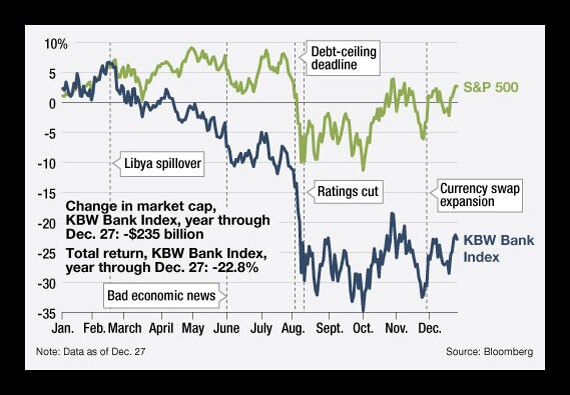

Overview

The year in bank stocks got off to a rough start. It turned worse still in the second half

Key Events:

- Libya spillover - Turmoil in Libya appeared to trigger the KBW Bank Index's first one-day decline of more than 3% in 2011.

- Bad economic news - A cluster of negative reports catalyzed worries about the faltering recovery, and the KBW Bank Index notched its first one-day loss of more than 4%.

- Debt-ceiling deadline - After weeks of gut-wrenching partisan brinksmanship, President Obama signed the Budget Control Act of 2011.

- Ratings cut - The KBW Bank Index plummeted 11% in the first trading day after S&P cut its rating of the U.S.

- Currency swap expansion - The Fed joined with other central banks to

expand currency swap arrangements , driving the KBW Bank Index to a 7% one-day jump.

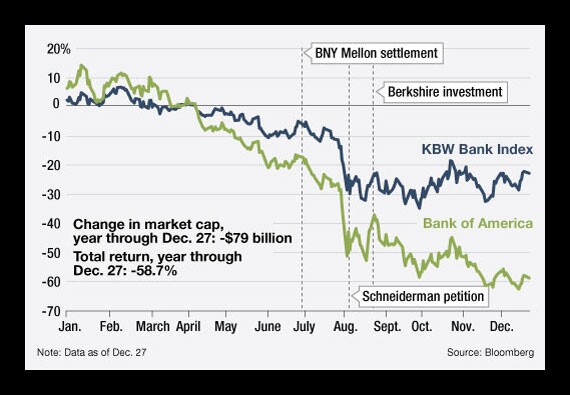

Bank of America Corp.

A vote of confidence from Warren Buffett provided temporary relief, but the sick man of American banking continued to sink under the weight of its mortgage liabilities.

Key Events:

- BNY Mellon settlement - B of A announced

an $8.5 billion settlement over Countrywide mortgage bonds , saying that a block of important investors including Blackrock and the New York Fed had signed on. - Schneiderman petition - New York AG Eric Schneiderman petitioned to intervene in the settlement, adding to

anxiety that the deal will not hold . - Berkshire investment - Buffett's Berkshire Hathaway

agreed to pay $5 billion for B of A preferred stock and warrants to buy common stock.

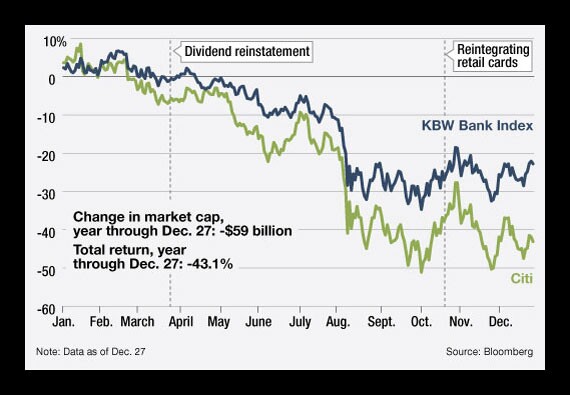

Citigroup Inc.

B of A took the mantle from Citi as the most troubled large banking company in the country, but Citi's shares still performed poorly in 2011. Citi did manage to end the year with a larger domestic core after deciding to hold onto a big piece of its cards business, and signaled confidence that it would begin to return capital to shareholders in 2012.

Key Events:

- Dividend reinstatement - Citi announced plans to

reinstate a quarterly dividend of one cent a share and to conduct a reverse split. - Reintegrating retail cards - After hinting at such a move for months, Citi announced that it had decided to take its $40 billion-asset

retail branded credit card operation out of a vehicle set up for businesses slated for disposal.

SunTrust Banks Inc.

SunTrust put what

Key Events:

- Tarp repayment - SunTrust bought back the preferred stock it had issued under the bailout program.

- CEO William Rogers - Former CEO James Wells completed a handoff to his successor, Rogers, who had been the company's president since 2008.

- Mortgage buyback warning - SunTrust said that costs from

buying back faulty mortgages would continue to increase in the fourth quarter.

Comerica Inc.

Comerica never regained the ground it lost to peers when investors sold off its shares in apparent displeasure over

Key Events:

- Sterling Bancshares deal - The deal's price of 2.3 times tangible book turned heads.

- Selloff on NIM pressure - Comerica's shares tumbled 11% the day it reported a 5 basis point decline in its net interest margin from the year prior in the third quarter

- 50% payout in 1Q12 - Comerica announced that it planned to

pay out about 50% of earnings through dividends and buybacks in the first quarter of 2012.

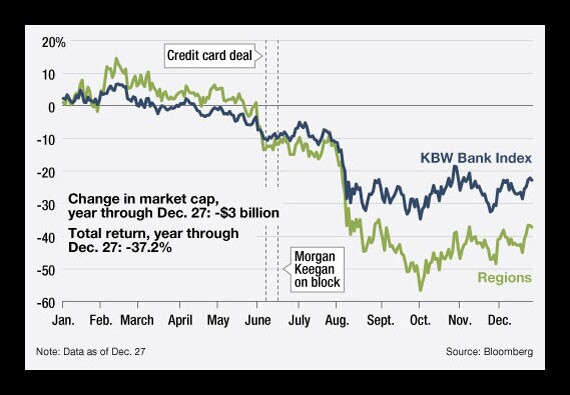

Regions Financial Corp.

Regions looked for a buyer for its brokerage unit - a sale would help ease the company's exit from Tarp - and brought its credit card business in-house to bulk up its consumer operation, but doubts about the company's long-term earnings prospects dragged down its shares.

Key Events:

- Credit card deal - The company bought about $1.2 billion of

Regions-branded credit card accounts from B of A in June. - Morgan Keegan on block - Regions announced that it would

explore a sale of the brokerage unit.

First Niagara Financial Group Inc.

Investors hammered First Niagara's stock after it announced its fourth major deal since 2009. Financial projections for the

Key Events:

- HSBC branch deal - First Niagara said it planned to unload about a third of the $15 billion of deposits it agreed to acquire, and projected that the deal would increase its EPS by about 10% in 2012.

- Earnings report disappoints - The company's shares dropped more than 5% on a good day for bank stocks generally as

questions swirled about the HSBC deal. - Capital plan - First Niagara launched its share offering, substituting a slug of common stock it had planned to sell with preferred. It projected the deal would

reduce EPS in 2012.