Michael Daly is still enamored of the mortgage business.

Daly, chief executive of Berkshire Hills Bancorp in Pittsfield, Mass., was excited about his company's chance to enter Philadelphia by buying First Choice Bank in Lawrenceville, N.J., in a low-premium transaction. The fact that First Choice has a national mortgage platform simply increased his enthusiasm for the deal.

"We've been committed to home finance and have been making the necessary investments to continue to grow it," Daly said during a conference call to discuss the acquisition. "It's a sizable investment to do right … so scale matters."

-

At least three community banks have hired lenders who once worked at banks bought by BB&T. The question is whether those lenders can coax their clients to also make a switch.

May 31 -

John Kanas, BankUnited's CEO, said the business never turned a profit, and there were no indications that it would. The company, meanwhile, remains committed to other residential lending operations while focusing on expanding its other businesses across Florida.

January 22 -

Parke Bancorp in New Jersey decided to sell its SBA lending business when it realized the group had national aspirations. Berkshire Hills Bancorp, a larger bank in Massachusetts, was pleased to buy the unit.

November 9

The $7.8 billion-asset Berkshire's interest in bulking up in mortgages comes at a time when other banks are taking a step back.

BankUnited in Miami Lakes, Fla., disclosed in January that it had stopped originating mortgages after concluding that the margins were too thin to generate a meaningful return. Christopher Whalen, senior managing director at Kroll Bond Rating Agency,

Daly, meanwhile, has witnessed firsthand the cyclicality of mortgage lending.

Berkshire, which jumped into the business with its 2012 purchase of Greenpark Mortgage, began a major cost-cutting effort just a year later after a spike in interest rates stymied refinance activity.

So why make a new push now?

Daly said during the conference call that Berkshire is determined to achieve a 1% return on assets without aggressively pursuing commercial real estate loans, which have been drawing significant regulatory scrutiny, or relying on the Federal Reserve to raise interest rates. Berkshire's ROA was 0.82% at March 31.

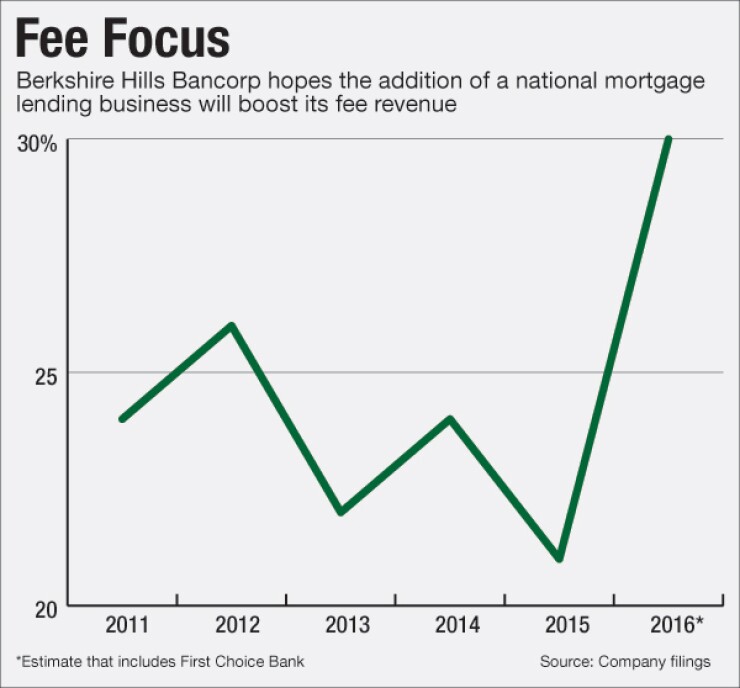

That is where First Choice comes in. Its mortgage unit, First Choice Loan Services, originated $2.5 billion in mortgages last year, generating $68 million in revenue. The unit sells all of its originations, and Daly said the resulting fees should push Berkshire's noninterest income beyond 30% of total revenue, a key milestone on the way to achieving a 1% ROA. (The ratio stood at 21% at the end of the first quarter.)

More than half of the mortgage unit's loans were made in Arizona, Texas and California. At the same time, a large percentage of the originations are tied to the unit's exclusive status as a mortgage lender to Costco customers.

"Their platform provides diversification of geography and risk and it comes with a compliance culture and management team that complements, and in some cases, upgrades our own," Daly said.

Berkshire's in-house mortgage unit generated just $4.1 million in mortgage revenue last year.

Still, the move has some people scratching their heads, including analyst Richard Parsons, who

At the same time, Parsons expressed concern about the elevated level of nonaccrual credits on First Choice's balance sheet. About 2.8% of the bank's $222 million portfolio of one- to four-family loans were in nonaccrual status at March 31, according to a regulatory filing.

Daly, for his part, said his team is scaling up with eyes wide open.

"This is not a new business to us," he said. "We've learned a lot of lessons along the way. Not all of them have been easy. We understand the volatility in the markets and we monitor that closely."

Beyond mortgages, Daly touted Berkshire's entry into Philadelphia, which should help with the expansion of 44 Business Capital, a Small Business Administration lender the company recently bought. The expectation is that 44 Business Capital, which has historically focused on loans of $1 million or more, can use First Choice's branches to finally make smaller loans that can qualify for credit under the Community Reinvestment Act.

"We like the economics of" smaller transactions, Sean Grey, Berkshire's chief operating officer, said during the call. "They're typically very deposit heavy [and] are typically very relationship-oriented and loyal to the financial institution."

Philadelphia, along with the rest of Pennsylvania, has been an M&A hotbed in recent years. Such activity has proved a double-edged sword for community banks that aren't selling, said Kevin Tylus, president and chief executive at Royal Bank America in Bala Cynwyd, Pa.

On the plus side, the $800 million-asset Royal and other small banks have been able to hire scores of bankers displaced by other deals. "We've had several strong people come to us as a result of M&A," Tylus said.

But the personnel gains are accompanied by a far more competitive landscape.

"Berkshire Hills is a sizable bank with more leverage," Tylus added. "I think Berkshire is nine times larger than Royal Bank. We're going to need to be more efficient."

It is unclear whether Daly, who has a penchant for identifying targets before insisting on one-on-one negotiations, will pursue more deals to bulk up around Philadelphia. He seemed content, for now, with the agreement he hammered out with First Choice.

"This is a really good transaction for us both strategically and financially," Daly said. "It provides us with a foothold into great markets and complements the specialty lending investments we've already made in those areas."