Image: Bloomberg

"There are fewer people capable of chairing a systemically important bank like HSBC than are capable of landing on the moon."

James Laing

Equities analyst at Aberdeen Asset Management, on why Douglas Flint should remain HSBC's chairman despite calls for his resignation

Related:

Image: Fotolia

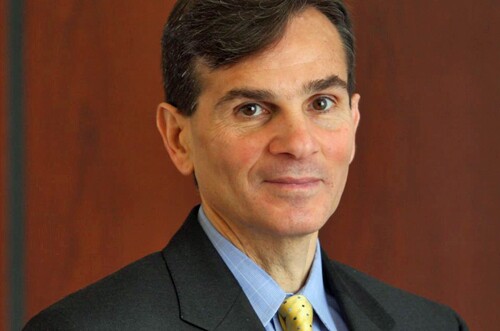

"Treasury Secretary Gensler? I don't think that's out of the realm of possibility."

Edward Mills

FBR Capital Markets policy expert, on Hillary Clinton naming Gary Gensler as CFO of her presidential campaign

Pictured above is Gensler, a former Goldman Sachs executive who earned a reputation as a tough regulator while he was chairman of the Commodity Futures Trading Commission. Even fellow Democratic CFTC commissioners butted heads with Gensler because they feared he was too harsh on big banks.

Related:

"Democrats are afraid of Elizabeth Warren."

Former congressman, saying Sen. Warren has an unusually powerful voice on policy issues partly because other Democrats don't want her to criticize them

Barney Frank

Related:

Image: Bloomberg

"My daughter could come up with an underwriting methodology based on what band you like, and it would work wonderfully right now. If you like My Chemical Romance, you're an A-1 credit."

Mike Cagney

SoFi CEO, describing the current credit cycle as very virtuous

"The banker of tomorrow is becoming a government employee."

Dennis Nixon

CEO of IBC Bank in Texas, on how Dodd-Frank has changed the banking industry

"Even Kentucky lost a game."

Joseph DePaolo

CEO of Signature Bank in New York, saying he expects that its streak of 22 quarters of record profits will end eventually

Related:

"What I'm asking for is a drop in the bucket compared to the amount of risk we are trying to mitigate."

Ted Tozer

Ginnie Mae president, on seeking a 20% budget increase to better police the nonbank lenders that have taken over the government-backed mortgage market

Related:

"Just as rural customers would be denied credit if their bank fails, they would also be denied credit if their bank's costs make it an unviable business proposition."

Daniel Tarullo

Federal Reserve Board governor, arguing for simpler capital requirements for community banks.

Related: