-

Richard Cordray, the director of the Consumer Financial Protection Bureau, is the target of a new TV ad campaign that alleges he is courting potential funders for a run as governor of Ohio by enacting a plan that would benefit trial lawyers. The campaign appears to be the work of Lincoln Strategy Group, a political strategy firm in Phoenix with ties to Republicans.

June 16 -

The prospect of banks and credit unions meeting small-dollar loan demand is at risk under the Consumer Financial Protection Bureau's restrictive proposal.

June 16 WSECU

WSECU -

Consumer advocates are urging the Consumer Financial Protection Bureau to strengthen its proposal to rein in payday lending, arguing it would still allow borrowers to be abused.

June 13 -

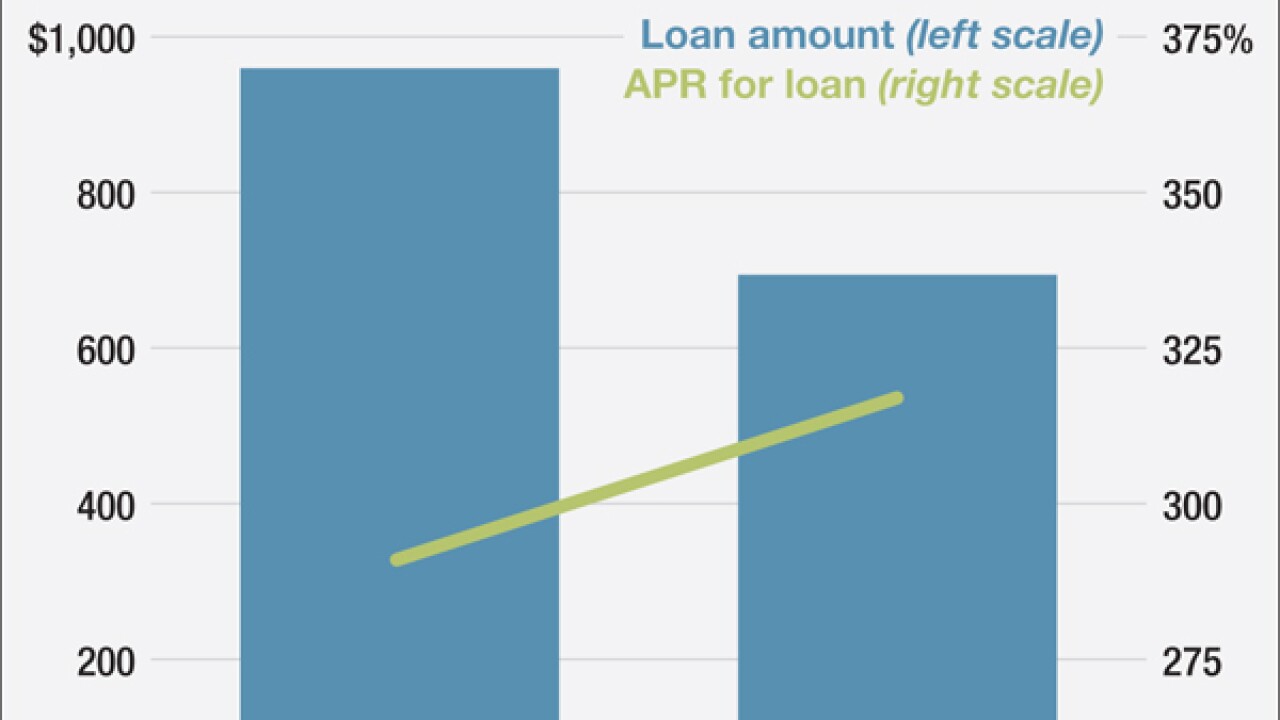

Lenders are questioning the legal justification for the Consumer Financial Protection Bureau's putting a 36% annual percentage rate threshold in its payday proposal, claiming loans made at that rate are unprofitable. That figure has been the subject of intense debate in the past decade.

June 8 -

Fintech firms and banks should collaborate on using alternative data sources to qualify more borrowers for small-dollar loans.

June 8

-

We need a variety of small-dollar credit products to meet a variety of consumer needs. So the Consumer Financial Protection Bureau's proposed payday plan must provide more flexibility.

June 7

-

The Consumer Financial Protection Bureau filed a lawsuit Monday against payment processer Intercept Corp. and its two top executives for allegedly enabling clients to withdraw millions of dollars' worth of illegal charges from consumer bank accounts.

June 6 -

The Consumer Financial Protection Bureau's complex payday lending proposal is sparking concerns that state legislatures will try to repeal existing usury laws and allow a parade of pro-payday-lending bills to move forward.

June 2 -

The Consumer Financial Protection Bureau proposal could have included flexibility for banks to offer payday loan alternatives, but the plan misses the mark.

June 2

-

The Consumer Financial Protection Bureau's long-awaited proposal to establish the first federal rules for payday, auto title and high-cost installment loans did not include a provision that banks had planned would allow them to compete by offering small-dollar installment loans.

June 2 -

We need to adopt a more nuanced view of credit that considers not only the cost of credit, but also the cost of default and the cost of having no credit.

June 1

-

While existing state laws show that payday lending curbs lead to positive outcomes, those laws will still benefit from a strong Consumer Financial Protection Bureau rule.

June 1

-

The Consumer Financial Protection Bureau will unveil sweeping federal regulations Thursday for payday lenders that could open the door for competition from banks, while forcing lenders to move toward longer-term installment loans. Here's what to track when the plan is released.

May 31 -

The idea that restricted access to loans for poor-credit borrowers is unequivocally a bad thing is based on industry talking points that don't stand up to real-world scrutiny.

May 31

-

Academics are challenging the Consumer Financial Protection Bureau's study of auto title loans, calling the findings inconsistent with state data. The study found that one in five borrowers who take out a short-term auto title loan end up having their vehicle repossessed. Some states report vehicle repossessions rates of between 6% and 11%.

May 26 -

The agency posted its semiannual rulemaking agenda

on a blog late Wednesday updating the next steps it will take on several areas of rulemaking. The CFPB expects to issue rules for prepaid reloadable cards, mortgage servicing and mortgage disclosures this summer but set no specific deadlines yet on overdraft and debt collection.May 19 -

The bureau said Wednesday that it plans to hold a public hearing in Kansas City, Mo., to discuss small-dollar lending. The hearing will be held at the Kansas City Convention Center and will feature remarks from CFPB Director Richard Cordray, as well as testimony from consumer groups, industry representatives and the public.

May 18 -

The Consumer Financial Protection Bureau found that one in five borrowers who take out short-term auto title loans have their vehicle seized for failing to repay the loan.

May 18 -

Google should be applauded for deciding to ban payday loan-sponsored ads. But it should tweak some of the details so legitimate lenders can still advertise.

May 17

-

Favorable treatment under upcoming Consumer Financial Protection Bureau rules has led banks to signal interest in small-dollar loans. But if they can serve the market profitably, why aren't they already doing it?

May 16 Community Financial Services Association of America

Community Financial Services Association of America