-

The North Carolina-based BB&T is far larger than any other bank regulated by the FDIC. It should be under the supervision of an agency with more experience overseeing large banks.

September 14

-

Federal regulators have cited F.N.B. Corp. in Pittsburgh for violating rules to protect consumers from unwanted, automated text messages.

September 11 -

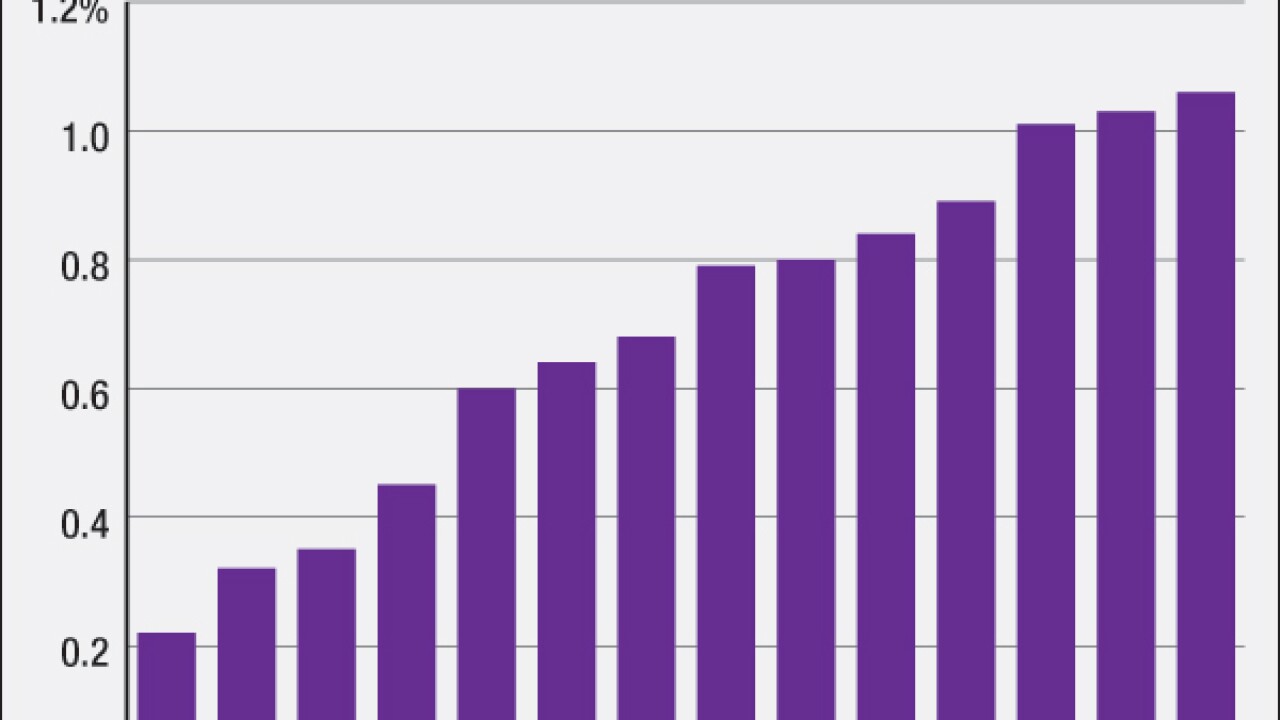

Under the Dodd-Frank Act, the agency must issue a proposal that would require large banks to bear the brunt of raising the DIF reserve ratio higher once it reaches a statutorily imposed minimum. With the fund rapidly increasing, the agency is likely to put out a plan by the end of 2015 sparking a debate over what the FDIC might do.

September 11 -

A recap of the informed opinions (and the discussions they generated) on BankThink this week, including banks' subpar shareholder value and how big-data advocates can better communicate with critics who worry about the technology's potential discriminatory effects.

September 11

-

Evans Bancorp in Hamburg, N.Y., has agreed to pay $825,000 to settle a lawsuit that accused the company of mortgage redlining.

September 11 -

Gregory Baer, the head of regulatory policy for JPMorgan Chase, will be the next president of The Clearing House Association, the group announced Friday.

September 11 -

The FDIC has proposed a plan that would increase premiums for banks that use reciprocal depositsa tool that community development financial institutions rely upon to meet credit demand in low-income communities.

September 11

-

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and from our social media platforms.

September 11 -

Two community banks Community Bankers Trust in Richmond, Va., and Charter Financial in West Point, Ga. have reached early terminations of loss-share agreements with the Federal Deposit Insurance Corp.

September 10 -

The Justice Department's announcement that it would target individual executives at banks and other companies that are being investigated for wrongdoing has sparked a debate about whether the move is actually substantive or instead just designed to boost the agency's public image.

September 10