Petal, the credit card aimed at millennials and others with limited credit histories, has raised $55 million in a Series C as main street banks pull back on credit during the COVID-19 crisis.

The Series C was led by Peter Thiel-backed

Additional investors include The Gramercy Fund, Rosecliff Ventures, Afore Capital, RiverPark Ventures, Great Oaks Venture Capital, GR Capital, Nelstone Ventures, Abstract Ventures, Ride Ventures, Adventure Collective and Starta Ventures. The total equity funding raised to date now exceeds $100 million.

“We’re pleased to once again invest in Petal,” said James Fitzgerald, co-founding partner with Valar Ventures, in the press release. “They have created a better and more modern credit experience, and a game-changing technology platform that’s well-matched to these times. We’re happy to support them as they scale.”

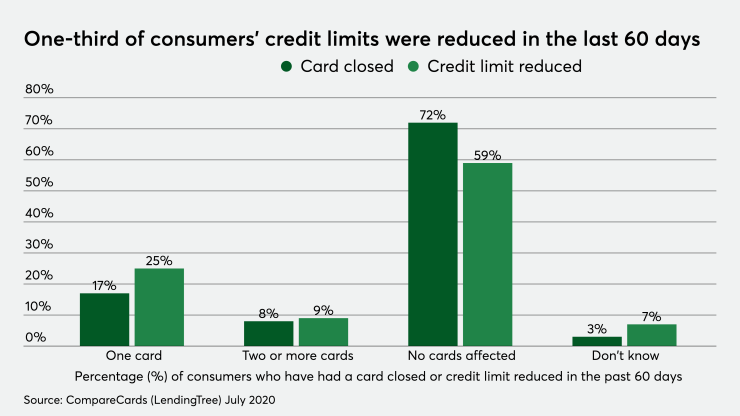

The continued support by Valar Ventures is notable during a time when many banks have been pulling back on credit card lines, as well as closing unused credit cards as the country goes deeper into a recession caused by the COVID-19 pandemic. According to

“Traditional credit scores have become less reliable in the COVID economy, forcing mainstream banks to significantly scale back access to credit at a time when many people need it most,” said Jason Gross, co-founder and CEO of Petal in the release. “Cash flow scoring allows Petal to continue making credit available even in these volatile economic conditions.”

Having celebrities and athletes participate in venture capital fundraising has become more common in the last few years, as evidenced by rapper

According to