Regions Financial is exiting indirect auto lending for the second time in a little over a decade.

Like other banks lately that have quit the business of making auto loans through car dealers, executives cited lackluster returns and poor potential for developing broader relationships with the borrowers.

“Essentially we weren't making any money there,” Scott Peters, head of consumer banking, said at the Birmingham, Ala., company’s recent investor day in New York. “This move out of indirect auto is going to allow us to put that capital to work in other products and businesses that make sense.”

The $125.7 billion-asset Regions said it decided in January that it would exit indirect auto lending and informed dealers that same month. It will cease making new loans in the first quarter and will complete any in-progress loans in the second quarter. However, Regions will continue making direct auto loans to consumers. The decision was

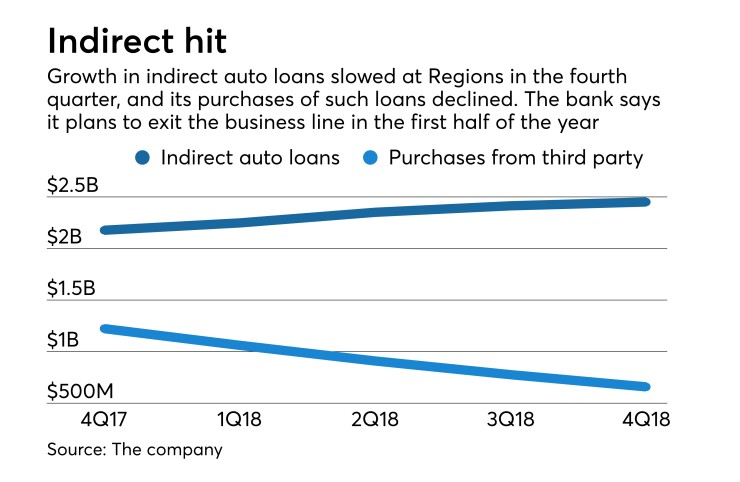

Regions’ total indirect auto loan portfolio at Dec. 30, including dealer financing and purchase agreements, shrank 8.5% from a year earlier to $3.1 billion; it made up a little over 3% of the total loan portfolio.

The company had exited indirect auto lending in 2008, the year the financial crisis began to unfold, but then re-entered it in 2010, shortly after then-CEO O.B. Grayson Hall took over as chief executive. Hall retired as chairman and CEO last year.

Regions is hardly alone in moving away from indirect auto. In recent years, the regional bank Fifth Third Bancorp and community banks like Fidelity Southern have scaled back their indirect auto business. TCF Financial said in 2017 that it would also reduce its indirect auto lending; that same year, Chemical Financial also announced plans to exit indirect auto lending. (Chemical in January

In all cases, those banks cited less-than-desirable returns, as opposed to credit quality concerns, as their chief rationale for doing so.

“It’s definitely something we’re seeing across the industry,” said Stephen Scouten, an analyst with Sandler O’Neill. “It’s a business that people are having a hard time making a profit in. You’ve got some level of losses, yields are pretty tight, and it’s a long duration asset, too.”

Although some auto lenders have remained upbeat, longer loan terms and the specter of the new loan-loss accounting standard are giving others pause about the category, Scouten said. Indirect auto loans also give banks fewer opportunities to reach customers and get them to open or switch accounts because the initial connection was through the dealer, he said.

“If incremental funding is costing you, say, 150 basis points, and your average loan on the car is 4%, it’s a pretty small spread relative to absorbing those credit costs,” Scouten said.

The exit from indirect auto also fits with the strategy executives outlined at the investor day last week. Regions places a high premium on low-cost consumer deposits, which account for roughly 61% of its deposit base.

Among other things, new CEO John Turner said Regions is selectively adding branches in high-growth markets like Atlanta and Orlando. He also emphasized its appeal among younger consumers: About half of all new consumer checking accounts opened at Regions are for consumers under 30, he said.

Peters said that he wants to focus more time and capital on those products that have a greater potential to lead to other customer accounts.

Indirect auto "is not a very strong relationship product. It doesn't provide a lot of opportunities for expanding those relationships,” he said. “The mortgage product, on the other hand, is a relationship product where we get a lot of opportunity to grow the overall customer profitability with those assets, and it's a good, strong-performing asset on our balance sheet as well.”