-

After months of rumors, Wells Fargo & Co. — the nation's largest originator of reverse mortgages — made it official confirming that it is leaving the sector, but will remain as a servicer.

June 16 -

OneWest Bank is exiting the reverse mortgage origination business it operated through Financial Freedom, once the dominant player in the industry.

March 22 -

Bank of America announced the establishment of Legacy Asset Servicing to oversee the servicing of all defaulted residential mortgage loans and discontinued lending products.

February 4

Wells Fargo & Co. decided to exit reverse mortgages after federal officials insisted it foreclose on elderly customers who were behind on property tax and insurance payments, a Wells executive wrote in an email to business contacts Friday.

The San Francisco bank had other reasons to shut its 1,000-employee reverse mortgage unit. The industry's lack of growth, declining housing prices and other issues have reduced its draw for major lenders, prompting other market leaders such as Bank of America Corp. and Financial Freedom Acquisition LLC, a unit of OneWest Bank Group LLC, to pull out as well. The business is simply not central to the mortgage operations of Wells and others.

But the pullout occurred after a disagreement between Wells and the Department of Housing and Urban Development came to a head, Phil Bracken, an executive vice president of Wells Fargo Home Mortgage, wrote in the email. Wells was worried that HUD would force it to foreclose on senior citizens with delinquent reverse mortgages insured by the Federal Housing Administration, according to a copy of the message obtained by American Banker.

"The last straw in our decision was the recent HUD decision to require servicers to initiate foreclosure on the Senior Reverse Mortgage customers [who] could not pay their taxes and insurance," the email said. "When a product or program creates more reputation risk than value … well … you get the picture."

Under a reverse mortgage, homeowners must continue paying property taxes and insurance premiums. If they lack the money, the lender makes the payments for at least two years while attempting to work out a repayment plan. In the event that fails, the lender is then supposed to seek authorization from HUD to begin proceedings that lead to foreclosure.

HUD declined to comment on Wells' decision to exit the business, and Bracken did not respond to requests for comment.

A Wells spokeswoman attributed the move to a more general concern over the bank's inability to assess whether a senior could afford homeownership, even with a reverse mortgage.

"That, I would say, was much more of concern than anything else," the spokeswoman said. "We were talking to HUD, and looking for ways to revise the program. We decided to discontinue these originations because we felt we'd exhausted our options."

Industry participants said that Wells departure was regrettable.

"We're hoping that the news of Wells announcement will serve as a call to action to expedite the department concluding work on" rule changes, said Peter Bell, head of the National Reverse Mortgage Lenders Association.

Wells' departure was unwelcome news for the industry at large.

"Nobody who wants to be in the reverse mortgage space is going to be helped by Wells withdrawing," said David Kittle, a former chairman of the Mortgage Bankers Association who now works for the mortgage auditing firm IMARC LLC. "The optics are, 'Oh, my God, Wells is getting out. What's wrong?' "

While the industry has generally grumbled about the FHA's failure to adapt its reverse mortgage guarantee program in the wake of the housing collapse, the reverse mortgage market's disappointing growth and HUD restrictions on cross-selling of reverse mortgages may also have influenced Wells' decision. The Wells spokeswoman said they were not significant concerns.

But there was no denying that expectations for the market are much lower than they used to be. As recently as mid-2009, Wells executives such as Peter Katsaros in Wells' Senior Products unit told Retirement Income Reporter that reverse mortgages were certain to be a winner because of the imminent wave of retiring baby boomers.

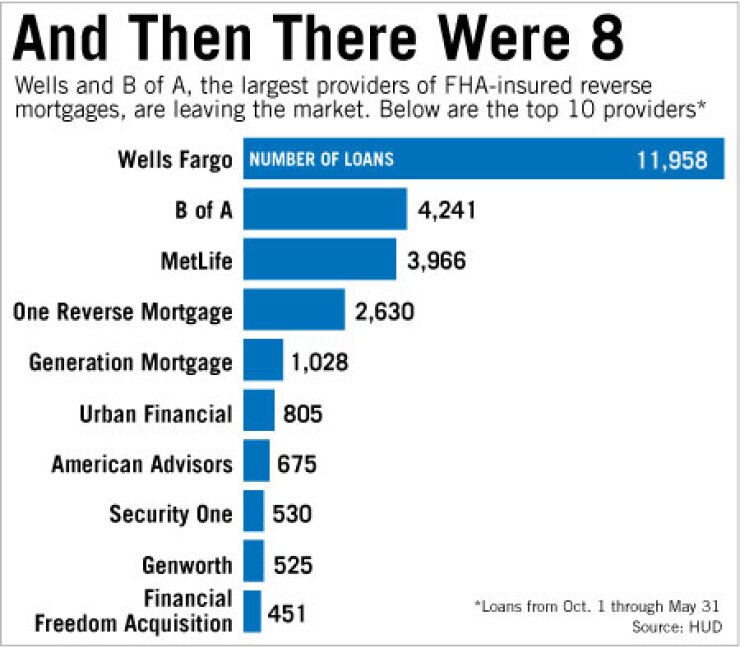

The fallout from the housing crisis has since caught up with the industry, sapping about 30% of its volume in 2010 alone. According to HUD data, Wells underwrote only 12,000 reverse mortgages between October and May — a number that made it the market leader but amounted to only a pittance in terms of mortgage origination dollars.

"Whether they were making or losing money, and I presume they were making money, it wouldn't even have been a rounding error," said Jeff Lewis, the chairman of Generation Mortgage Co. in Atlanta, the nation's largest independent reverse mortgage underwriter. "I think [the big banks' withdrawal] is in a lot of respects a function of the government concentrating the financial services industry. A niche product like this … is not worth the time or complexity for institutions that are so large."

Another factor that may have weighed on the business was restrictions against cross-selling reverse mortgages that have been in place since the 2008 housing reforms. Lewis said they prevent him from partnering with life insurance companies to offer policies that could pay off the reverse mortgage when the borrower dies. Wells would likely have found the rules to be particularly galling given its institutional focus on cross-selling. "That takes away a big competitive advantage," Lewis said. "It turns out Wells Fargo is buying leads from the same guys I'm buying leads from."

Reverse mortgage market participants generally agreed that the industry is enduring hard times. Aside from the obvious damage that a decline in home prices has done to equity and thus the potential market, the persistence of housing declines and economic distress have left underwriters of FHA-backed reverse mortgages exposed to greater risks. One problem is that lenders are not allowed to set aside payments for property taxes and other such recurring costs, leading to trouble if the borrower cannot pay them. Contributing to the issue is a prohibition on underwriting loans based on borrowers' credit rather than the equity they have in their home.

A third problem arises in the course of disposing of the property. If the borrower dies and the equity in the home does not cover the mortgage, the FHA is responsible for making up the difference. But it is often the lender's duty to dispose of the house, a process that sometimes forces it to eat some of the costs. An FHA requirement that the lender not sell the house for less than 95% of its appraised value can make that process difficult, Lewis said. "Imagine 5% as your margin on this kind of housing market — it's insane. If someone has a 375 bid for a 400 house, we can't sell it."

But the program has more benefits than flaws, Lewis said.

"The FHA makes a remarkable product available to U.S. consumers that is unique," he said, adding that he believes the agency will adjust its reverse mortgage program in a way that suits as broad a range of lenders and borrowers as is possible. "While it's not perfect, the FHA does a good job maintaining it."

Kittle also supported the idea that the big banks' departure was perhaps only circumstantial.

"With home values declining, it just became more of a distraction if anything," he said. "Can they always get back into it? Sure. They can take a look and say 'Things are stable. We'll lend.' "