-

The central bank, which received broad authority after the crisis to supervise big banks, is expected to get more attention from lawmakers over its discretion to ease banks’ burden.

September 10 -

Randal Quarles was considered for Financial Stability Board chair spot; the outgoing student loan ombudsman says the agency puts lenders before consumers.

August 28 -

As the state phases in tougher requirements from its 2017 regulation, federal agencies continue to show an interest in updating their cyber policies.

August 17 -

Lawmakers fear that regional banks could still get stung as the central bank implements a new law meant to ease their burden.

August 16 -

The Federal Reserve’s forthcoming rules for banks with assets of $100 billion-$250 billion hinge on their perceived risk to the financial system.

August 1 -

The letter from 29 Republicans, including some who may chair the House Financial Services Committee next year, urges the Federal Reserve’s top regulator to "recalibrate" the capital surcharge for banks like JPMorgan Chase and Citigroup.

July 30 -

The Fed’s top regulator is reportedly gunning to run the international Financial Stability Board, but the president's trade wars and recent criticism of Europe are impeding that effort and weakening U.S. regulators' hand more generally.

July 24 -

The Fed's top regulatory official suggested that some banks could get a break from filing resolution plans and see the frequency of their stress tests reduced.

July 18 -

The Senate voted 66-33 to approve Federal Reserve Vice Chairman for Supervision Randal Quarles for a full 14-year term on the central bank's board.

July 17 -

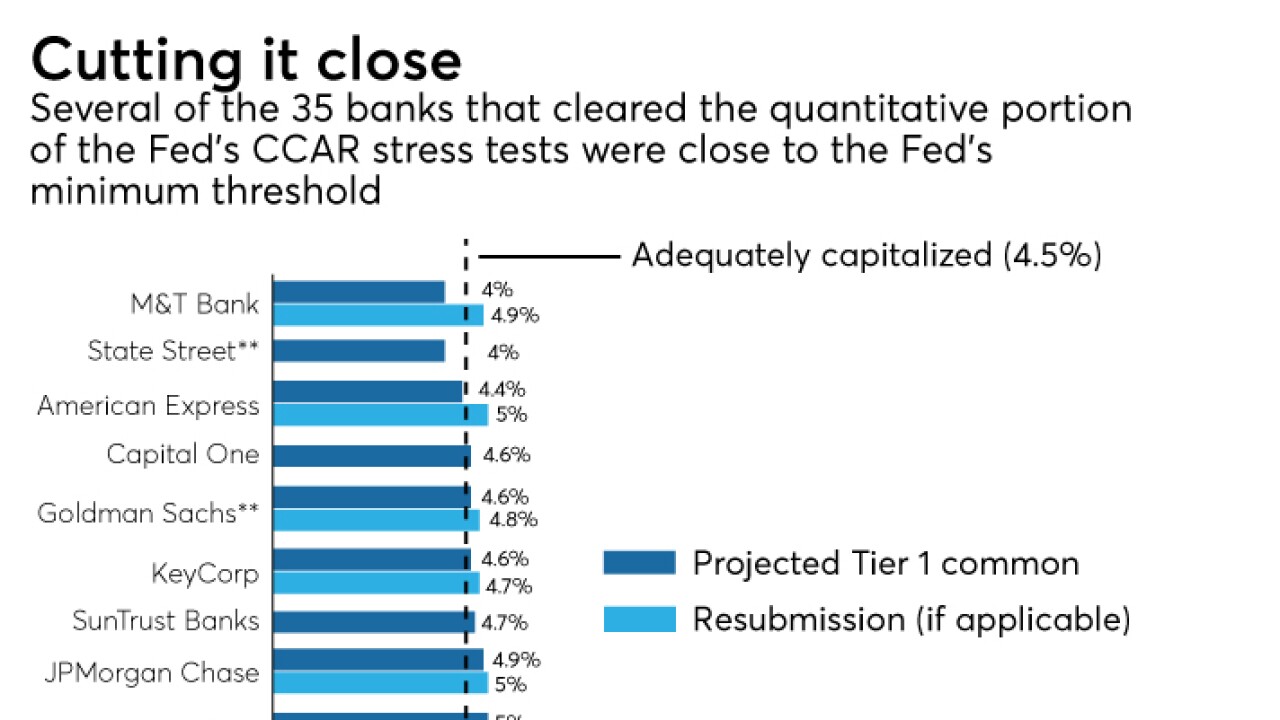

The president’s signature tax reform law muddled this year’s stress test results, causing several banks to incur greater-than-expected losses and spurring the Federal Reserve to constrain capital distributions at a handful of banks.

June 28