-

Low interest rates may be pressuring margins, but they provided a lift to community banks that sell mortgage originations. Bankers are now debating how long the current refi boom will last.

April 24 -

Still reeling from underwriting guidelines that went into effect last year, some small lenders are worried that a new mortgage disclosure regime might be the thing that pushes them over the edge.

April 14 -

Two House Financial Services subcommittee chairmen are urging the Consumer Financial Protection Bureau to delay enforcement of a new disclosure regime due to take effect this summer until Jan. 1.

April 10

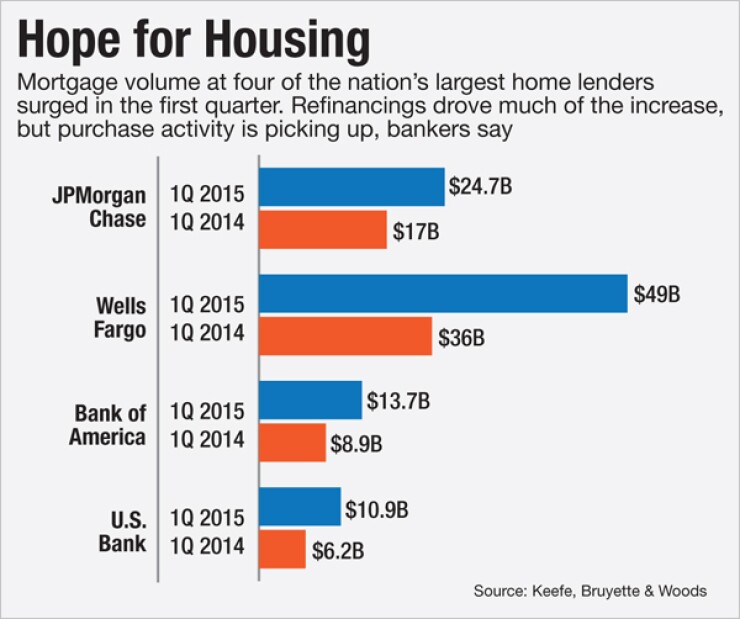

Home lending at most large and regional banks soared in the first quarter and loan pipelines are bulging heading into the second quarter, early signs that 2015 could be a strong year for the housing market.

Falling interest rates in January and February sparked a flurry of refinancing activity, while home buying finally picked up steam in March, the start of the spring selling season. With low rates tempting more home owners to refinance and relaxed down payment requirements spurring more home sales, bankers are more optimistic about mortgage lending than they have been in some time.

"All the metrics that we are following in the mortgage business are positive at the moment," Grayson Hall, the chief executive at Regions Financial, said on an April 21 conference call with analysts. "We, like most people, anticipate a very strong second and third quarter."

To be sure, the first quarter's strong results compare with depressed volumes a year ago, when rates for 30-year loans had climbed above 4.3%. Compared with the first quarter of 2013 the peak of the refi boom loan volume is down 50%.

Still, the mortgage market is clearly rebounding, and it's not just refi activity that's driving demand. Even with mortgage rates sitting well below 4%, refinancings dropped to 56% of total applications for the week that ended April 22, the lowest level since October, according to the Mortgage Bankers Association.

Mike Fratantoni, the MBA's chief economist, said that the purchase market has been aided by the introduction of 3% down payment loans by Fannie Mae in December and Freddie Mac in March. Lower down payment requirements for jumbo loans also have helped boost lending.

"We're at an inflection point where refinances are getting some lift and purchase volume is doing really well," said Marty Mosby, director of bank and equity strategies at Vining Sparks in Memphis.

Wells Fargo, the largest home lender and the industry's bellwether, said that its mortgage volume in the first quarter

Loan volume jumped 45% at JPMorgan Chase, to $24.7 billion, 54% at Bank of America, to $13.7 billion, and 76% at U.S. Bank, to $10.9 billion. Among regional banks, residential lending volume jumped

BB&T said that its refinance volume was 55% in the first quarter while purchase volume was 45%, a more balanced mix than in the past few quarters. Other banks are seeing similar shifts, an indication that many borrowers eligible to refinance their home loans have already done so.

"We think the second quarter will be strong with the purchase market showing some traction, but from an overall volume standpoint, purchase doesn't solve the drop in refinances," said Bose George, a KBW analyst.

Nancy Bush, a manager at NAB Research LLC in Madison, Ga., noted, however, that some banks' numbers are skewed by the fact that they are buying loan portfolios from correspondent lenders. The cost of buying those loans, rather than originating them through retail branches, can thin banks' margins, she added.

The first quarter is typically the weakest for mortgages but increased refinance activity drove strong mortgage fees. With interest rates low, gain on sale margins are at their highest levels in six quarters.

Another clear sign that momentum is building: Wells' loan application volume increased 41% between Dec. 31 and March 31, to $93 billion, according to Keefe, Bruyette & Woods.

Activity has been particularly brisk in Florida, one of the states hardest hit by the housing bust.

"Florida is back," Ricky Brown, BB&T's president of community banking, told analysts on an April 21 call. "They are buying homes particularly in South Florida."

John Stumpf, Wells' chairman and CEO, echoed those comments.

"I was in Miami recently and that market, it's stunning how that market is really doing so well," Stumpf said on a conference call with analysts. "You would have looked back six years ago and you couldn't imagine what's going on today."

To be sure, Florida has not fully recovered from the downturn. While home prices are rising faster there than in most states, they are still 32.4% below their 2006 peak, according to data from CoreLogic. Also, Florida still had the second-highest share of distressed home sales at 22.3% in January, trailing only Michigan's 23.1%, CoreLogic data showed.

There is concern that new mortgage disclosure rules that take effect Aug. 1 could put a damper on lending in the second half, just as the qualified mortgage rule did a year ago.

Paul Miller, an analyst at FBR Capital Markets, said, some lenders are worried that they will not have computer systems aligned properly ahead of the disclosure rules, which combine requirements of the Truth-in-Lending Act and the Real Estate Settlement Procedures Act. In the long run he sees the new rule as being good for banks, but the transition period could be rough, he warned.

"You're going to see a huge run-up in originations up to July, but after that, it could be disruptive," Miller said. "People were afraid of QM and they tightened up the credit box. The industry will be much better off when everything is done but it will have a magnified effect."