regulators' schedules is probably causing the bunching now.

"I think 2010 was a catch-up year for the regulators. They were dealing with banks that were out of options and were dealing with their own internal changes," said Michael Iannaccone, the president of MDI Investments in Chicago. "I think they were also thinking that there was not a reason to push the issue. They thought with the economy stabilizing that some of these banks would come out of the malaise. That hasn't happened."

Of the 15 banks that received orders, nine are held by the $2.8 billion-asset Metropolitan Bank Group Inc. in Chicago. A call and an e-mail to Metropolitan's chairman, Peter Fasseas, were not returned.

The remaining six banks are independently owned. None returned calls for comment. Collectively, all but one of 15 banks were well capitalized at Dec. 31. More so, many of the banks were either in excess or slightly below the capital ratios that the orders called for them to have.

On average, most of the orders gave the banks 60 days to 90 days to have a leverage ratio of 9% and a total risk-based capital ratio of 13%.

However, these institutions are also under significant credit stress. For instance, Metropolitan's $276 million-asset Chicago Community Bank had a noncurrent loans to total loan ratio of 13.02% at Dec. 31.

Charlie Crowley, a managing director of Paragon Capital Partners, said those capital and credit statistics are emblematic of banks that are now facing consent orders across the country.

"Our sense is that a number of the banks that are getting consent orders now had a fair amount of capital riding into the storm and were able to avoid being deemed as in peril," Crowley said. "But now that more losses have materialized and asset quality has turned out to be more stubborn, they are facing tougher exams and unfavorable actions."

Bonaventure said that regulators are pushing banks to plan for future problems, making the enforcement action process more true to its corrective intention.

"Even if you are excessively well capitalized, you may not be that way six months from now," Bonaventure said.

"The goal of these orders is to solve future potential problems. Some would argue that they are being overreactive, but I think they are erring on the side of being proactive."

Should the banks need to explore alternatives in order to comply, Iannaccone said that they would face a more friendly environment than their predecessors.

"The largest factor that will help them is that nonperforming asset trends in general have come to a plateau," Iannaccone said.

"Second, with all the exams that have occurred, investors have more confidence in call report data," he said. "Banks are no longer just wishing for the numbers to be true. And also there is a greater opportunity for M&A that just wasn't there."