-

The Republican nominee for president wants to renew the provisions of the Tax Cuts and Jobs Act.

August 23 -

Committee Chair Sherrod Brown is facing a tough election.

August 23 -

A coalition of financial industry groups is calling on the Federal Deposit Insurance Corp. to provide more data and extend the comment period on proposed brokered deposit restrictions, warning the changes could disrupt banking practices and harm consumers.

August 21 -

"Fed watchers will be parsing Powell's comments for signs that a 50bp rate cut is on the table for September," noted Lauren Saidel-Baker, an economist with ITR Economics. "However, the notoriously tight-lipped chair is unlikely to confirm this, making a 25bp cut the most likely outcome."

August 21 -

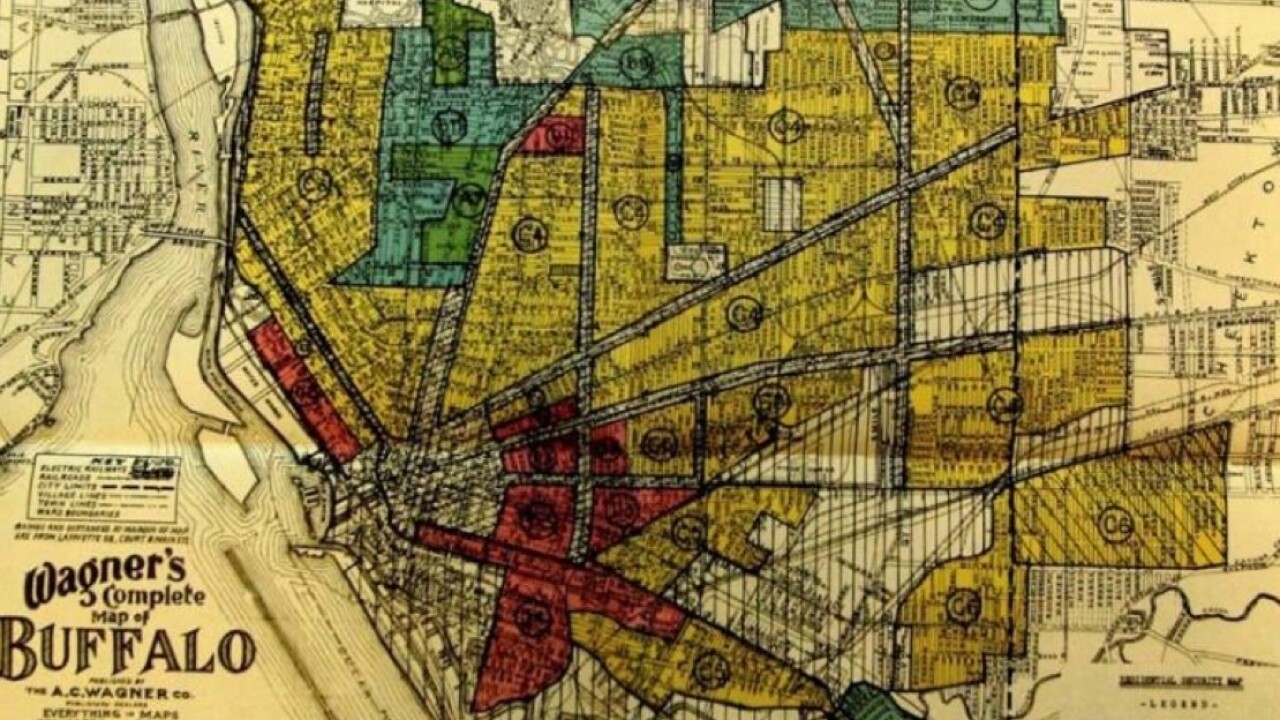

The industry-led legal challenge to new anti-redlining rules is opposed by some banks and consumer protection groups, who say the changes are necessary.

August 20 -

Federal Reserve Gov. Michelle Bowman said she has concerns about an uptick in inflation and will need to see more positive data before supporting an interest rate cut.

August 20 -

The new president will shape the direction of banking policy, but because financial regulators are more insulated from politics than many other areas, that transition will be gradual.

August 20 American Banker

American Banker -

The Consumer Financial Protection Bureau has moved to ban medical debt from appearing on credit reports, but its analysis relies on a sliver of consumer data from more than a decade ago.

August 20

-

For half a century, the Shadow Open Market Committee has been one of the Federal Reserve's sharpest critics. After years of seeing its public profile wither, the group is eyeing a return to prominence.

August 20 -

Four companies are fighting CFPB enforcement actions by claiming the agency cannot be funded by the Federal Reserve, which has not been profitable since 2022. The consumer bureau calls the new legal theory "meritless."

August 19