Want unlimited access to top ideas and insights?

The payments industry obviously moves very fast, and creating challenges in managing ownership ambiguity, content flux and lack of clarity about what’s really happening day by day.

To effectively keep your operations and risk departments up to speed with the rest of your business, periodically auditing your processes and tools makes a lot of sense in order to uncover ways to increase efficiency and productivity for your overall programs. And emerging "RegTech" companies can play a role in making this easier.

Processes and tools should serve your business, not the other way around. Understanding where the gaps are in both procedures and technology capabilities is key. What this means is matching your internal operational/risk/compliance policy with the right internal/external tools to help support the policy. To the extent that you know what gaps you have and what new tools and capabilities are out there, you are in a better position to solve problems for your organization.

If it turns out that you find you are doing the best you can, that’s a best-case scenario. However, with the increasing need for speed, automation, and operational efficiency, it stands to reason there likely are ways to improve.

For example, logging into two systems and then later unifying data from both is a real time-killer. Simply combining the capabilities of two systems into one that covers both functions is a very straightforward way of taking the operational load off of your team. In other words, just make sure your teams “touch it once”, as re-working processes and juggling tasks tend to provide a higher institutional load and are more prone to errors.

Another example is using a system that is outright faster to do a given job. If it normally takes a couple hours to perform due diligence on components of merchants, and a tool exists that can perform the task in a matter of minutes, adopting the tool can improve speed and performance. If you are to use the faster tool, the surplus of time you and your team now have can be devoted to more “strategic” initiatives and/or just getting more merchants in the door to support the rest of your organization. Bringing speed and rich data together helps solve some of these merchant onboarding problems.

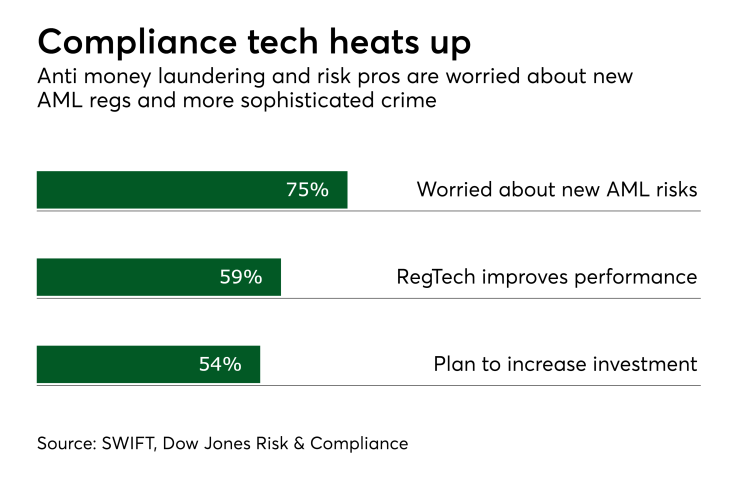

At the forefront of solving for common merchant onboarding problems are RegTech companies, which use technologies to solve for issues of automation of rote tasks, consolidation of capabilities and new risks. In fact, according to a