-

Sens. Sherrod Brown, D-Ohio, and Chris Van Hollen, D-Md., called on the bank to explain a report that the private wealth management division quashed anti-money-laundering reports prepared by compliance staff.

May 20 -

Banks would be better able to comply with anti-money-laundering laws if all 50 states collected information on the owners of new corporations and published it in a national database, Comptroller Joseph Otting said Monday.

May 20 -

Mark Calabria said he wants Fannie Mae and Freddie Mac to take preliminary steps by Jan. 1 toward exiting conservatorship.

May 20 -

The credit union regulator’s proposal to raise the appraisal threshold for nonresidential real estate loans won’t harm the economy or consumers, contrary to critics’ claims.

May 20

-

The Federal Reserve is considering revising Regulation D, which limits consumers to six transfers per month on savings and money market accounts through certain methods.

May 20 -

Advancements are bringing improvements to risk and user experience, but global reach remains a top priority, writes Marc Recker, global head of institutional market management and cash management for Deutsche Bank.

May 20 Deutsche Bank

Deutsche Bank -

The comptroller, now a year and a half on the job, discusses his attempts to revamp the supervision process for national banks and make the agency run more efficiently.

May 19 -

His administration is looking at different alternatives to reform the housing finance system.

May 17 -

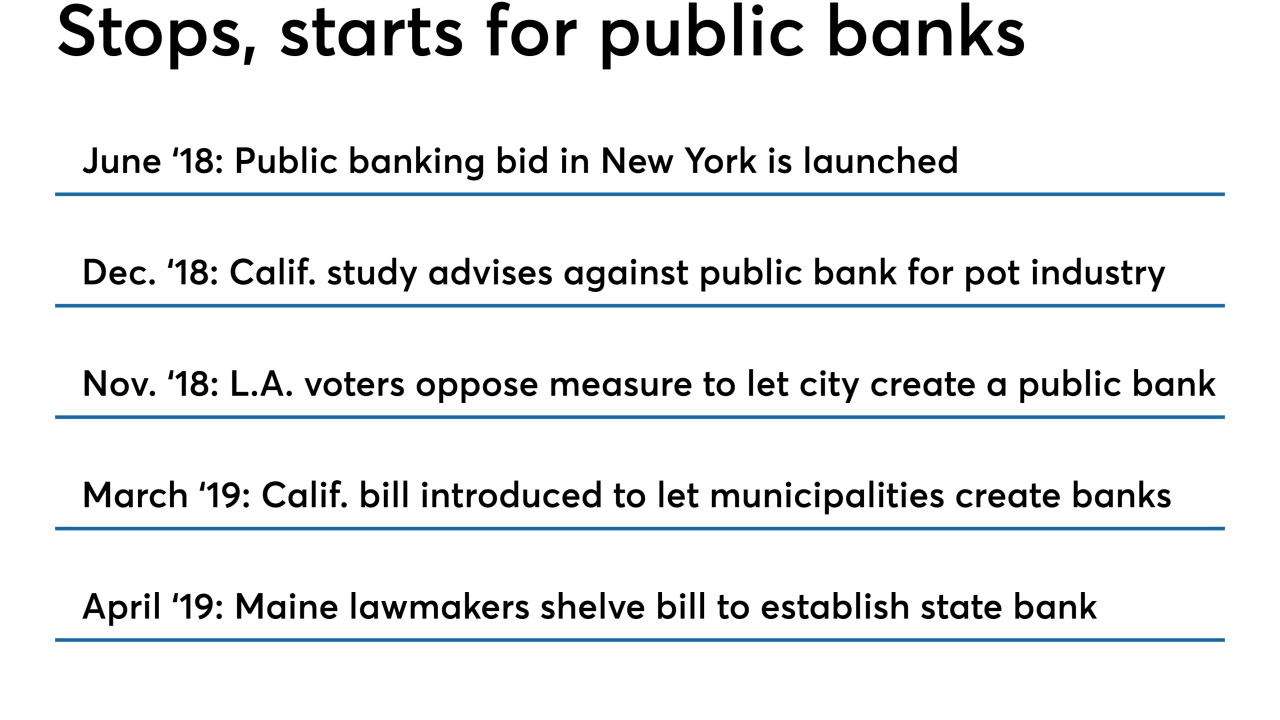

Undeterred by setbacks in other cities, a broad coalition of community groups is seizing on popular mistrust of traditional banks to press the case for a city-owned bank.

May 17 -

The AGs say the agency's plan to rescind ability-to-repay requirements for payday loans would undermine states' ability to enforce their own laws.

May 17