-

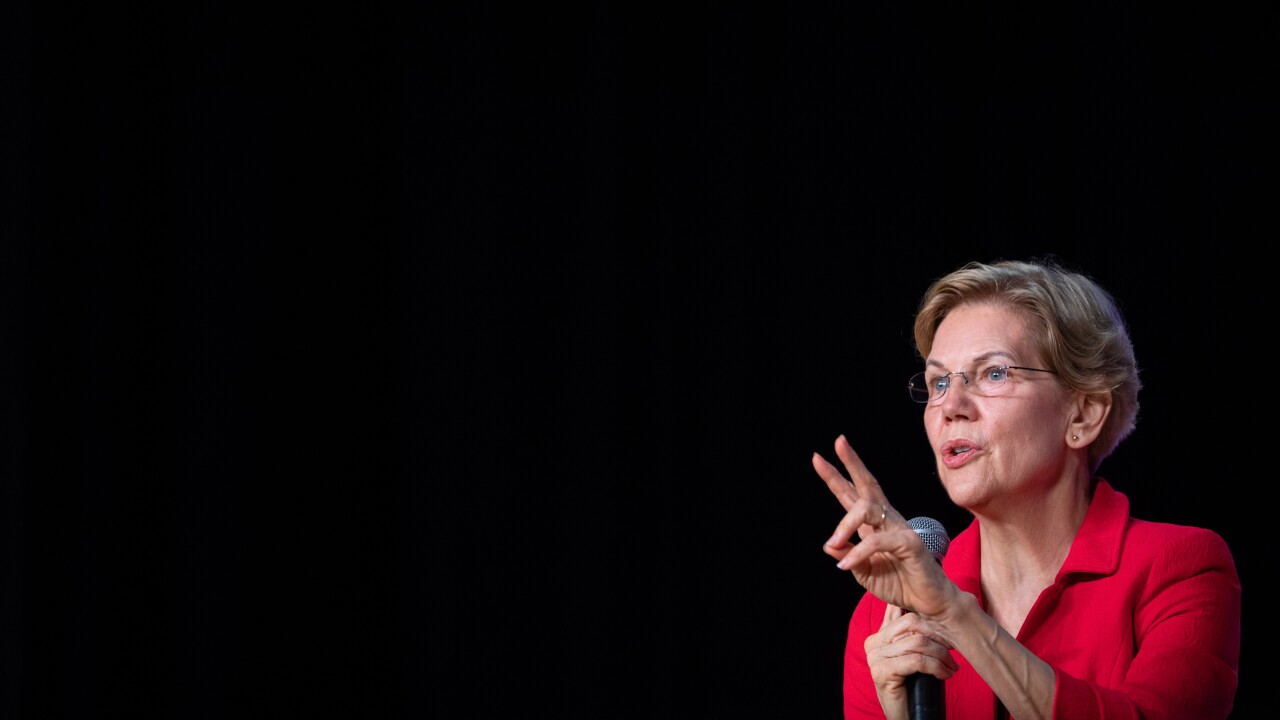

Sen. Elizabeth Warren stepped up her criticism of some of the largest U.S. corporations and singled out senior-level government officials who accepted jobs at Citibank, Wells Fargo, Facebook and Walmart after working for the federal government.

October 29 -

The government has used the law to bring fraud claims against Federal Housing Administration lenders, but the new steps respond to criticism that minor offenders were also getting punished.

October 28 -

As the Federal Reserve prepares for its October meeting, many institutions are waiting to see how the board's actions might impact the ongoing war for deposits.

October 28 -

The regulator of Fannie Mae and Freddie Mac discussed steps the companies have already taken to limit their risk, as well as efforts to prevent housing market “overlap” with the FHA.

October 28 -

Executives are deciding what roles could be relocated to lower-cost hubs such as Plano, Texas; Columbus, Ohio; and Wilmington, Del.

October 28 -

Regulators globally are using "tech sprints" to test new anti-money-laundering solutions. More can be done, but it's a good start.

October 28 Alliance for Innovative Regulation

Alliance for Innovative Regulation -

Concerns over banks’ level of preparation have led to worries about disruptions in the lending market, and some financial institutions warn that a new interest rate benchmark could cause lenders to pull back on credit.

October 27 -

It's time to establish a fintech commission.

October 25

-

The Rakuten application has opened another front in the battle over nonfinancial companies' ownership of banks.

October 24 -

Citigroup promoted Jane Fraser to president, its second-highest post, making her a likely candidate to succeed CEO Michael Corbat and someday become the first woman to run one of the largest U.S. banks.

October 24 -

The Federal Trade Commission should look into whether Amazon’s failure to secure its services “constitutes an unfair business practice,” which would violate federal law, Sens. Elizabeth Warren and Ron Wyden wrote the agency's chairman.

October 24 -

A letter from the Ohio Democrat claims Rodney Hood, chairman of the National Credit Union Administration, is using social media to "curry favor with the president, seriously compromising the independence of the agency."

October 23 -

The Government Accountability Office determined that three Obama-era letters from the central bank related to large-bank supervision should have been submitted for congressional review.

October 23 -

The Corporate Transparency Act would require companies to report their true owners to the Financial Crimes Enforcement Network, removing the burden of financial institutions to collect beneficial ownership information about their clients.

October 23 -

A regulatory cloud still follows fintech companies following a judge's decision throwing out the Office of the Comptroller of the Currency’s special-purpose charter.

October 22 -

The Corporate Transparency Act would require companies to report their true owners to the Financial Crimes Enforcement Network, removing the burden of banks to collect beneficial ownership information about their clients.

October 22 -

At a House hearing covering a whole host of housing finance reform topics, Fannie Mae and Freddie Mac's regulator said "if the circumstances" call for eliminating investors, "we will."

October 22 -

The Massachusetts senator and presidential candidate warned the Treasury secretary not to use the incident as a rationale for weakening regulations.

October 22 -

The Treasury secretary repeated his concerns about the social media giant's proposed cryptocurrency, one day before Mark Zuckerberg is expected to face tough questioning from House lawmakers.

October 22 -

The new CEO is the first outsider to head the scandal-ridden bank in decades; Facebook CEO faces the House Financial Services Committee on Wednesday to discuss Libra.

October 22