-

Banks burdened by excessive regulation are unable to provide the kind of support that growing small businesses in their communities need. The entire system is in dire need of an overhaul.

August 27

-

The Federal Deposit Insurance Corp. is trying to limit the impact of a Supreme Court decision that curtailed federal agencies' use of administrative law judges.

August 26 -

A federal judge excoriated banks for inflating data in a challenge to the Consumer Financial Protection Bureau's data collection on small-business loans.

August 26 -

The proposed Inclusion of TANs within the CFPB's Section 1033 rule is a mistake that threatens to undermine the security of financial transactions and undercut consumer choice and competition.

August 26 -

The Republican nominee for president wants to renew the provisions of the Tax Cuts and Jobs Act.

August 23 -

Committee Chair Sherrod Brown is facing a tough election.

August 23 -

A coalition of financial industry groups is calling on the Federal Deposit Insurance Corp. to provide more data and extend the comment period on proposed brokered deposit restrictions, warning the changes could disrupt banking practices and harm consumers.

August 21 -

"Fed watchers will be parsing Powell's comments for signs that a 50bp rate cut is on the table for September," noted Lauren Saidel-Baker, an economist with ITR Economics. "However, the notoriously tight-lipped chair is unlikely to confirm this, making a 25bp cut the most likely outcome."

August 21 -

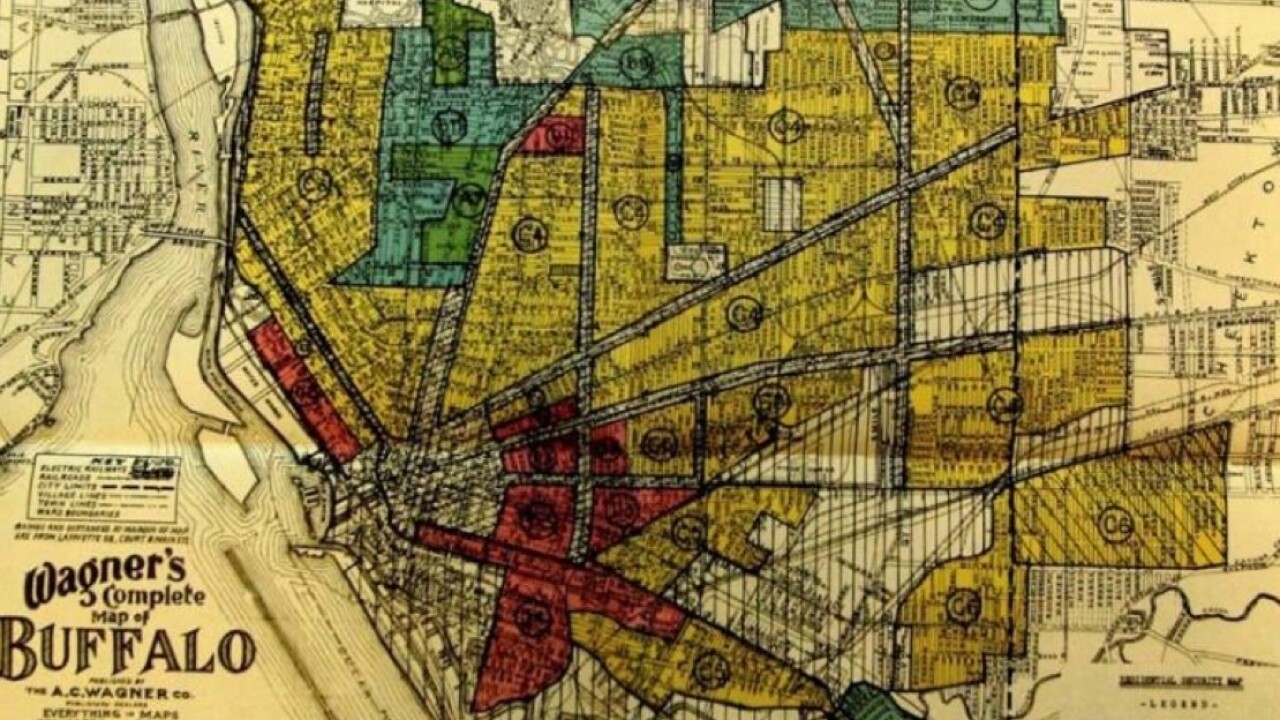

The industry-led legal challenge to new anti-redlining rules is opposed by some banks and consumer protection groups, who say the changes are necessary.

August 20 -

Federal Reserve Gov. Michelle Bowman said she has concerns about an uptick in inflation and will need to see more positive data before supporting an interest rate cut.

August 20