Time's up: GSE reform ain't happening this year

(Full story

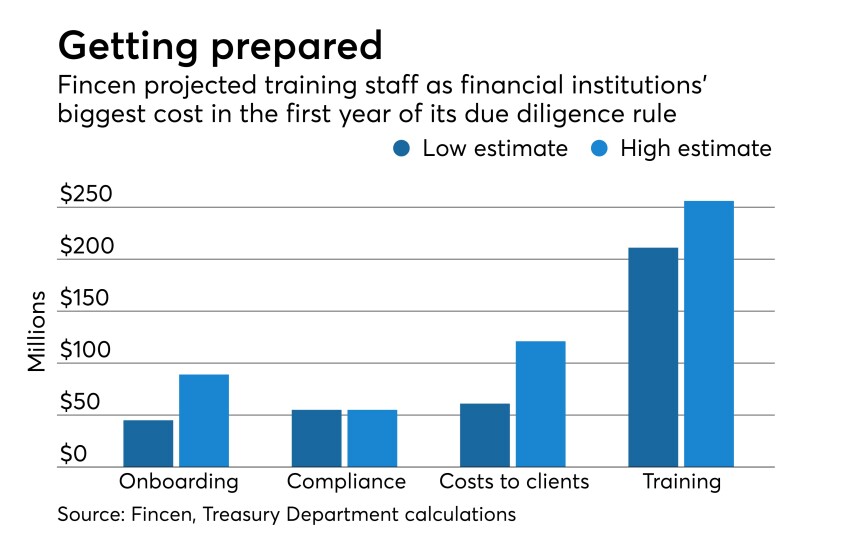

Banks struggle to unmask true account owners for looming AML rule

(Full story

When it comes to emojis, banks just ¯\_(ツ)_/¯

(Full story

Wells Fargo execs, directors got the boot. Will its auditor be next?

Mick Mulvaney's CFPB plan is dangerous

(Full story

Mulvaney thwarts Warren inquiry, citing CFPB structure

(Full story

Blockchain collective snags big fish: Ripple

(Full story

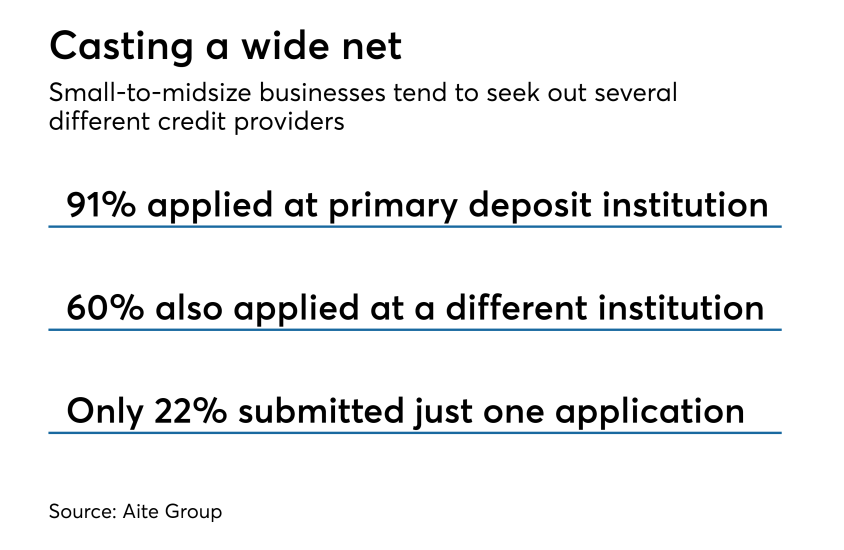

How one small bank increased lending without hiring more lenders

(Full story

It 'would stab a knife' into CFPB: Critics react to Mulvaney proposal

(Full story

5 takeaways from Treasury's call to action on CRA

(Full story