-

John Quill, a former deputy comptroller, had a key role deciding which banks could participate in the Troubled Asset Relief Program.

March 7 -

U.S. regulators are poised to scrap their proposal for revising Volcker Rule restrictions on banks' trading in favor of a newer version as they respond to a misstep that drew fire from Wall Street lobbyists, according to people familiar with the effort.

March 6 -

With the two companies said to be still mulling which charter to seek, the various options each have possible advantages and drawbacks.

February 27 -

Lawmakers on the Senate Banking Committee pushed Federal Reserve Chair Jerome Powell for details about how he plans to review the proposed merger between the two regional banks.

February 26 -

A report identified gaps in documentation and other weaknesses that the watchdog said heighten the risk of agency officials being too cozy with the institutions they supervise.

February 25 -

The OCC said that branches in New York, Los Angeles and Chicago will be required to take certain corrective actions, but it did not hit the Japanese-owned bank with any financial penalties.

February 22 -

The federal banking agencies will not hold a hearing on a proposal to reduce the number of residential real estate transactions that require an appraisal.

February 22 -

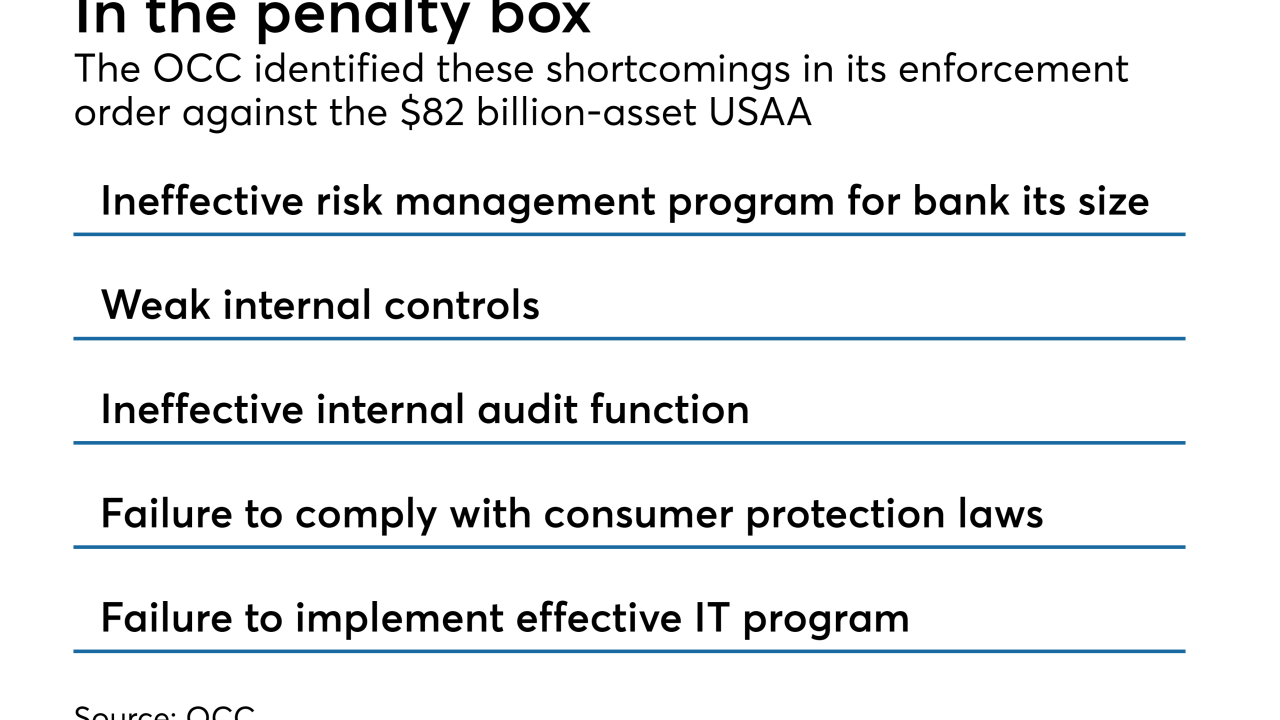

The enforcement action from the OCC comes on the heels of a CFPB consent order that said USAA reopened customers' accounts without consent and neglected stop-payment requests.

February 15 -

The comptroller of the currency also addressed, in his role as acting FHFA head, whether Congress or the Trump administration will spearhead GSE reform.

February 7 -

Federal Reserve Board Gov. Lael Brainard said public comments demonstrate a desire among stakeholders for reforms to be implemented consistently across the Fed, OCC and FDIC.

February 1 -

The agency is exploring how to reopen small-dollar lending options for banks, but consumer groups are urging it to maintain pricing limits and other controls.

January 31 -

Banks say regulatory relief efforts should go even further, while public interest groups — and even one of the Fed’s regional offices — say the proposals to roll back supervisory standards go too far.

January 29 -

The lawmakers want U.S. banking agencies to join their international peers in ensuring the financial system is resilient to climate-related risks.

January 28 -

As suspense builds over which firm will be the first to seek the special-purpose charter, a side discussion has emerged over which financial services sector has the most to gain — or lose — from the new option.

January 27 -

Despite a generally positive picture in the Shared National Credit report, regulators warned that underperforming loans in the portfolio remain elevated.

January 25 -

The industrial loan company charter is getting more attention as doubts grow about a new federal license for fintechs.

January 21 -

Morris Morgan, previously one of the top large bank supervisors at the OCC, was tapped as senior deputy comptroller and chief operating officer amid a multimillion-dollar effort to revamp the agency.

January 17 -

Federal regulators should consider applying guidance that is nearly two decades old to end uncertainty about the legality of particular bank partnerships.

January 17 Pepper Hamilton

Pepper Hamilton -

Some in the industry worry the Fed may balk at allowing OCC charter recipients into the payments system, but Otting downplayed those concerns.

January 16 -

Sen. Elizabeth Warren questioned the five largest U.S. retail banks in a letter on what they are doing to reduce the impact of the government shutdown on customers.

January 16