-

The Consumer Financial Protection Bureau on Wednesday ordered online payment processor Dwolla Inc. to pay a $100,000 fine for deceiving customers about its security practices the first action it has taken related to data security.

March 2 -

Senate Banking Committee Chairman Richard Shelby's easy victory in his primary battle in Alabama is fueling hopes he may soon move forward on a number of key financial nominations.

March 2 -

In almost any other election cycle, bankers would be celebrating the fact that a Republican candidate has emerged so far in front of the pack and would quickly fall in line behind him. But this has been anything but a normal election cycle, and there are a whole host of reasons that bankers will be at least as reluctant to embrace the outspoken businessman Donald Trump as the Republican establishment has been.

March 1IntraFi Network -

The Financial Crimes Enforcement Network's revocation of orders finding certain foreign banks to pose substantial money laundering risk shows the agency is trying to evade scrutiny as it pushes the banks out of business, according to observers.

March 1 -

Bankers are still grappling with vendor software problems, longer processing times and delays in mortgage closings as a result of new disclosures that went into effect four months ago, according to a new survey by the American Bankers Association.

March 1 -

WASHINGTON The House Financial Services Committee will hold a vote Wednesday on a bill that would provide regulatory relief for financial institutions that are not considered systemically important.

March 1 -

The Clearing House has picked Federal Reserve economists William R. Nelson and Francisco Covas to lead its research arm.

March 1 -

The mortgage servicer said it has received letters from the Securities and Exchange Commission regarding separate probes into its collection practices and fees.

March 1 -

Sunstate Bank in Miami has been released from an enforcement action that had required it to strengthen its anti-money-laundering controls.

March 1 -

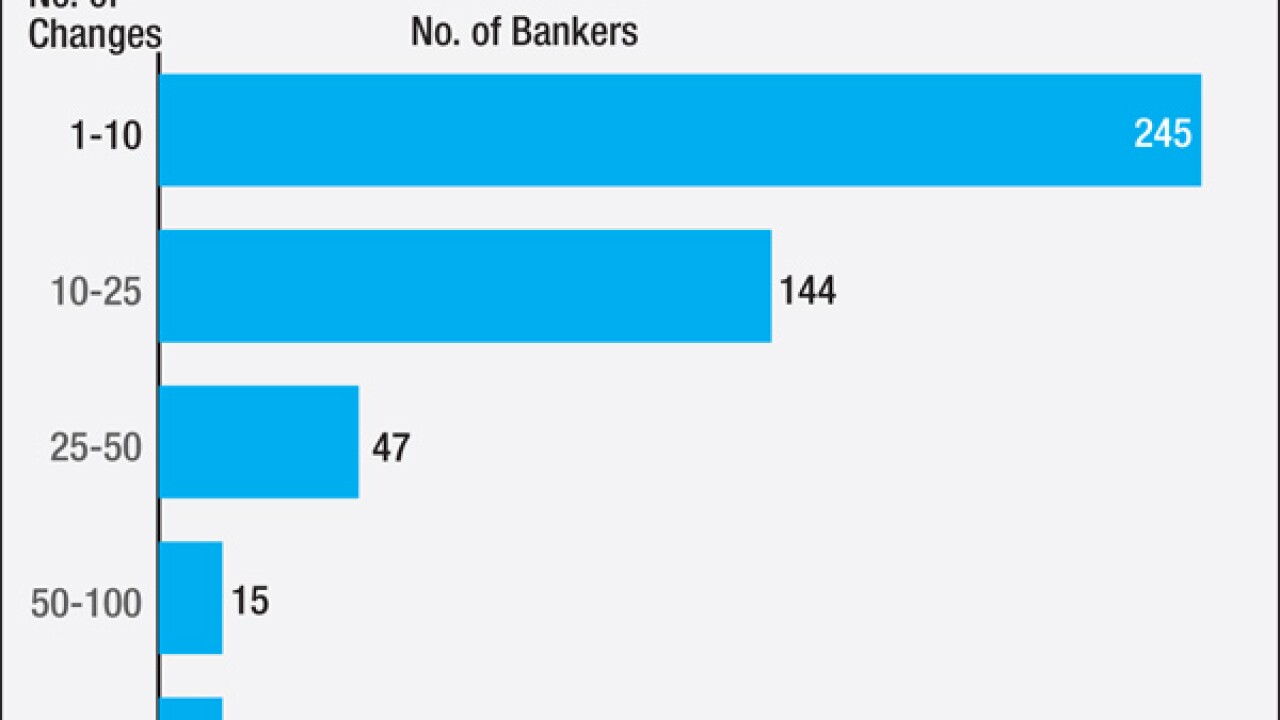

Estimates of nonbank mortgage providers that will close or change hands should worry consumers and policymakers about access to credit.

March 1 Community Home Lenders of America

Community Home Lenders of America