Boston Private Financial Holdings is already catching flak from a shareholder for its proposed sale to SVB Financial Group in Santa Clara, Calif.

The $9.7 billion-asset company agreed on Monday to be sold to the

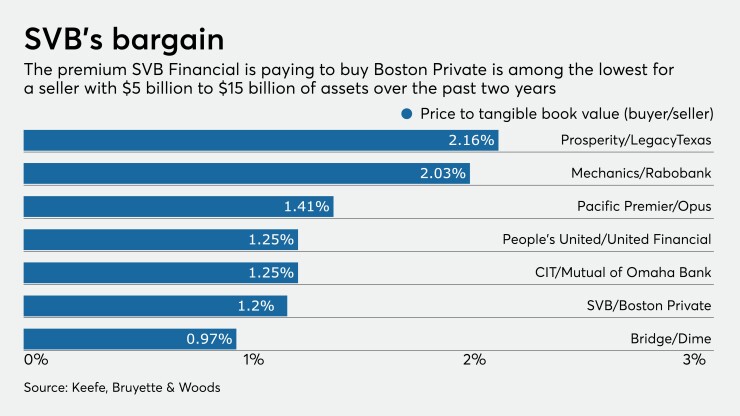

HoldCo Asset Management, which owns 4.9% of Boston Private’s stock through a group of managed funds, issued two letters after the deal’s announcement. The first letter, addressed to Anthony DeChellis, Boston Private’s CEO, and Steve Waters, the company’s chairman, claimed that the “price is grossly too low,” while seeking more information about the conditions that led to the merger agreement.

“Our primary concern is that, based on comments made on the call and our review of the transaction metrics, it does not appear [Boston Private] … conducted a competitive process to maximize value for shareholders,” Vik Ghei and Misha Zaitzeff, HoldCo’s co-founders,

Mergers frequently draw attention from a slew of

HoldCo’s objections are different because they are coming directly from a big shareholder that has the ability to make a bigger stink as Boston Private seeks investor approval for the sale. And it raises the possibility that more investors will grumble about future bank mergers, especially as challenging market conditions drive down premiums, industry observers said.

For now, HoldCo is simply on a fact-finding mission.

The investor wants more disclosures about the deal’s terms, including a breakdown of the $200 million in proposed restructuring charges and details on retention payments promised to the seller’s management. It also wants to know if there was a bidding process.

“As large shareholders of Boston Private, our goals are to make sure value is maximized for the benefit of shareholders and that shareholders are provided with adequate information to make informed decisions,” Ghei said in an interview.

“We agree with Boston Private that the best way to maximize value for shareholders is through a sale of the bank [but] … we want to make sure that the board runs a comprehensive and competitive sales process so that the best and highest purchase price is achieved," Ghei added.

HoldCo, in

The $6.5 billion-asset First Foundation had "persistently" called DeChellis “to pursue a dialogue about a merger,” the HoldCo letter said, attributing the comments to Kavanaugh. First Foundation was told in late November that Boston Private’s board had instructed DeChellis to focus internally and that the company was “not interested in pursuing a sale.”

Boston Private did not immediately respond to a request for comment. A First Foundation spokeswoman said Kavanaugh was traveling and unable to comment.

Greg Becker, SVB’s president and CEO, declined during an interview Tuesday to discuss whether or not it bid on Boston Private, though he said he believed the pricing was fair. He said the merger conversations began in early 2020 and accelerated later in the year.

Kavanaugh’s email “adds fuel to our concerns” that Boston Private “did not run a comprehensive, competitive process including all likely and logical partners for the company,” Ghei and Zaitzeff wrote in the second letter. “If that is the case … shareholders deserve to know and receive an explanation for what appears to be a significant failure of the board in its fiduciary duties.”

While it is unlikely that HoldCo’s objections will derail the deal, it is possible that SVB could raise the price it pays for Boston Private to head off more investor dissent.

SVB “has a huge multiple and could afford to win a bidding war almost every time,” said Abbott Cooper, a managing member at Driver Management, a New York-based bank investor.

“It would be difficult” for First Foundation to compete with SVB on pricing, said Matthew Clark, an analyst at Piper Sandler. “At the end of the day, we think the end result could potentially involve [SVB paying] … a little more.”