WASHINGTON — A regulatory report on the status of syndicated credits — loans of more than $20 million held by three or more financial institutions — was the bleakest in years.

The Shared National Credit Review, released Thursday, showed credit losses on such loans hit $53 billion — more than the combined losses of the past eight years and three times higher than the previous record — while classified credits jumped 174%, to $447 billion.

The report, which is conducted each year by federal banking regulators, may serve as a justification for raising capital requirements, observers said.

"Bolstering capital is probably going to be the watchword in the banking industry for the next several years to protect against these losses," said Gil Schwartz, a partner at Schwartz & Ballen.

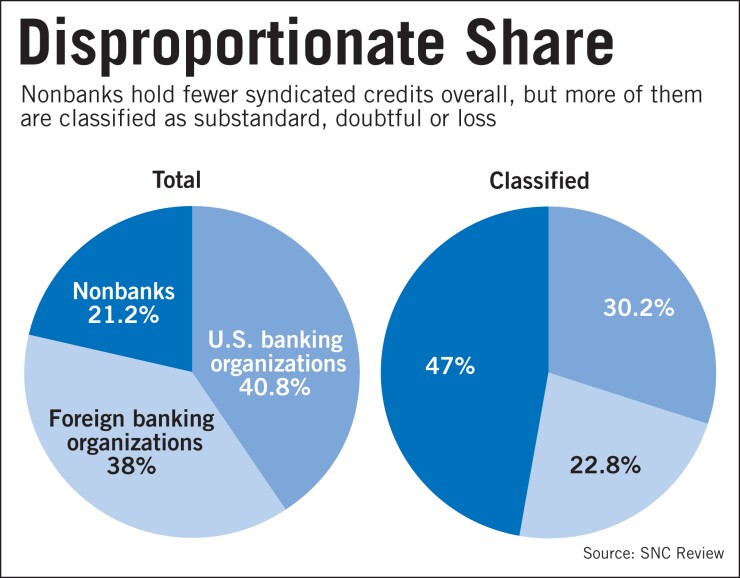

The biggest portion of problem credits are held by nonbank financial institutions. Though they hold roughly a fifth of the $2.9 trillion in total syndicated credits, they hold nearly half, or $210.2 billion, of all "classified credits" — those deemed substandard, doubtful or loss.

U.S. banking companies, in contrast, hold approximately 40% of syndicated credits, but accounted for just 30% of classified credits (the rest are held by foreign banking companies). Still, classified credits held by banks increased 65%, to $134 billion.

Regulators noted the discrepancy between banks and nonbanks.

"This is the second consecutive year where credit quality of the SNC portfolio has declined," said Joe Evers, deputy comptroller for large bank supervision at the Office of the Comptroller of the Currency. "Banks with significant credit exposure to syndicated loans … will need to ensure they have sufficient loan-loss reserves to deal with deterioration in credit quality. The key thing to recognize, however, is that the risks are more concentrated in nonbank institutions with 47% of the classified assets being held by nonbanks."

The 2009 data showed a continuation of a trend begun last year, when nonbanks held 19.9% of syndicated credits but accounted for 42.9% of classified credits.

Evers said commercial banks "try to sell off the riskier tranches" of syndicated loans.

In some cases, just a few large deals could make a big impact on the data. "It can be three of four deals—because some of these are large credits," he said. "You could have three or four deals that were sold to the non-banks and that are criticized."

Observers said it reflects the market's evolution.

"The sharp difference between the risk characteristics of loans held by banks versus those held by nonbanks is graphic — and costly — proof of the speculative corporate-credit market leading to the current crisis," said Karen Shaw Petrou, the managing director of Federal Financial Analytics Inc.

A total of $642 billion of all syndicated loans were considered criticized — a category that includes both classified loans and those attracting special mention by regulators. The figure represented more than 22% of the total portfolio, up from 13% in 2008. Classified loans totaled 16% of the portfolio, up from 5.8% a year earlier.

More problems appear to be on the horizon. The volume of loans considered to be in the worst shape — those classified as "doubtful" or "loss rising" — increased fourteenfold, to $110 billion, from $8 billion a year earlier. Nonaccrual loans totaled $172 billion, up from $22 billion.

A third of all criticized assets were among the 50 largest leveraged finance syndicated loans.

Bert Ely, an independent analyst in Alexandria, Va., said the data could further drive a wedge between big banks and small banks.

"It will affect how the regulators and the Hill look at the overall magnitude of the credit-quality problems among big banks, because smaller banks tend not to buy syndicated loans," he said.

Regulators may start asking, "To what extent are the purchasers of the syndicated loan participation adequately reserved for losses?" Ely said.

But Evers said many community banks buy pieces of syndicated loans.

The review said underwriting standards for syndicated loans had actually improved in the last year, but loans made before mid-2007, which generally had "structurally weak underwriting characteristics," were responsible for the portfolio's deterioration.

The review also found that special-mention loans — a leading indicator of credits that are not yet classified but show weakness — declined 9%, to $195 billion. Regulators said that a significant number of special mention credits in 2008 migrated to substandard or worse in 2009.