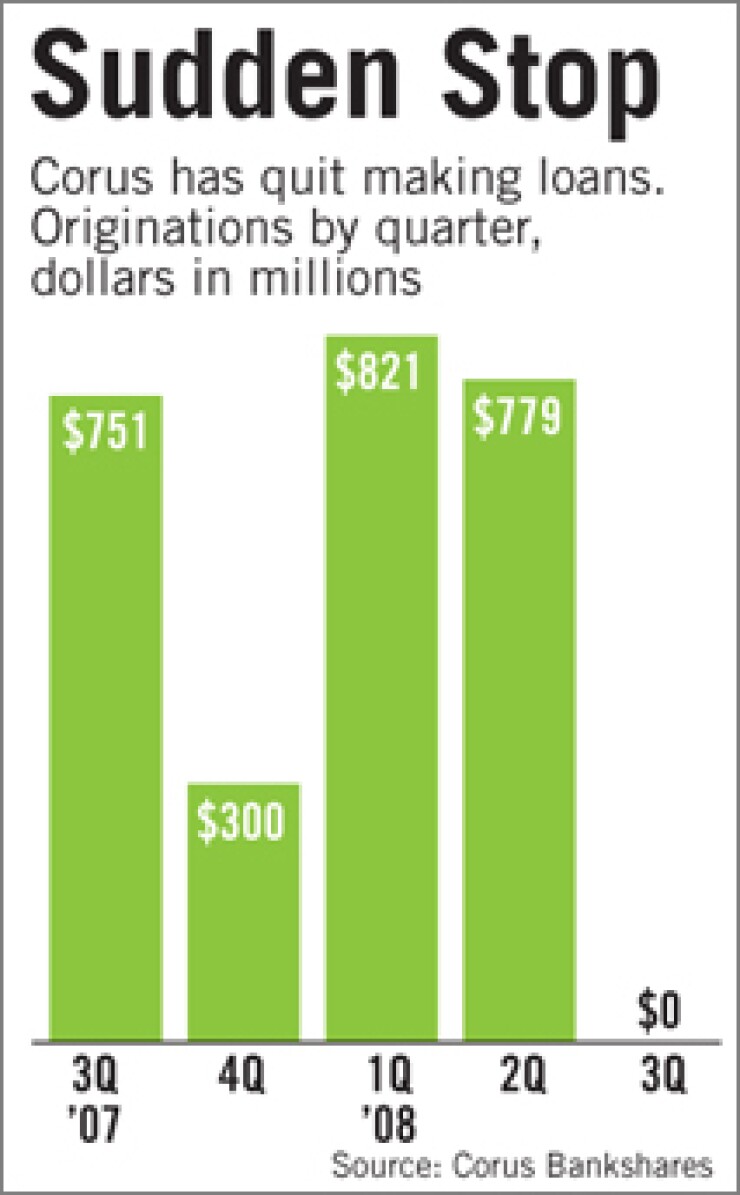

With more than a fifth of its loans not performing, Corus Bankshares Inc. has turned off the origination spigot and is not planning to turn it back on anytime soon.

The move is a drastic reversal for the $8.4 billion-asset Chicago company, which in the first half of the year originated $1.2 billion of construction loans. But Corus, which specializes in lending to condominium developers, said this week that with real estate conditions in its markets rapidly deteriorating, its top priority is preserving capital.

"We are operating in an economic environment that is more challenging and volatile than any we have ever seen," Robert J. Glickman, Corus' president and chief executive, said late Tuesday in a press release. "Given the uncertain condition of the commercial real estate market and our desire to bolster our capital ratios, management has decided that this is not the right time to originate new loans."

Most banking companies are still making loans, but Corus is not alone in halting originations. Steve Brown, the CEO of Pacific Coast Bankers' Bancshares in San Francisco, said about 10% of the banks that do business with Pacific Coast stopped making loans in the third quarter.

"They have hunkered down and pulled in and are resetting their risk profiles," Mr. Brown said. "Right now you are dealing with an awful lot of transition that no one has ever had to deal with in such a short period of time. It's not alarming, but if it continues for a few quarters, it would be disconcerting."

Corus' earnings have been battered as condo sales in once high-flying markets like Miami, Las Vegas, and Phoenix have cratered. After posting a second-quarter loss of $16.2 million, the first quarterly loss in its history, this week it reported a third-quarter loss of $128 million, or $2.38 per diluted share, compared with a profit of $35.5 million for the third quarter of last year.

The most recent loss was driven primarily by a loan-loss provision that increased more than 12-fold from a year earlier, to $182.2 million.

Without any new originations, Corus' loan commitments shrank 15%, to $6.6 billion.

At $1 billion, Corus' nonperforming loans represent 20.7% of its total. That rate was 4.89% a year earlier and 0.84% at the end of the third quarter of 2006. The company also reported $733 million of loans it classified as potential problems.

Mr. Glickman did not return calls for comment. In the release he said that Corus knew its loans carried higher-than-average risks, so it "built unusually strong capital and liquidity levels during the good years."

Its total risk-based capital ratio is 16.7%, well above the baseline for well-capitalized institutions.

Corus said it has access to cash and other investments that could be used for additional liquidity or capital. It also said that it has had preliminary conversations with regulators about the Treasury Department's Capital Purchase Program, though it has not decided if it would apply to participate.

Bert Ely, an independent analyst in Alexandria, Va., said Corus could be overstating its capital position, since its ratio of reserves to nonperforming loans decreased over 10 percentage points from a year earlier, to 21.2% at Sept. 30.

"They are dumping a lot into reserves, but it is not keeping up. My sense is that they are significantly under-reserved for loan losses," Mr. Ely said. "They are in a difficult situation. The third quarter was pretty grim."