Want unlimited access to top ideas and insights?

Companies today are looking for any opportunity to increase efficiency, knowledge, accountability, and accuracy. Manual and paper-based processes stand in the way of these opportunities.

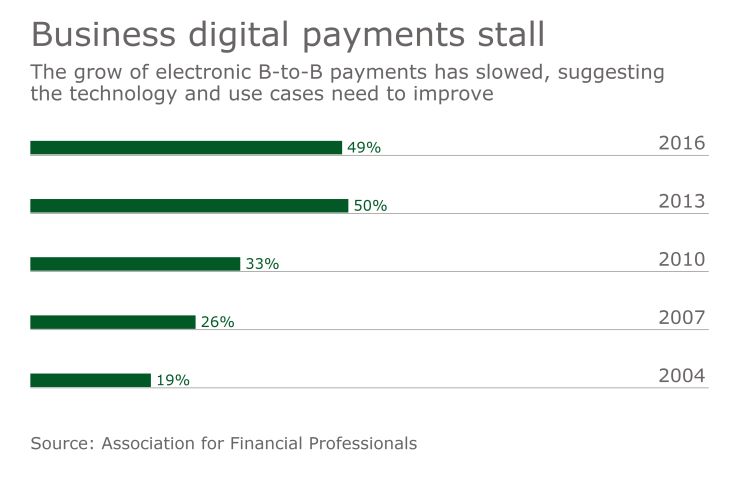

More companies are turning to digital solutions for their most important financial operations, transforming them from purely functional necessities into strategic assets. And that’s why businesses are turning to e-payment solutions.

Switching payment methods for businesses is not as simple as downloading Venmo and tapping the button for “pay” or “request.” To harness the true value of e-payments, here are four tips companies need to keep in mind to see long-term success.

Put the proper technical foundation into place: A company’s supply base will be diverse in terms of the methods of payment they are capable and willing to accept. A successful e-payment solution needs to be able to address the various forms of payment accepted, including Virtual Card, ACH, and Check. The key is for the e-payment solution to have a uniform, automated, and digital process on the front end to support these various payment methods on the backend.

Communicate the value of e-payments to executives and internal stakeholders: The value that comes from switching to e-payments does not only affect the accounts payable (AP) department. Teams across an entire organization and even executive leadership will benefit from digital payments. Many internal stakeholders do not fully recognize this, so it is up to AP leaders to communicate the value of e-payments. When all teams are on the same page, decision-making for future investments is less of a heavy lift.

Develop the analytical abilities to turn payment data into business value: With most e-payment solutions, the AP team ends up collecting a flood of information about supplier payments, but just having the data is not enough. It is critical that companies develop the capabilities and tools to analyze its financial data so that actionable insight can be extracted. Only through this analysis can AP make sense of the data it collects to share with other teams across the organization.

Set short and long-term goals to track success and areas of improvement: Many companies make the mistake of thinking that simply launching a digital payment system is all that is required to achieve success. It is important to set goals throughout the year to track the actual business transformation brought on by e-payments and to monitor for areas of improvement. Setting these goals and targets can help your team develop and maintain momentum and move your company toward greater innovation.

The business value of switching to e-payments is evident and adoption is on the rise, but companies need to take a strategic approach when it comes to implementing this technology. To benefit from the transformational power of e-payments, teams need the proper technical foundation, communicate its value to all departments, develop analytical tools to determine business value of the data, and set short and long-term goals to track momentum.