It was almost as if Mary Mack, the new head of community banking at Wells Fargo, was interviewing for the job she was given three months ago.

Speaking at an industry conference Thursday, Mack spent the first few minutes of her presentation walking through her resume, highlighting her experience in managing through periods of change. The first bullet-point on her slide presentation began with the simple question: "Why do you think you are the right person for this role?"

It was unusual – and almost jarring – to hear a senior executive justify her credentials, months after taking on a top job. But the speech illustrated one of Mack's primary challenges: convincing skeptics that, as a Wells Fargo insider, she has what it takes to fix the scandal-plagued retail unit.

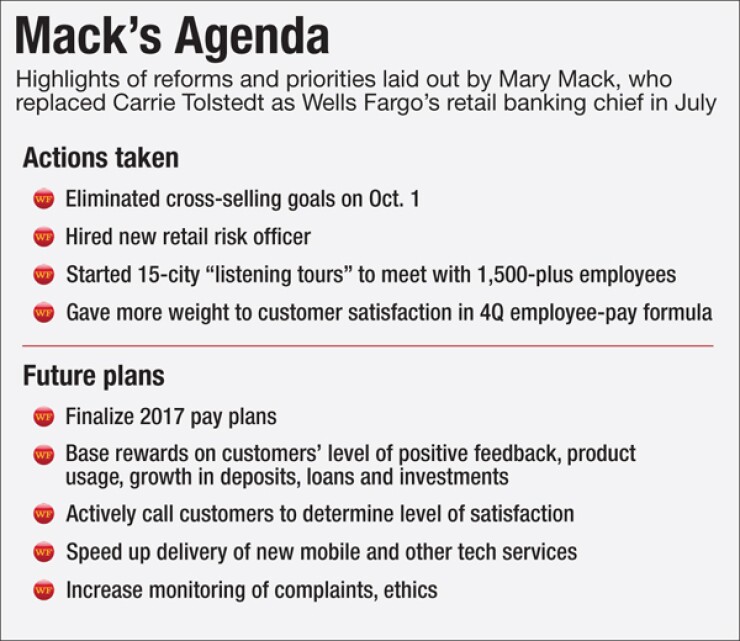

Mack said her top priority in the coming year will be redesigning the company's pay plans for branch employees, to prioritize customer service over sales volume. Improving ethics procedures and digital products are also on her agenda.

"I understand the retail banking business, and I've managed through many periods of change for our company and industry, in roles that required a lot of collaboration," Mack said at the annual BancAnalysts Association of Boston conference.

The speech was a public debut of sorts for Mack, who took the helm of the retail unit in July. She succeeded Carrie Tolstedt, a previously low-profile executive who was cast into the public spotlight by the phony-accounts scandal.

Wells Fargo in early September agreed to pay nearly $190 million to settle charges that its branch employees created roughly 2 million sham accounts to meet aggressive sales targets.

The case quickly escalated into a reputational crisis. Former Chief Executive John Stumpf stepped down last month as a result. Both he and Tolstedt were also forced to relinquish millions of dollars in stock awards and other pay.

A slew of agencies at the state and federal levels have also launched probes into the San Francisco company's sales practices.

Amid the public outrage, Mack faces what could be a career-defining challenge: making broad changes to compensation and culture, all while still maintaining the division's track record of growth.

"Can she heal the reputation externally so that she can such push forward and get that growth in customer account openings at a normal pace?" said Marty Mosby, an analyst with Vining sparks.

Even before the scandal, Wells had seen the pace of new account openings slow down as fewer customers visited branches and migrated online, Mosby said. New account openings declined 30% in September compared with the previous month and were 25% lower than in September 2015, according to the company.

CEO Tim Sloan – who spoke alongside Mack – acknowledged the challenge of growing the retail division at a time when the company is also looking to overhaul its sales culture. The company last month eliminated product sales goals for branch employees, amid intense public pressure.

"There's no question that there's a risk of over-correcting," Sloan said.

Mack began her career in banking more than three decades ago at First Union bank in Charlotte, N.C. The company was purchased by Wachovia in 2001; Mack was a regional president in the retail division at the time of the acquisition.

Following Wells' acquisition of Wachovia in 2009, Mack moved up quickly in the corporate ranks. She was head of Wells Fargo Advisors, overseeing 15,000 financial advisers, before being named head of community banking in July.

Mosby said there have been questions about Mack's ability to create change at the company because of her status as a company insider. But he said Mack hit the issue "head-on" by outlining her plans to revamp the sales culture and focus on growing the company's digital customer base.

In her presentation, Mack sought to make a clear break from the recent past. "The sales practices issues identified in the settlement are unacceptable and were never consistent with the true vision and values of the company."

She said her first priority will be to change compensation plans for branch employees. Pay plans across the organization – "from team members in the branch to senior management" – will measure what customers say about Wells Fargo, and which products they use.

Compensation plans will also look at whether customers "reward" the company with additional deposits, investments or loans, according to Mack.

"We will ensure that the new plan is aligned with customer outcomes," she said

Mack stepped into the new role at a time when customer traffic across Wells Fargo branch network is declining – a trend that began well before phony-accounts scandal.

Over the past four years, Wells has closed 115 branches, with more than half of those closures coming in the past 12 months; it still has more than 6,000 branches. Customer visits with branch bankers declined 10% in September from a year earlier due to fewer internal referrals, reduced product offerings and less marketing, according to the company.

In the coming months Wells will continue to review its branch network, as customers increasingly switch to digital banking options. Mack also said the company will begin "gradually increasing" its consumer marketing to get new customers in the door.

Mack also emphasized that most branch employees are excited about the shift toward a service-oriented culture.

"Of all the things I have learned in my first 90 days on the job, that is the one that gives me the most energy and confidence," she said.