-

State student loan authorities sense a business opportunity helping graduates who are gainfully employed lower their payments. Their low-cost funding could put them in competition with banks and marketplace lenders.

June 10 -

As more employers offer student loan repayment assistance to their workers, lenders that specialize in refinancing debt like Citizens Financial and SoFi see an opportunity to reel in more customers.

April 5 -

The Consumer Financial Protection Bureau is clamping down on student loan lenders and servicers that automatically default on loans when a co-signer declared bankruptcy or dies. Because private student loans are often sold and securitized, some companies' promises to eliminate so-called "auto defaults" are not being upheld.

March 9

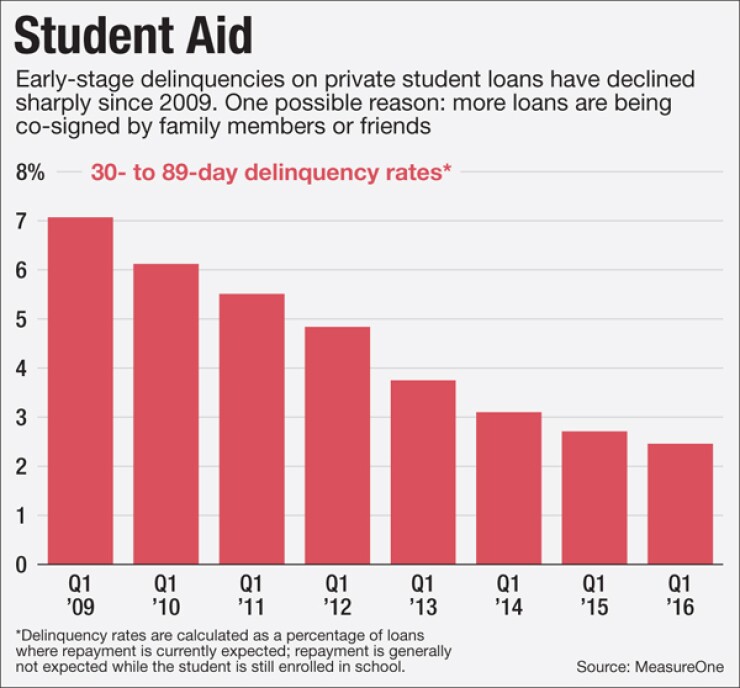

Banks that stuck with student lending after the financial crisis are finding the business far less risky than it used to be.

In the first quarter of this year, the percentage of private student loans that were at least 30 days past due plunged to its lowest level since the Great Recession, according to new data from six big lenders.

That is the good news for banks that offer private student loans. The bad news is that the business is barely growing because the federal government continues to dominate the market.

The volume of outstanding loans at the six firms that contributed data to a report released Friday did not budge between the first quarter of 2015 and the same period a year later. While loan originations rose by about 7% during the last academic year, overall balances were flat as repayments on accelerated.

The six big lenders that provided data are Wells Fargo, PNC Financial Services Group, Citizens Financial, Discover Financial Services, Sallie Mae and Navient.

Though the federal government is by far the country's largest student lender, students frequently turn to these private lenders when they need additional funds to cover tuition costs.

Today borrowers are having a much easier time repaying those loans — which make up an estimated 7.5% of the total outstanding loan volume — than they were several years ago.

That's largely because the U.S. economy has improved substantially since the depths of the recession. The unemployment rate for adults ages 20 to 24 fell from a high of 15.8% in early 2010 to 8.6% in the second quarter of this year.

"Certainly the economic environment has gotten better, particularly for people who are graduating from school," said Chris Keaveney, president of MeasureOne, an analytics firm that compiled the data on behalf of the six lenders.

Lenders also have more protection these days in cases where borrowers struggle to find work. During the 2015-16 academic year, 89.7% of private student loans were co-signed, usually by a family member. During the 2008-9 school year, only 74.6% of private student loans were co-signed, according to the report.

Within the pool of private loans where the lender expects a monthly payment — borrowers generally do not have to make payments while they are still in school — 4.37% were at least 30 days past due during the first quarter of 2016. The comparable number during the first quarter of 2010 was 11.53%, according to the report released Friday.

The six firms that contributed data to the report make up roughly 65% of the private student loan market. The report did not include data on federal loans that were refinanced into private loans.

Following the financial crisis, when private student lenders recorded big losses, JPMorgan Chase and Citigroup both headed for the exits. Discover, of Riverwoods, Ill., bought loans from Citi in 2011 and has remained in the business.

Discover reported that it had $8.9 billion in student loans in the first quarter of this year, which was up just 3% from a year earlier.

Despite the competition from the federal government, some banks do see an opportunity in student lending. Providence, R.I.-based Citizens, for example, last year started refinancing student debt.

Discover CEO David Nelms said last month that the business is showing "good profitability," and indicated that his company would be well positioned to benefit if the U.S. government ever decides to scale back its own efforts.