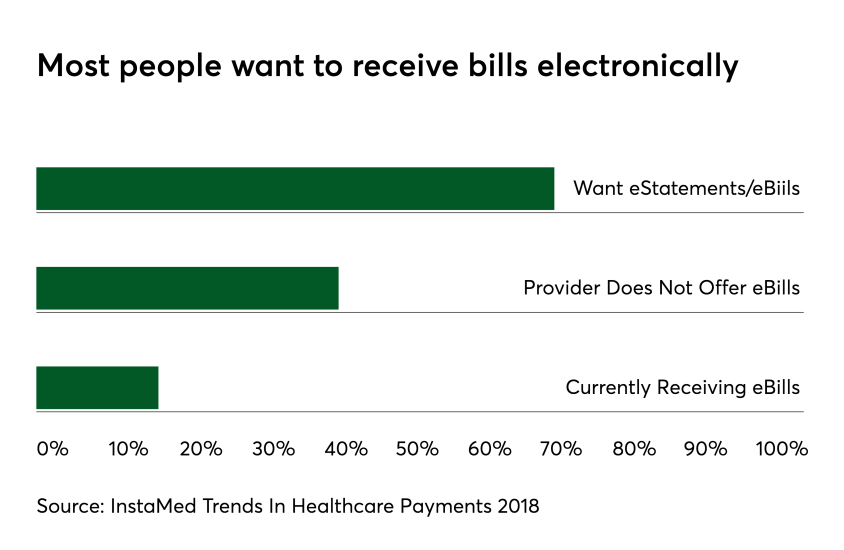

The health care payments market is big – accounting for over one in six dollars of the U.S. GDP – yet it remains perpetually outdated with its heavy reliance on using paper statements for sending out bills.

In an age where consumers can use mobile phones for metro transit rides, order ahead coffee and digital person-to-person payments, it seems strange to be writing a paper check and mailing it to pay a doctor's bill.