-

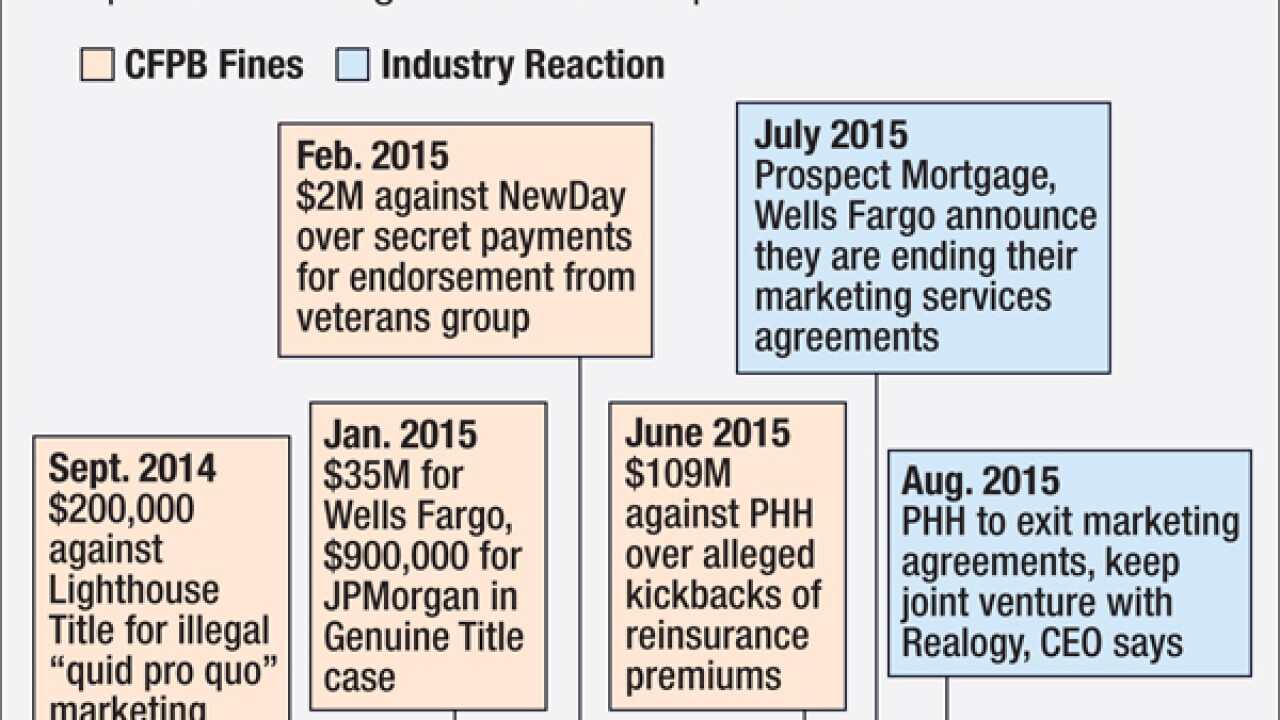

Nothing touches off an argument more than questions about whether the CFPB will allow any marketing services agreements to continue. Some mortgage lenders say no and are winding down their agreements, others insist regulators can be satisfied, and still others are just plain confused.

August 21 -

Prepaid cards appeal to a growing percentage of the population like millennials and other 21st century consumers who want to manage their money without being tied down to bank locations.

August 21

-

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and from our social media platforms.

August 21 -

WASHINGTON Two California companies allegedly sold pension advance loans that they claimed were not credit products but in fact charged usurious interest rates, according to a lawsuit brought Thursday by the Consumer Financial Protection Bureau and New York regulators.

August 20 -

Roughly 20 banks still have capital from the crisis-era program. Most are way behind on dividend payments and have limited options to raise capital to repay the Treasury Department.

August 20 -

Rubio's harsh words about Dodd-Frank and Kasich's record on the House Budget Committee have helped the two policymakers attract significant support from bankers, but Trump also has significant momentum.

August 20 -

For those who lament the U.S. government's failure to put individuals on trial for their role in the 2008 mortgage crisis, Iceland's prosecution of bankers represents a platonic ideal of financial supervision. But the comparison between the Icelandic and U.S. cases is not as simple as it may appear.

August 20 -

JPMorgan Chase has named retired Army Gen. Raymond Odierno senior adviser to the company on international relations, cybersecurity, leadership development and other issues.

August 20 -

Alternative payments are taking hold at a brisk pace. Now a major bank lobbying group and payment company is crying foul.

August 20 -

Before it dissolves in late September, a bipartisan House task force should take a broader look at de-risking, changing technologies, cybersecurity and the private sector's role in deterring terrorism financing.

August 20