-

Four community bankers on the hunt for acquisitions warned prospective sellers that they will have little say in how much they get paid.

November 10

On the fence about selling your bank?

The boutique investment firm Sheshunoff & Co. has a quick — if imperfect — quiz to determine if a franchise on the brink is marketable.

The Austin firm studied current merger trends and came up with three questions to gauge whether a problem bank has a decent-enough profit engine under the hood to entice shoppers.

A lot of

But it is a buyer's market right now. His firm's test is a starting point for would-be sellers to determine if they have key traits acquirers are looking for: a manageable amount of problem assets, decent earnings power and relatively healthy margins.

A franchise's true marketability depends on, well, an actual market. But if a bank answers yes to all three quiz questions, there's a good chance it is salable, Adams says.

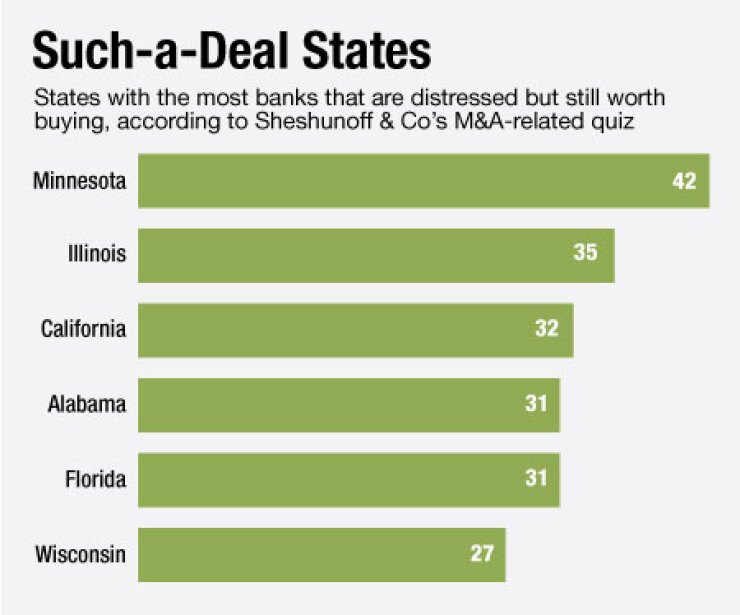

"We can kind of get a sense of the fairly distressed banks, (of) how many still have some intrinsic value in the marketplace," he says.

Here are the three questions and a description of the rationale behind each:

Does the franchise have a Texas ratio of between 50% to 150%?

Sheshunoff's quiz uses a modified Texas ratio that excludes intangibles and includes loans or foreclosed properties guaranteed by the government.

It settled on a ratio of 50% to 150% for two reasons. A bank beneath that range probably is not too distressed. A bank with a ratio in excess of 150% is too damaged and could be in danger of failing.

Does the institution have a pre-tax, pre-provision return on assets of more than 1%?

Before bank profits soared during the credit bubble, a return of at least 1% was the defining characteristic of a good, profitable bank, Adams says.

About 40% of the country's banks met that benchmark in 2006, according to Sheshunoff data. As of the middle of 2011, about 20% did.

Banks are willing to look past problems with borrowers if a bank has robust cash flow. "If a seller has a 1% [pre-tax, pre-provision] ROA there are some decent profits there," Adams says.

Is the bank's net interest margin higher than 4%?

If so, the bank probably has assets and liabilities a buyer would want.

"Historically, that has been fairly healthy," Adams says. "They must have decent yielding loans, and they must have some fairly low-cost deposits if they are yielding 4% interest."