OneUnited Bank in Boston has a plan to remain relevant while continuing to press for social justice.

The $664 million-asset OneUnited — the nation’s biggest black-owned bank — in the past year has launched a debit card with the Black Lives Matter movement, backed pro quarterback Colin Kaepernick’s protests during the National Anthem, and sponsored a fund-raising drive dedicated to eliminating racial disparities in criminal justice.

The key to sticking around to support such endeavors lies in a business model aimed at becoming a digitally focused retail bank, said Teri Williams, OneUnited’s president. In many regards, Williams wants OneUnited to look more like USAA in San Antonio.

“I’m really impressed with” USAA, Williams said in an recent interview, adding that she has often considered asking USAA executives to brief her on the banking and insurance giant’s approach to courting and keeping clients.

“They seem to understand the model,” Williams said. “Customers are lifelong members that they care for through the journey. I admire them for that. … They really get it.”

USAA, for its part, appreciated the compliment.

“We’re always striving to serve our members to the best of our ability,” spokeswoman Tiffany Edmonds said.

OneUnited, meanwhile, has scaled back its physical operations, closing a pair of branches in Los Angeles last year. At the same time, the bank has added thousands of ATMs that customers can access without a fee; it also plans to add Apple Pay to its menu of online services.

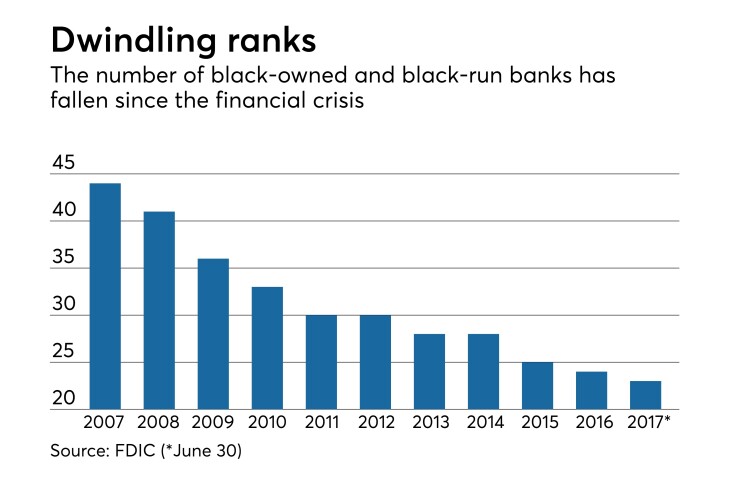

The strategic shift is critical at a time when the ranks of black-owned and black-operated banks total just 23 institutions, based on data from the Federal Deposit Insurance Corp. That compares with 44 prior to the financial crisis.

On its face, the contrast between OneUnited and USAA couldn’t be sharper. Activism at USAA’s $79 billion-asset bank rarely extends beyond extolling the military, whose service members comprise the core of its customer base.

It is USAA’s service ethos — not its marketing — that has caught Williams’ eye.

USAA boasts a cutting-edge mobile-banking app, a long and robust menu of products and services and consistently top-notch reviews for customer service.

OneUnited is determined to move in that general direction, and more products are in the works, Williams said.

“We’re going to have a lot more than basic checking and savings,” she said.

Though a significant proportion of its clients now are online-only, OneUnited’s transformation has yet to produce breakout financial results. The bank has lost $835,000 so far this year, after earning a total of $5.9 million from 2012 to 2016. Williams said technology investments are helping the bottom line, adding that she expects OneUnited to return to profitability in the fourth quarter.

OneUnited’s remaining five branches are concentrated in historically black communities: Roxbury in Boston, Liberty City in Miami and Compton in Los Angeles. Those neighborhoods were hit especially hard by the financial crisis, and its ill-effects have lingered longer.

Black communities “have lagged behind disproportionately” during the economic recovery, said Maude Toussaint-Comeau, a senior business economist at the Federal Reserve Bank of Chicago.

“They still have homes underwater, high unemployment and issues with credit,” Toussaint-Comeau said. “Housing related shocks and unemployment related shocks have affected these communities. People are struggling and that has resulted in lower levels of demand for business services.”

Banks that served those clients also suffered. Several have failed, including the $298 million-asset

Many of the remaining institutions received an unexpected lift last summer, when a movement urging consumers

Williams, however, is hopeful that the effort will gain more traction over the long term.

“We working for a movement, not a moment in time,” Williams said.