-

Wells Fargo said it can't fully meet demand from small businesses rushing to participate in a U.S. relief program because of constraints imposed by the Federal Reserve on the bank's growth.

April 6 -

Banks will tell the Fed they would remain strong after payouts; customers would need $250,000 in liquid assets on deposit at the bank to qualify to refinance.

April 6 -

First State Bank, which the FDIC sold to MVB Financial, had struggled with profitability and capital levels for several years.

April 3 -

Emergency loan program plagued by chaos on eve of launch; why Moven, one of the first challenger banks, is calling it quits; Fed faces conundrum on whether to remove Wells Fargo's asset cap; and more from this week's most-read stories.

April 3 -

The decision sparked outrage from small-business owners who have checking accounts with the bank but not loans or business credit cards. Bank of America started taking applications Friday for a $349 billion program that's intended to offer aid to small businesses suffering from the shocks of the coronavirus pandemic.

April 3 -

The agency proposed changes in December to how customer relationships affect the definition of brokered funds, which has big implications for banks that are not well capitalized.

April 3 -

Requiring banks to test themselves is likely to be a waste of time in the current crisis, says a former Senate Banking counsel.

April 3 Corporations and society initiative at Stanford Graduate School of Business

Corporations and society initiative at Stanford Graduate School of Business -

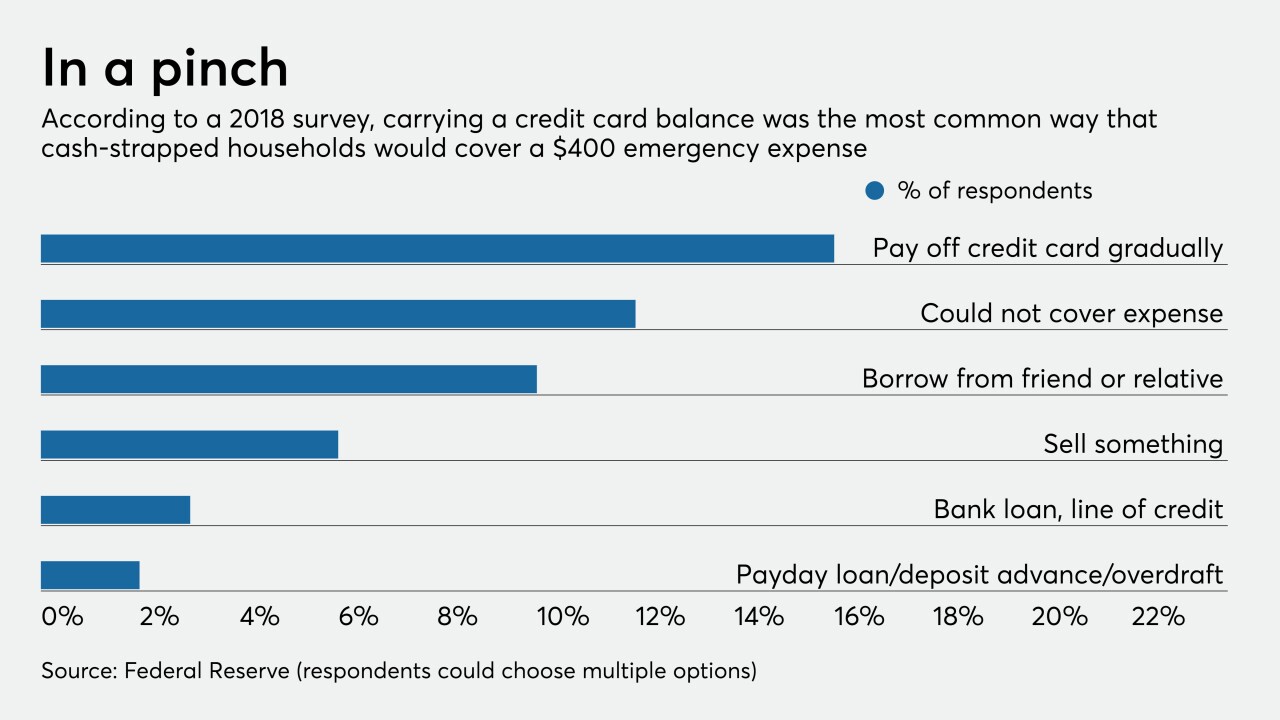

Regulators point to traditional financial institutions as well-positioned to meet short-term credit needs during the coronavirus pandemic, but there are still a host of questions about whether the industry should try to compete with high-cost lenders.

April 2 -

The agencies will give the industry another month to submit feedback on the so-called covered fund portion of the rule "in light of potential disruptions resulting from the coronavirus.”

April 2 -

If Capitol Hill plans another round of stimulus, Democrats could have more leverage to demand steps such as suspending overdraft fees – a measure which could have a big impact on credit union revenue.

April 2