-

Congress should consider giving direct authority over nonbank mortgage servicers to the Federal Housing Finance Agency, according to a report released Monday by the Government Accountability Office. The report said there should be "parity" among financial regulators in the oversight of regulated entities and third parties they do business with.

April 11 -

Goldman Sachs will pay $5.1 billion to settle a U.S. probe into its handling of mortgage-backed securities involving allegations that loans weren't properly vetted before being sold to investors as high-quality bonds.

April 11 -

Several years after regulators began developing the "net stable funding ratio," there is good reason to ask if its utility has been eclipsed by other liquidity-related rules.

April 11 The Clearing House Association

The Clearing House Association -

The Consumer Financial Protection Bureau's agenda is so packed it's no wonder that when Director Richard Cordray testifies on Capitol Hill, he has to tackle a huge array of subjects. Following are areas where the agency has proposals or final rules outstanding:

April 11 -

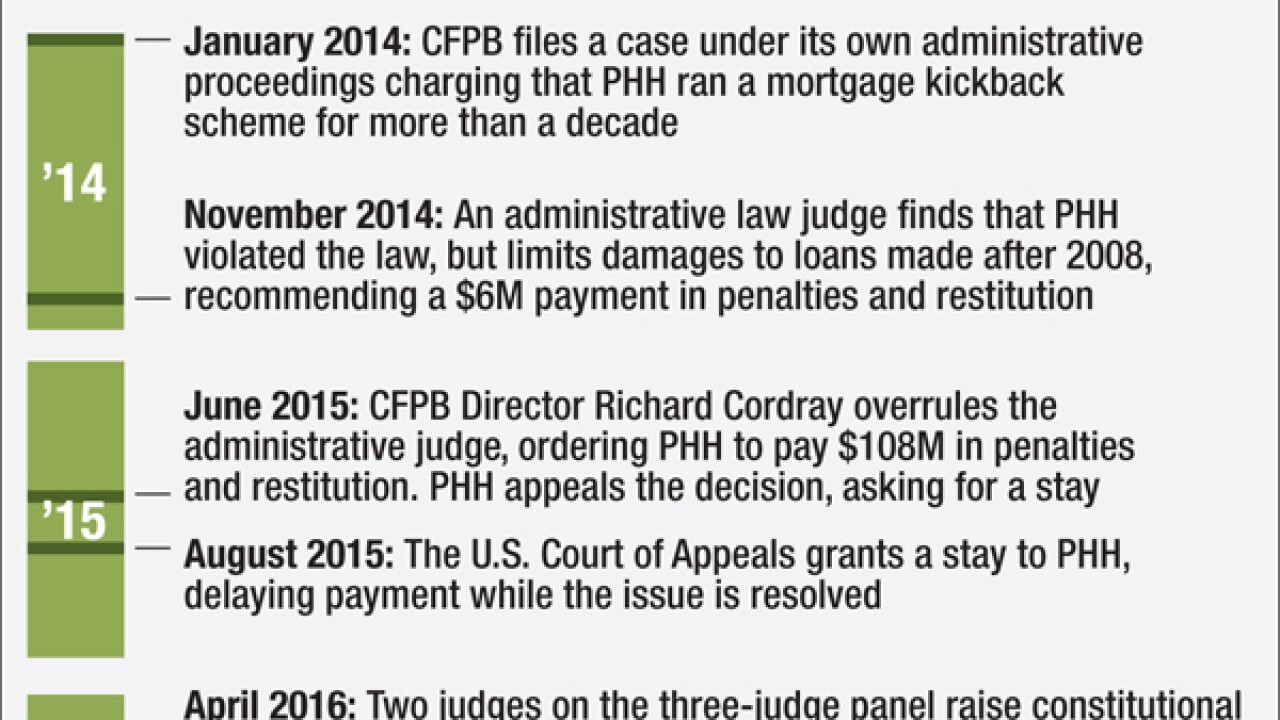

The U.S. Court of Appeals for the D.C. Circuit will hear oral arguments Tuesday about the Consumer Financial Protection Bureau's structure, in a case that has national implications. Even though a ruling isn't expected until the end of the year, legal experts say there are four major legal issues involved.

April 10 -

Fannie Mae and Freddie Mac's experiments with selling credit risk to investors are a critical element of new plan to merge the two entities and move them out of conservatorship, but what form so-called credit risk transfers take could make a big difference.

April 8 -

Federal rules for technology-based firms providing the fast-moving sector certainty and consistency would be a benefit, even if rules are suboptimal.

April 8 Mercatus Center at George Mason University

Mercatus Center at George Mason University -

Banks should prepare for renewed scrutiny of their anti-money-laundering efforts in the wake of the headline-grabbing leak of the Panama Papers.

April 8

-

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

April 8 -

In a panel featuring the four living chairs of the Federal Reserve Board, Janet Yellen said that she does not share Minneapolis Fed President Neel Kashkari's view that the biggest banks need to be broken up but respects his opinion and the role of regional banks in the Fed system.

April 7