-

The Consumer Financial Protection Bureau's proposal to limit the use of arbitration clauses came under attack Wednesday for potentially raising costs and liability for financial firms.

May 18 -

The five federal financial agencies released guidance on Wednesday that requires financial institutions to ensure they are addressing discrepancies customers sometimes face between the amount they deposit in their account and the amount they are credited.

May 18 -

Bank of America and Deutsche Bank AG were among five banks sued over claims that traders conspired to manipulate the market in agency bonds, which is made up of an estimated $9 trillion of debt issued by government entities and institutions like the World Bank.

May 18 -

The banking industry has influenced several key features in the final beneficial ownership rule, a top official at the Treasury Department's Financial Crimes Enforcement Network said this week, while defending the rule's effectiveness.

May 18 -

New York's bank regulator is investigating LendingClub Corp. over loans issued to consumers and its relationships with financial institutions, saddling the embattled company with another probe after its chief executive was forced to resign earlier this month.

May 18 -

The Consumer Financial Protection Bureau's proposal to restrict the use of arbitration clauses would allow it to seize enormous amounts of data from financial firms that could lead to more enforcement actions, according to industry lawyers.

May 18 -

Requiring banks to improve records on which depositors are insured overlooks how the Federal Deposit Insurance Corp. resolves failures.

May 18

-

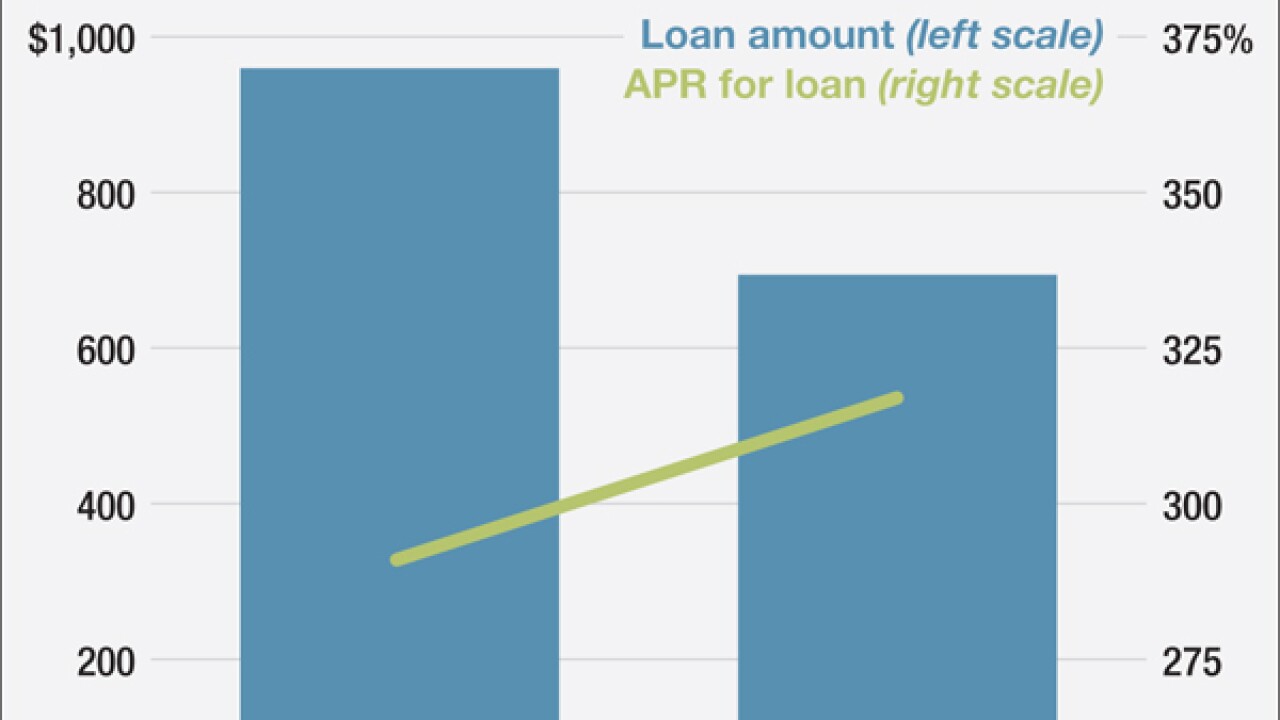

The Consumer Financial Protection Bureau found that one in five borrowers who take out short-term auto title loans have their vehicle seized for failing to repay the loan.

May 18 -

With the CFPB flexing its regulatory muscles, it's no surprise that collectors are making compliance a priority.

May 18 BillingTree

BillingTree -

Key Democrats abruptly reversed course Tuesday concerning a monetary policy tool, saying they now support the Federal Reserve's ability to pay interest on banks' excess reserves.

May 17