Blackhawk's $175 million acquisition of

Blackhawk and CashStar have taken different paths to today’s point of convergence. While in the same business, Blackhawk Network's focus has been more on physical retail, having developed as a subsidiary of the Safeway grocery chain in 2001. CashStar, while offering physical gift cards, has historically focused on digital channels.

“While CashStar does digital and physical gift cards, our innovation and our pedigree is obviously oriented around digital,” said Ben Kaplan, CEO of CashStar. “In the case of Blackhawk, they have an amazing digital business, but it is a fact that their origins, their history, that a significant component of their business remains an incredible sales distribution and marketing network in retail stores.”

The fusion of CashStar’s digital capabilities into Blackhawk Network is a logical progression given shifting consumer trends in shopping and gifting. “People love gift cards—and are increasingly interested in omnichannel options for buying, giving and redeeming them. But consumers are also changing the ways they pay and shop, and as a result are transforming payments and commerce,” said Erin Wood, vice chair of the RGCA board of directors. “New mobile wallet capabilities, apps, e-gift and other usage options are popping up all the time to adapt to these developments, and we don’t anticipate that changing.”

Digital gifting keys prepaid growth

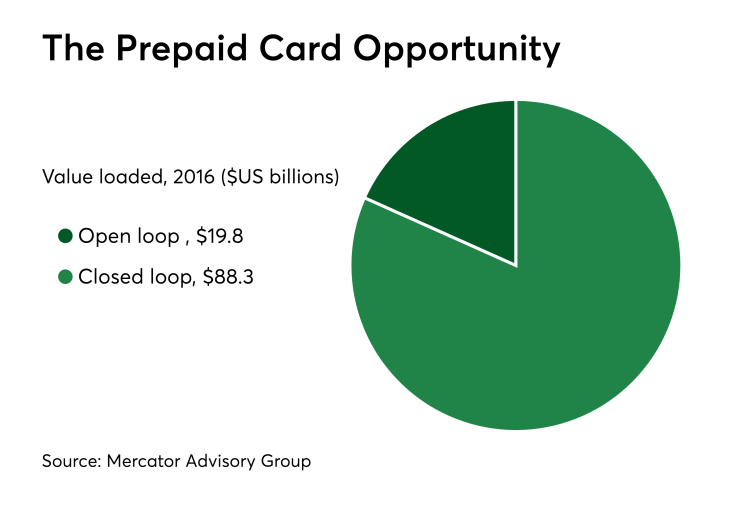

The market for prepaid cards is growing. Mercator Advisory Group estimates that the total open- and closed-loop gift card market in 2016 was US $108 billion, up from US $104 billion in 2015. The majority of this value was on closed loop gift cards at $88.3 billion, which includes all in-same-store sales and third-party sales through distributors such as Blackhawk and InComm. The total open-loop gift card load value for 2016 was $19.8 billion. The majority of this is sold through prepaid malls.

The largest area of growth, however, is in digital rather than plastic cards. According to

While plastic gift cards remain a top gift-giving choice, with 89% of consumers surveyed reporting they have purchased at least one plastic gift card in the last year, 71% of those individuals have also purchased one or more e-gifts during the same time frame and nearly half of consumers surveyed (42%) had purchased electronic gifts for both gifts and self-use.

However, Kaplan stresses that there is another key area to the acquisition of CashStar that is mutually beneficial to the two companies , namely CashStar’s edge in first-party gifting. “We're also bringing in a really dominant position in first party — the sale of gift cards and the use the gift cards for a range of different use cases by merchants to that merchant's own consumers, as opposed to B-to-B or third party where it is being distributed through other businesses to loyalty program members, employees or consumers.”