-

The New York licensing process for virtual currency companies is stoking fears that firms which do apply could inadvertently open themselves up to prosecution.

September 3 -

Dark pools have a bad reputation these days but they also reduce the transaction costs of large trades and help provide the market with liquidity. That's why regulators need to ensure these platforms fulfill their intended purpose instead of simply shutting them down.

September 3

-

The Financial Crimes Enforcement Network's enforcement action against Ripple Labs sent a clear message to the cryptocurrency industry about regulators' high expectations for compliance. Such actions will help clear the way for banks to partner with blockchain technology firms down the line.

September 3

-

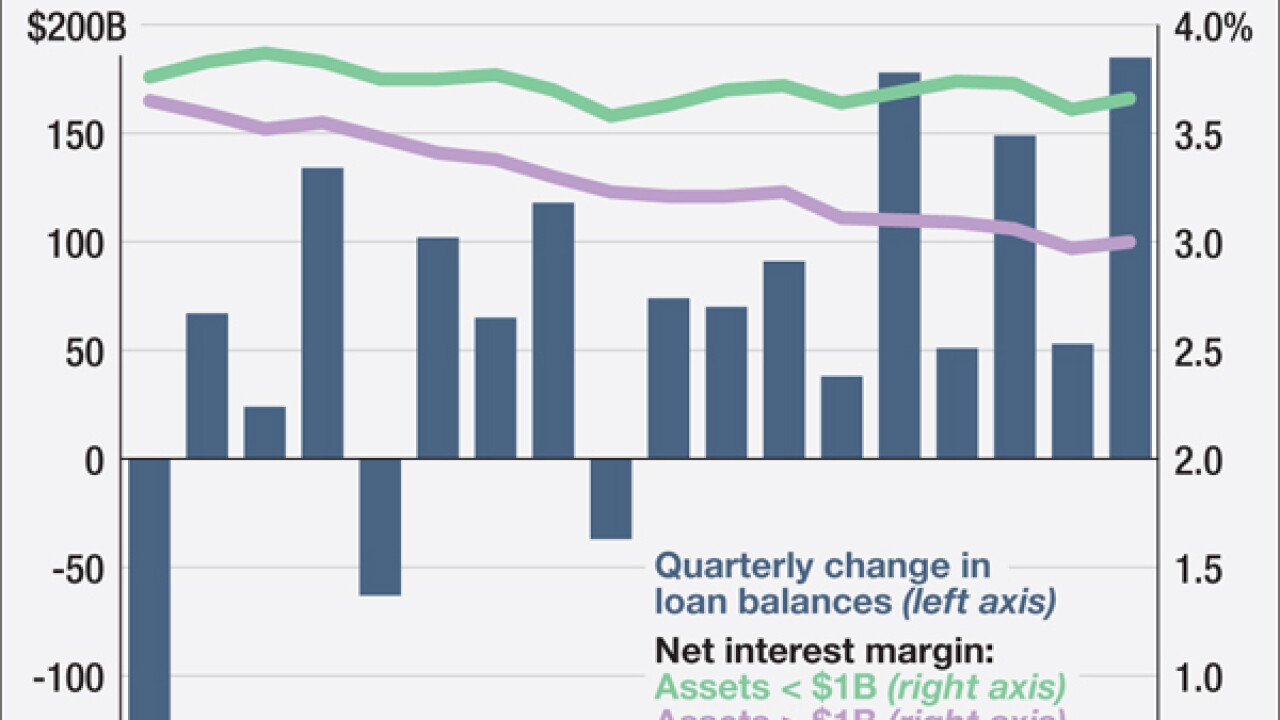

The Federal Deposit Insurance Corp.'s second-quarter industry update showed steadily rising loan balances making up for persistently tight net interest margins.

September 2 -

Ebrahim Shabudin, former chief operating officer and chief credit officer at United Commercial Bank in San Francisco, has been sentenced to 97 months in prison for securities fraud related to the bank's failure.

September 2 -

Banks are seeing steady growth in consumer loan demand nationwide, particularly in auto loans and mortgages, according to a report released Wednesday by the Federal Reserve Board.

September 2 -

U.S. banking earnings in the second quarter rose 7.3% from a year earlier to $43 billion as institutions enjoyed higher revenues and lower noninterest expenses, the Federal Deposit Insurance Corp. said Wednesday.

September 2 -

Minorities receive surprisingly few small-business loans, high-level employment promotions and business contract opportunities. The federal government can help remedy the situation by collected detailed data on these matters from financial institutions.

September 2

-

The Federal Housing Administration is reissuing a loan certification proposal that has sparked industry concerns that it will make it easier for the Justice Department to sue lenders when they file claims for agency-insured loans that go into default.

September 1 -

More than half of real estate agents are planning to extend their sales contracts to provide more time for the closing processing due to the coming implementation of new mortgage disclosures.

September 1