-

The Biden administration is poised to specify which cryptocurrency firms will be forced to report reams of customer data to the Internal Revenue Service, said people familiar with the matter.

January 7 -

-

Fearing government intrusion, financial institutions’ own clients rallied against the Biden administration plan for their account information to be shared with the IRS. Their involvement added weight to the industry’s opposition.

November 5 -

A proposal that would enlist financial institutions’ help in raising tax revenue to pay for President Biden’s social policy agenda lost steam after objections from a key senator. The administration was said to be narrowing the plan’s scope to preserve its chances.

October 27 -

Sen. Joe Manchin of West Virginia, a swing Democratic vote in deliberations over President Biden's social spending bill, signaled opposition to requiring financial institutions to report customer account information to help catch tax evaders. The measure "is going to be gone," he predicted.

October 26 -

In their first direct appeal to President Biden, financial institutions and other industries' trade lobbies called on the administration to abandon its proposal that would give the Internal Revenue Service new information on customer accounts.

October 25 -

Democrats proposed raising the account threshold and exempting certain transactions from a measure enlisting financial institutions’ help in catching tax cheats. But opponents say the changes are insufficient and centrist lawmakers — whose support is crucial to enact the plan — were mum.

October 19 -

A House member suggested she and other party moderates are open to revamping or even scrapping a plan that would require banks to report customer account information to the Internal Revenue Service.

October 18 -

Banks and other stakeholders are trying to stop a proposal requiring financial institutions to submit more account data, but the Biden administration says opponents of the measure are spreading the false notion that it would reveal information about specific transactions.

October 14 -

The financial sector had been outraged over a Senate proposal requiring data submissions for accounts with at least $600 of inflows and outflows. House leaders are aiming to raise that threshold to broaden support, but industry groups say they still oppose the idea.

September 24 -

Requiring financial firms to report customer account data to the IRS as a means of catching tax cheats would be intrusive and costly, industry officials say. Backers of the measure say those claims are exaggerated.

September 19 -

Treasury Secretary Janet Yellen lobbied the chairman of the Ways and Means Committee on the measure requiring bank-provided customer data to help crack down on tax cheats and pay for the $3.5 trillion spending plan.

September 15 -

Congress is considering whether to fund Biden administration spending priorities by forcing tax evaders to pay what they owe. Banks are intensifying efforts to kill a related provision requiring them to share more account data with the Internal Revenue Service.

September 8 -

The IRS and Justice Department waged a successful campaign to crack down on UBS and other Swiss banks for facilitating tax evasion. Coinbase, Kraken and other crypto exchanges should take note.

August 23 Fox Rothschild LLP

Fox Rothschild LLP -

The Biden administration wants financial institutions to tell the government more about their customers to help the IRS thwart wealthy tax evaders. But critics say the plan could threaten account data security and the privacy of even low-income consumers.

June 17 -

A Biden administration initiative to crack down on wealthy taxpayers hiding pass-through income would require financial institutions to send account flow data to the IRS.

May 20 -

Binance Holdings Ltd. is under investigation by the Justice Department and IRS, ensnaring the world’s biggest cryptocurrency exchange in U.S. efforts to root out illicit activity that’s thrived in the red-hot but mostly unregulated market.

May 13 -

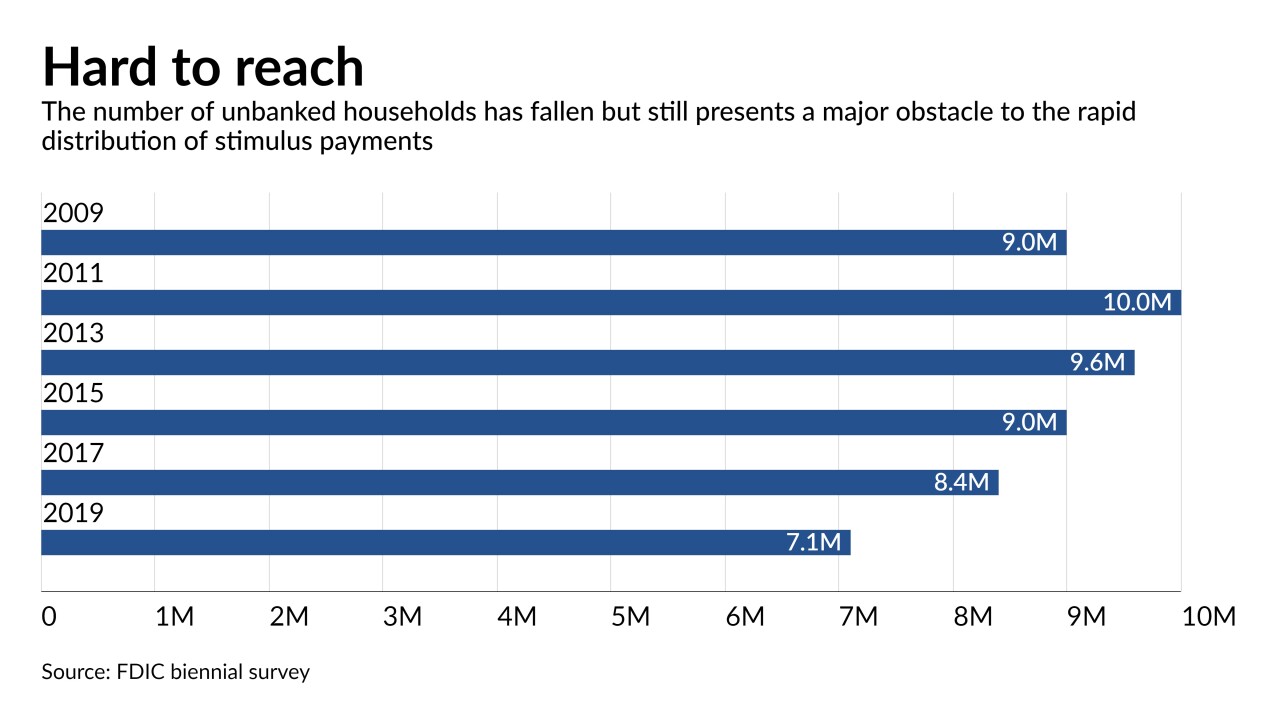

The IRS, FDIC and more than 70 banks and credit unions are urging consumers to open affordable accounts so they can receive their Economic Impact Payments quickly and safely. Many people have signed up, but millions lack accounts and will be harder to serve.

March 17 -

Banks have borne the brunt of the criticism from consumers still waiting for coronavirus relief funds to land in their accounts. But the industry says the lag time is the fault of the government and its antiquated payments system

March 16 -

The Internal Revenue Service will allow businesses that got their Paycheck Protection Program loans forgiven to write off expenses paid for with that money, shifting policy after Congress passed new legislation last month.

January 6

![Lawmakers want to “shape [the IRS reporting provision] in a way that's carefully balanced,” said Rep. Stephanie Murphy, D-Fla., left, a member of the so-called Blue Dog Coalition. Other Democratic centrists such as Sens. Joe Manchin of West Virginia and Kyrsten Sinema of Arizona have not commented on the proposal.](https://arizent.brightspotcdn.com/dims4/default/02c3031/2147483647/strip/true/crop/1400x788+0+6/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2Fe4%2F57%2Ff5e72dd04554834fe548ef831910%2Flinkedin-post-15.jpg)