Consolidation of the mortgage servicing business continues.

Processing Content

Mellon Bank Corp. is in the final stages of evaluating bids for its mortgage operation, the key attraction of which is its $73.5 billion servicing portfolio, industry sources said.

The big home loan units of Chase Manhattan Corp. and Fleet Financial Group are said to be among the final bidders. If Chase bought the Mellon unit, it would leap to the top of the servicing ranks, with about $290 billion.

And sources say First Nationwide Mortgage of Frederick, Md., bought BankAtlantic Bancorp's $3 billion servicing portfolio last month.

The deal would mark BankAtlantic's exit from the servicing business and boost First Nationwide's total servicing book to about $90 billion.

Servicing is the business of collecting and processing mortgage payments. The business is considered risky because of its sensitivity to interest rates.

When rates fall and homeowners refinance, the fees that companies collect for servicing disappear, and the market value of servicing rights drops. If book value of a company's servicing exceeds market value, the company must take an impairment charge to earnings.

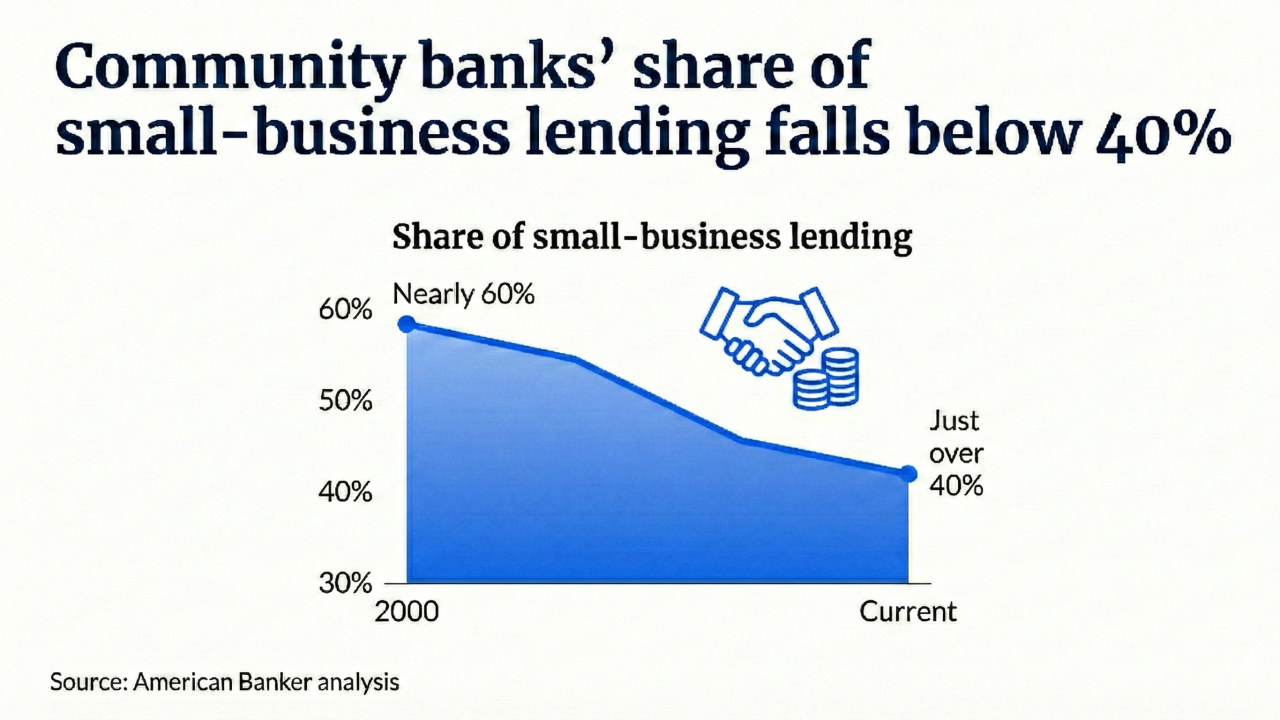

That risk, combined with economies of scale, has spurred industry consolidation, as mortgage servicers have decided to either become giants or leave the business.

Mellon put its entire mortgage division-both servicing and originations- on the block in January. But the Pittsburgh bank's home lending subsidiary originated only $7 billion in 1998, a paltry sum compared with its huge servicing portfolio.

"Their production numbers were not robust," said a mortgage executive whose company looked at Mellon. "It's more a servicing play with a platform around it than a production play."

This executive, who spoke on condition of anonymity, said he expected Mellon to announce a decision in the next two weeks. "There's an auction going on, and it's at the tail end of the process," he said.

Servicing brokers say packages of conventional loan servicing have been trading at multiples of four to six times the servicing fee, which is usually 25 basis points. That would put the price of the Mellon package at $735 million to $1.1 billion.

BankAtlantic, based in Fort Lauderdale, Fla., took a $15 million writedown on its portfolio in October. In December the thrift decided to bow out of servicing.

First Nationwide, a subsidiary of Golden State Bancorp of San Francisco, agreed last month to buy the package. Countrywide Servicing Exchange, a unit of Countrywide Credit Industries Inc. of Calabasas, Calif., brokered the sale.

Market levels would put the price of the BankAtlantic deal at $30 million to $45 million.

Meanwhile, Pitney Bowes Inc. has delayed the sale of its subsidiary, Atlantic Mortgage and Investment in Jacksonville, Fla., sources said.

A spokeswoman for Pitney Bowes said it has been considering a "range of strategic options" since January, and nothing has changed since then.

Last month it looked as though a deal was imminent, with Fleet, PNC Bank Corp. of Pittsburgh , and Bank United of Houston said to be the three finalists.