A Friday swoon capped a volatile week for bank stocks as investors appeared to punish or reward companies for how, or whether, they chose to address market speculation about credit quality and capital issues.

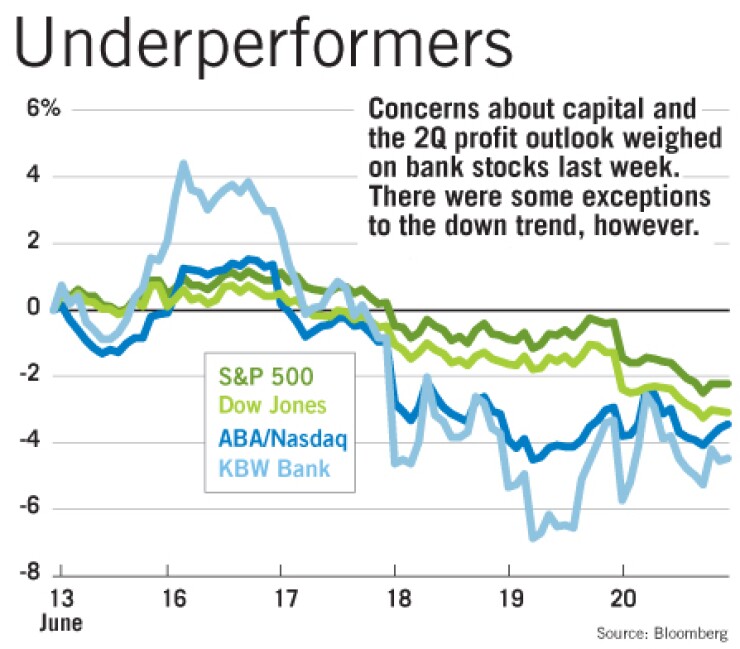

The KBW Bank Index fell more than 3% early in the session but rallied slightly to close down 1.18%. For the week, the index shed 7.21%.

SunTrust Banks Inc. quelled weeks of speculation Friday by affirming its support for its dividend and refuting speculation that it could issue common stock to raise capital. The announcement erased a 4% stock decline in a matter of minutes.

"We typically don't react to fluctuations in our stock price, but this time is anything but typical," said Barry Koling, a SunTrust spokesman. He spoke after JPMorgan Securities LLC issued a note Friday saying that SunTrust may need to sell preferred stock or cut its dividend to cover losses from problematic loans. The Atlanta company's stock closed up 5.5%. It had fallen 43% since SunTrust's last public statement May 13.

Investors soundly rewarded Huntington Bancshares Inc. on Friday for addressing market concerns about its credit quality Thursday. The Columbus, Ohio, company's shares, which had gained more than 30% at one point Friday, closed up 29.8%.

Huntington said it is building reserves more quickly than before, but it told investors it does not have "significant" credit issues.

Thomas E. Hoaglin, its chairman, president, and chief executive, tried to put an end to market speculation that had pushed the stock down 23% earlier in the week. "Investor skepticism is not surprising," he said in a press release, but Huntington's outlook for net chargeoffs "has remained consistent" with previous forecasts.

Analysts said Huntington's stock jump is another sign of investors' increasingly edgy behavior. "We're in a new world where the volatility is simply unprecedented," said Scott Siefers, an analyst at Sandler O'Neill & Partners LP.

Early Thursday afternoon, after Sterne Agee & Leach Inc. said in a note that BB&T Corp. was likely to cut its dividend in response to credit issues, the Winston-Salem, N.C., company reaffirmed plans to raise the dividend. The reaffirmation quickly turned a 9% stock drop into a slight full-day gain. The shares rose another 1.4% Friday.

Not everyone is being commended for their chosen method of disclosure. Richard Bove, an analyst at Ladenburg Thalmann Inc., chided Citigroup Inc. after Gary Crittenden, its chief financial officer, used a one-on-one conference call with the Deutsche Bank Securities analyst Michael Mayo to say Citi expects to report "significant" second-quarter writedowns related to subprime and leveraged lending exposure. "Material information was made available, but it is open to question if it was made available in a fair and honest fashion to all investors," Mr. Bove wrote in a note.

Shannon Bell, a Citi spokeswoman, said Friday that it had announced the Deutsche Bank call, which was available through live Webcast and replay, a week before it was held. "We fully complied with all requirements" for regulatory disclosure. Citi's shares fell 4.8% Friday.

Others have remained relatively mum as investors have pummeled their stocks. Regions Financial Corp. in Birmingham, Ala., has been silent since voicing support for its dividend and capital strength at a May 29 conference; its shares have lost 37.8% since then, despite a 0.4% gain Friday. At least two analysts issued notes last week suggesting it may need to raise capital or cut its dividend. A Regions spokesman would not discuss the matter.