Credit card issuers spent the year raising interest rates, lowering credit limits, and pulling back on direct mailings as chargeoffs mounted.

No one is predicting a letup in 2009, when losses are expected to continue rising and new regulations due out today from the Federal Reserve Board are expected to curb issuers' ability to reprice customer accounts.

In fact, observers say, issuers' baseline standards have changed, and they will be marketing to a much smaller pool of consumers for the foreseeable future. This shift, combined with consumers' newfound economic caution, is expected to magnify the long-running trend for debit card growth to outpace that of credit.

"There will be a large voluntary, and involuntary, migration to debit," said Brian Shniderman, a director of the banking team at Deloitte Consulting LLP who focuses on credit cards. "Credit is going to be something that not everybody gets to have." Issuers may, in three to five years, return to "loosened" lending standards, he said, but they "probably won't ever go back to where it was."

Duncan MacDonald, a former general counsel of Citigroup Inc.'s Europe and North America card businesses, said it could take even longer for the pendulum to swing back.

"It may be 10 years before we get back to where we were a year ago," he said. "Bankers today are going to have to do what they did 20 years ago" — segmenting customers and pricing up front for risk.

Late last month, Meredith Whitney, an analyst at Oppenheimer & Co. Inc., predicted that tightening standards at top issuers would cause as much as a 45% decline, or cut up to $2 trillion, in the credit amount available to U.S. consumers during the next 18 months.

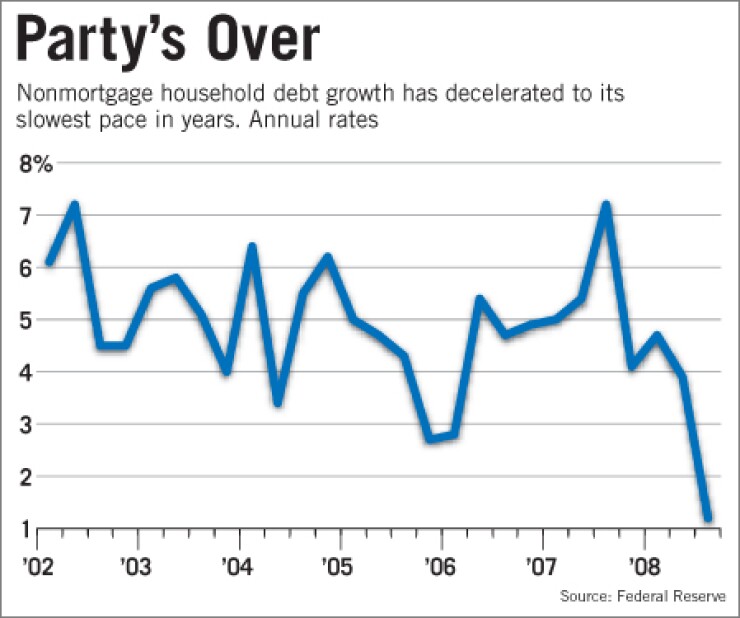

According to the Fed, nonmortgage household debt grew at an annual rate of 1.2% in the third quarter, the slowest pace for any quarter since at least 2002, to $2.61 trillion. Revolving consumer debt, excluding loans secured by real estate, contracted at an annual rate of 0.2% in October, to $976 billion, according to the Fed data. It was the first monthly decline since April — and only the second since mid-2005.

James Chessen, the American Bankers Association's chief economist, said he expects to see this decline persist for several months. "I would think we're going to have either flat or declining consumer credit over the next three to six months," he said. "There will continue to be some decline as people reevaluate how large a balance they want to carry on their credit cards."

"The landscape has changed so significantly," said Curtis Arnold, the founder of U.S. Citizens for Fair Credit Card Terms Inc., which operates the lead-generation Web site CardRatings.com. "It's been altered permanently."

Across-the-board pullbacks by issuers may be a relatively "temporary" response to the current economic woes, Mr. Arnold said. But "will the industry go back to 'if you have a heartbeat and were 18, you could get a firm offer of credit'? I don't think so."

John Grund, a partner in the card-issuing practice at First Annapolis Consulting Inc., said the credit card industry is facing "probably its most challenging headwinds in the last 10 years," if not since the recession of 1991.

"It's not just unemployment," he said. "If it was just rising loss rates, that's what credit card issuers get paid to do." But "this has the funding environment, bank failures, political uncertainty around regulations — it's a real mess."

Issuers will make less use of the "hot money" tactics they used in more flush times, like low- or no-interest introductory rates or balance transfer offers that let customers "surf" from one card to the next as the generous terms expired, Mr. Grund said. "I expect much more disciplined marketing and tighter underwriting to mark an era of more rational competition."

This week, issuers are perhaps most concerned about the regulatory front.

Nessa Feddis, a senior federal counsel at the ABA, said last week that the Fed's new rules will "exacerbate the current economic environment where credit has already become less available."

Mr. MacDonald said such talk reminded him of how the industry used to react to regulatory changes when he worked at Citi in the 1990s.

Back then, he said, government relations lawyers would make "Chicken Little arguments — 'The sky is falling.' " But "the business people invariably said, 'We'll make adjustments, we'll survive it.' "

This time around, such adjustments could include the revival of annual fees on more credit cards, especially those with rewards programs. "There's a good chance that in some way, in some form, annual fees will come back," Mr. MacDonald said. Even before potential government action on interchange, a return to a more fee-based model is "not inconceivable at all, especially with the pressure on the APR side" from the Fed rules.

Analysts also argued that the regulations will enshrine tighter lending standards that could otherwise be relaxed as the economy improves.

Scott Valentin, an analyst at Friedman, Billings, Ramsey Group Inc., said the Fed rule defining unfair and deceptive credit card practices "has the potential to really change the availability of credit." Because "it eliminates preventive pricing … , rates across the board will go up, and availability of credit will go down."

Craig Maurer of Credit Agricole's Calyon Securities said regulations that "materially curb banks' ability to reprice for risk" will have a more permanent impact on issuers' long-term standards. Absent such regulations, "access to credit will return; it's just a question of time and turning of the cycle."

But consumer advocates said the issuers have, with their own responses to the economic downturn, already caused a fundamental decrease in the mass availability of credit cards.

"We are entering a new era. It may lead to less credit for some people, and that won't necessarily be a bad thing," said Travis Plunkett, the legislative director at the Consumer Federation of America.

"It's hard to imagine a scenario where the regulation, by itself, as opposed to the current economic era, will substantially harm access to credit for the creditworthy, or the price," he said.

Issuers have emphasized the appeal of credit card rewards programs, which spur spending. But observers said efforts to build up comparable rewards programs for debit may discourage consumers from returning to their former levels of credit card use.

"Clearly some efforts over the past few years that would help to engrain debit card spending, like rewards programs tied to debit cards … would help solidify the shift to debit cards," said Ron Shevlin, a senior analyst at Aite Group LLC. "As the economy improves, is the move to debit set in stone? It'll be a marketing battle for one versus the other."

Banks that offer both products to customers looking to rein in their spending may be the best positioned to weather the downturn. "Any decline in discretionary spending favors the debit card," said First Annapolis' Mr. Grund. "Consumers are much more budget-conscious, managing out of their checking and savings accounts, not their credit card accounts. I think those banks that have large credit and large debit businesses will be the most resilient."

But in the long run, though credit cards may regain some favor, banks may have to fight harder for a share of consumers' skinnier wallets. "Customers will probably on average carry fewer cards," Mr. Grund said. "That probably favors their bank: They will have a relationship-based product," instead of "just jumping at every new offer" from a credit card company.

Friedman Billings' Mr. Valentin said that, as the economy improves, "you'll see credit lines move back up," though "I don't know if they will get back to pre-2007 levels."

Consumers at the "lower FICO end of the range will see a reduction in the credit available," he said.

"There'll be a segment of the population that won't qualify for a credit card going forward," but "people carry about five credit cards in their wallet. It's an ubiquitous product, and it's still going to be a very mass product."

Despite the gloomy forecast for the next few years, no industry members or observers would go so far as to write off the credit card.

"The rewards and the value propositions are still very attractive, the product is 50-plus years old, and it's engrained in our society," Mr. Grund said. "What will get flushed out will be some of our reckless behavior surrounding it."

CardRatings.com's Mr. Arnold said that the prospect of stronger regulation, as well as issuers' initiatives in response to mounting chargeoffs, may be making the industry more consumer-friendly.

He pointed to the credit card payoff calculators found on the Web sites of Discover Financial Services and JPMorgan Chase & Co. as "encouraging" signs.

"Who'd a thunk a year ago that credit card companies would help customers pay down their debt?" he said. "Being forced to rethink some of their practices … will put a better light on the industry from a consumer perspective" and "over time could help consumers warm up to credit cards again."