-

In response to the Federal Reserve's stress tests, Wells said it will lower its third-quarter distribution to shareholders. Meanwhile, JPMorgan Chase, Goldman Sachs and five other companies announced stress test capital buffers that exceed the minimum requirement.

June 29 -

The Supreme Court threw out a key statutory provision concerning the agency’s leadership structure, but the presidential election and possible legislative reforms could bring about more changes to the embattled bureau.

June 29 -

The Supreme Court ruled the Consumer Financial Protection Bureau's leadership structure is unconstitutional and refused to hear a lawsuit over the NCUA's field of membership rule. Credit unions are watching to see what happens now.

June 29 -

In a split 5-4 decision, the justices gave presidents new power to remove the agency's head at will. The ruling could have far-reaching implications for other regulators with single directors.

June 29 -

While they are not dramatically opposed, Jelena McWilliams and Brian Brooks have articulated their own ideas on postal banking and the use of artificial intelligence in lending.

June 26 -

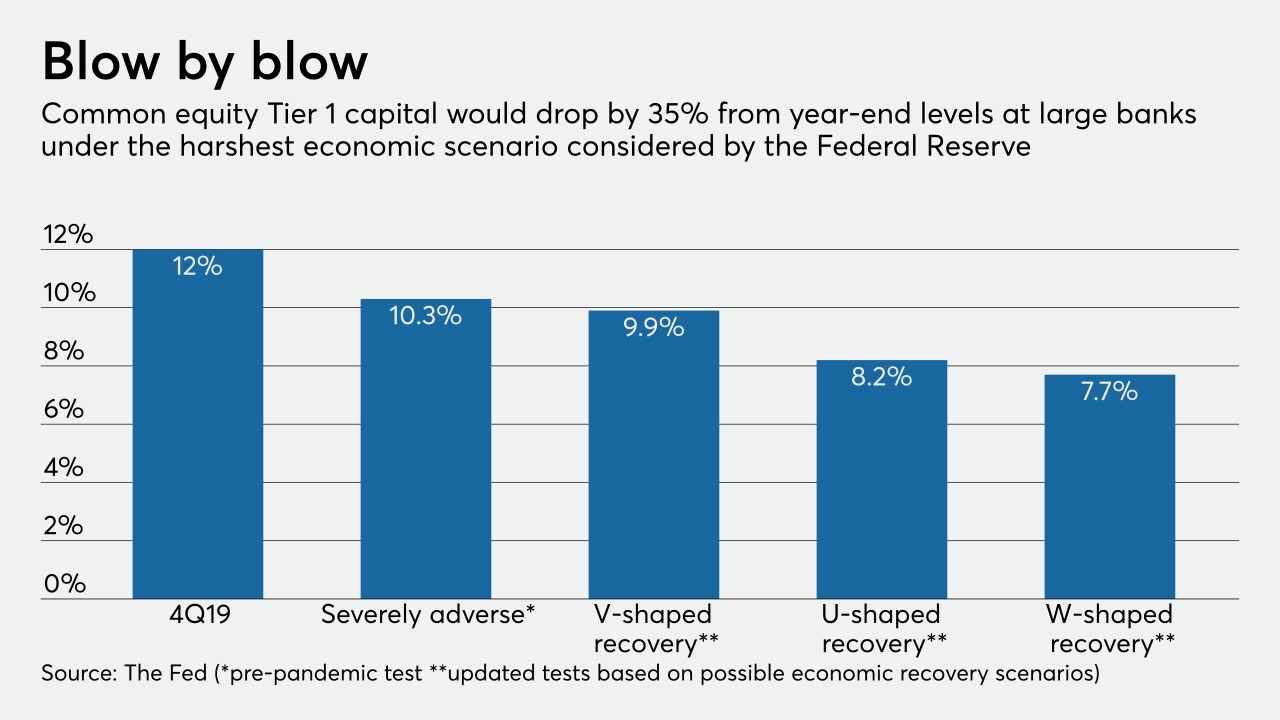

Some observers said the central bank should have suspended dividends entirely in response to an unprecedented economic emergency caused by the pandemic. Others said its more cautious moves were appropriate because big banks' capital is strong and the economy could bounce back.

June 26 -

The Fed stopped short of banning payouts entirely following bank stress tests; banks get greater freedom to invest in venture capital funds and reduced collateral on swap trades.

June 26 -

Nearly 900 institutions are set to receive a payout related to the demise of Southwest Corporate FCU, but the agency could ultimately return as much as $2.5 billion tied to the corporate credit union failures of 2009 and 2010.

June 25 -

In the most sweeping capital distribution order since the financial crisis, the Federal Reserve says it will prohibit big banks from buying back their stock in the third quarter and limit dividend payments to second-quarter levels.

June 25 -

Five financial regulatory agencies clarified the meaning of "covered funds" under the Volcker Rule. Meanwhile, the FDIC gave certain banks more flexibility in interaffiliate exchanges of swaps and adopted a workaround of a court decision governing interest rates on loans sold across state lines.

June 25