-

A split Congress starting in January will likely result in total legislative gridlock – which actually works both for and against credit unions.

November 12 Dollar Associates LLC

Dollar Associates LLC -

Regulators typically write rules before applying them. But the CFPB is attempting the reverse.

November 11 -

Democrat Maxine Waters, in line to take over the House Financial Services Committee, told colleagues she would undertake a deep dive into President Trump's "money trail," beginning with ties to Deutsche Bank.

November 10 -

NCUA Chairman Mark McWatters discussed some of the biggest issues facing the industry during a recent address at the California and Nevada CU Leagues' annual conference.

November 9 -

The Financial Accounting Standards Board is considering a plan to have banks break out charge-offs and recoveries on a year-by-year basis. Bankers fear new systems would be needed to comply.

November 9 -

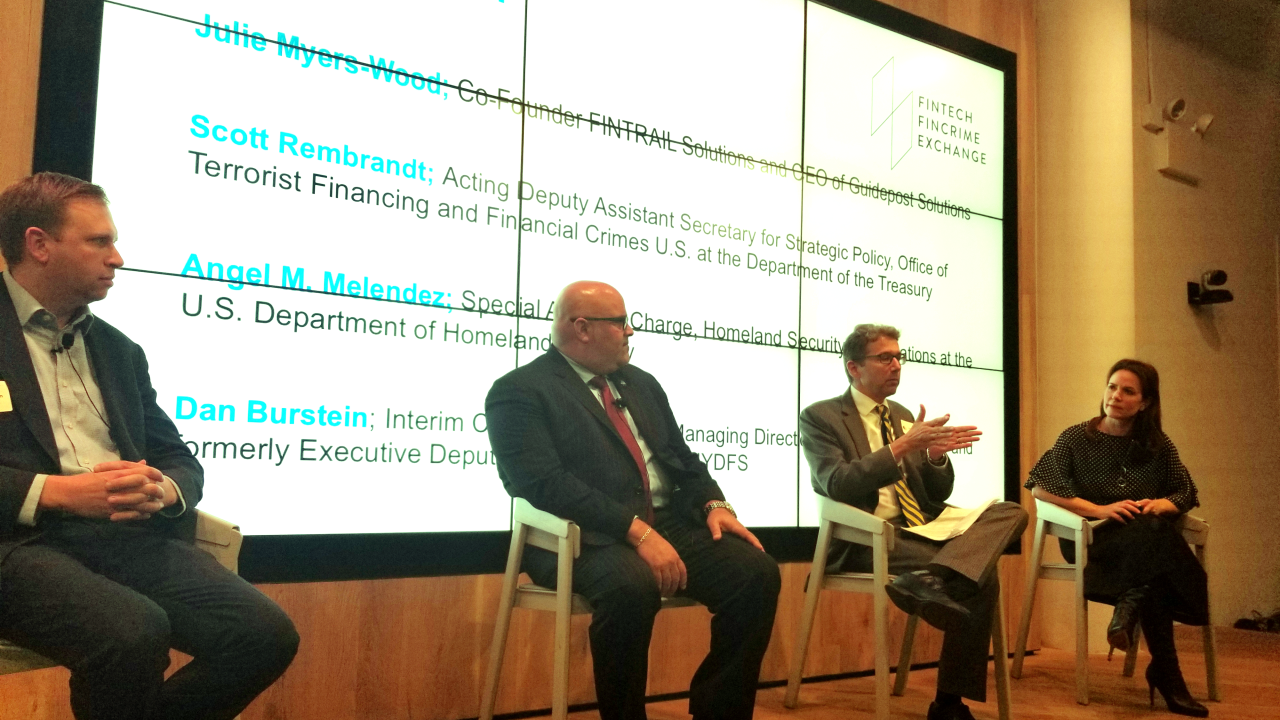

A new group aims to foster collaboration between fintechs and state and federal officials in the fight against crime — without hindering legitimate business innovation.

November 9 -

The central bank's top regulator said public comments about the new tool, used to gauge capital strength during stress tests, will likely result in changes before it is adopted.

November 9 -

The revised blueprint by Moelis & Co. LLC incorporates a pending regulatory capital plan for the mortgage giants.

November 9 -

At the California and Nevada CU Leagues' annual REACH conference in Hollywood, credit union executives offered their take on how the 2018 election could impact the industry.

November 9 -

The Nashville, Tenn., company had opposed a request by Gaylon Lawrence to boost his ownership to 15%.

November 9