Signature Bank in New York posted record loan growth in the fourth quarter as demand from commercial borrowers far surpassed the bank’s expectations.

The $118.5 billion-asset bank said Tuesday that net loans, excluding Paycheck Protection Program credits,

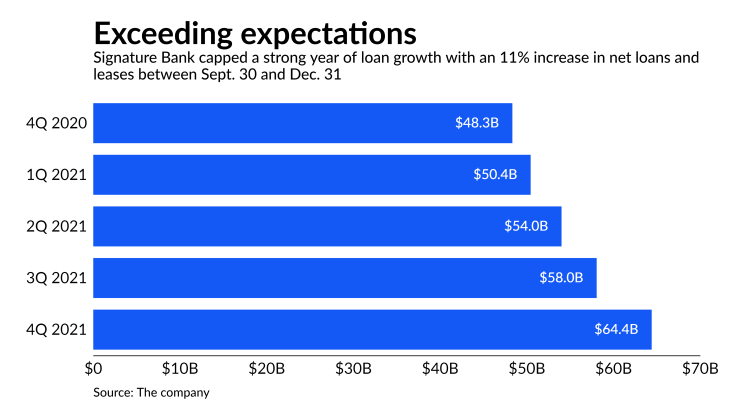

At year-end, total loans stood at $64 billion, up 33% from a year earlier.

President and CEO

He said the growth spanned the bank’s East Coast and California operations and included robust gains in its portfolio of loans to private equity and venture capital firms as these companies ramped up their investments. The bank also reported gains in mortgages and commercial real estate loans.

The blistering growth drove fourth-quarter net income to a record $272 million, up 13% from the prior quarter and 57% from a year earlier. Earnings per share advanced 12% from the third quarter and 33% from a year earlier, to $4.34. The EPS result surpassed the average estimate of $3.97 among analysts polled by FactSet Research Systems.

DePaolo said aggressive hiring efforts during the year helped drive the growth. The bank brought on eight banking teams in 2021, including two in New York and four on the West Coast.

Fourth-quarter total securities increased 22% from the prior quarter and 91% from a year earlier to more than $20 billion.

Signature did not specify a specific loan growth target for the year ahead but said it expected continued expansion, bolstered in part by the new teams and anticipated ongoing economic growth. The company estimated that loans and investment securities combined would increase $3 billion to $7 billion in the first quarter and between $4 billion to $7 billion over each of the following three quarters.

Fourth-quarter net interest income climbed 11% from the prior quarter and 36% from a year earlier to $535.9 million.

Deposits, meanwhile, increased 11% from the prior quarter and more than 60% from a year earlier to $106 billion.

The bank’s net interest margin ticked up by 3 basis points during the quarter to 1.91% but was 31 basis points lower than a year earlier. With markets now expecting the Federal Reserve to raise interest rates multiple times this year to help curb inflation, Signature said its margin should increase this year. The Fed has signaled that increases would come in 25-basis-point increments.