Lenders, while generally supportive of the Small Business Administration’s restart of the Paycheck Protection Program, have a number of unanswered questions about how it will operate.

The SBA, which issued more than 120 pages of

“The biggest unknown right now how will applications will be submitted,” said Mark Marionneaux, CEO of Bank of Zachary, a $299 million-asset community development financial institution in Louisiana.

“There seems to be some chatter that there will be a different application portal this time around … similar to the forgiveness portal,” Marionneaux added. “Will second-draw loans use a different portal from new loans, or will they both be on a new portal?”

"We have some unknowns still," said Chris Albrecht, director of SBA at Sunrise Banks, a $1.4 billion-asset CDFI in St. Paul, Minn. "We have yet to see an application and have yet to get confirmation on what the portal will look like. But we’re working diligently to make sure we’re prepared."

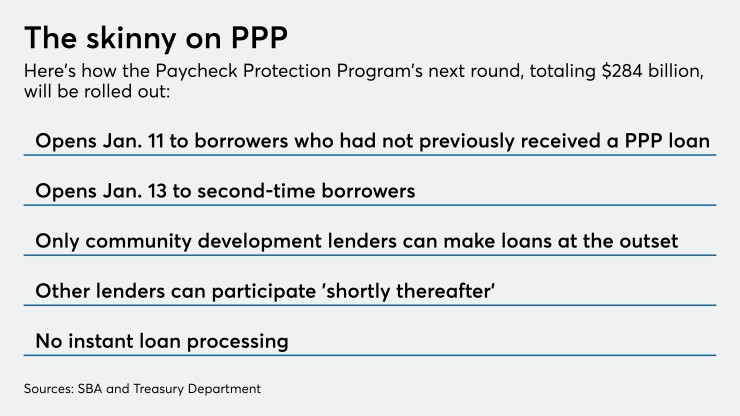

The SBA will start accepting new applications on Monday and requests for second draws two days later, an SBA spokesman said. CDFIs, minority depository institutions, microlenders and other community financial institutions — which senior government officials said make up about a tenth of all participating PPP lenders — will have an exclusive window of at least two days to process new PPP applications.

The SBA spokesman said there will be different applications for new borrowers and second draws. There will also be separate lender guarantee applications.

The goal is to process more applications for minority- and women-owned businesses, among other groups overlooked during the PPP’s initial phase.

Though the inclusionary effort was well received, lenders are still waiting on the application forms.

“Generally, I really like the guidelines, but I was disappointed they didn’t actually release what the second-draw application will look like,” said Lendio founder Brock Blake.

“The guidance was helpful but, in some cases, disappointing,” said Dan Yates, CEO of the $361 million-asset Endeavor Bank in San Diego, which will have to wait until midweek to process applications.

“The application form has not been released and our technology platform vendors need that template … to prepare our technology platform for use,” Yates said.

Lenders also noted that the SBA’s guidance lacked clarity on the level of scrutiny needed to review the financial documents borrowers submit to support second draw loans greater than $150,000.

“There were rumors circulating that the new bill was going to simplify the process for banks by placing the entire burden on borrowers to certify that they qualify,” Yates said. “As we now know from the guidance that is not the case. It will require that banks once again become subject-matter experts … to determine all the nuances that apply to different types of businesses.”

“For loans over $150,000, does this require a thorough review of the documents and calculations, or just a review that the documentation is in the file,” said a spokesman for an industry trade group who asked not to be named. “Secondly, is it confirmed that loans $150,000 and under do not require a documentation review?”

Lenders also want more clarification on certain qualifying expenses and the safe harbor for certifying a borrower's need for new funds, said Clem Rosenberger, CEO of the $1.7 billion-asset NexTier Bank in Kittanning, Pa.

Senior government officials are encouraging small businesses and lenders to be patient, expressing a belief that there is enough money allocated to the program to meet the funding needs of new and existing PPP borrowers. They noted that, unlike the Paycheck program's first iteration, the new phase will not offer instant loan processing, and they said borrowers should not expect same-day approvals.

Some lenders are skeptical that there is enough money available. The SBA set a March 31 origination deadline for the latest round.

“I’ll be surprised if funding lasts until the end of March,” Blake said.

To meet the expected surge of new business, Lendio plans to double the size of its workforce, adding 500 employees by the end of January.

Under the stimulus package that became law Dec. 27, businesses with 300 or fewer employees that received a PPP loan during the program’s initial run from April 3 to Aug. 8 are eligible to borrow up to $2 million. They must have expended the proceeds of the first loan and be able to demonstrate a 25% reduction in revenue in at least one of the four quarters of 2020.

The latest stimulus package reserved $15 billion for CDFIs and minority depository institutions, and another $15 billion for lenders with less than $10 billion of assets. It also set aside $35 billion for new borrowers.

Still, lenders said they are ready to process loans when the portal —

or portals — are reopened. As with the initial run of the PPP, they are bracing for updates and course corrections from the SBA and the Treasury Department in coming weeks.

“We plan to be ready when we’re allowed access,” Marionneaux said. “We anticipate there to be hiccups to work through with anything new.”

"We're excited to be a part of this again," Albrecht said. "I think we’re in the best shape possible to be able to open up our portal once we have direction from the SBA. We’re going to keep the coffee on and prepare for a busy weekend."